Even though a pandemic has dramatically slowed overall deal activity, buyers and sellers willing to adjust to the new environment are still finding ways to transact albeit off the recent record-setting pace.

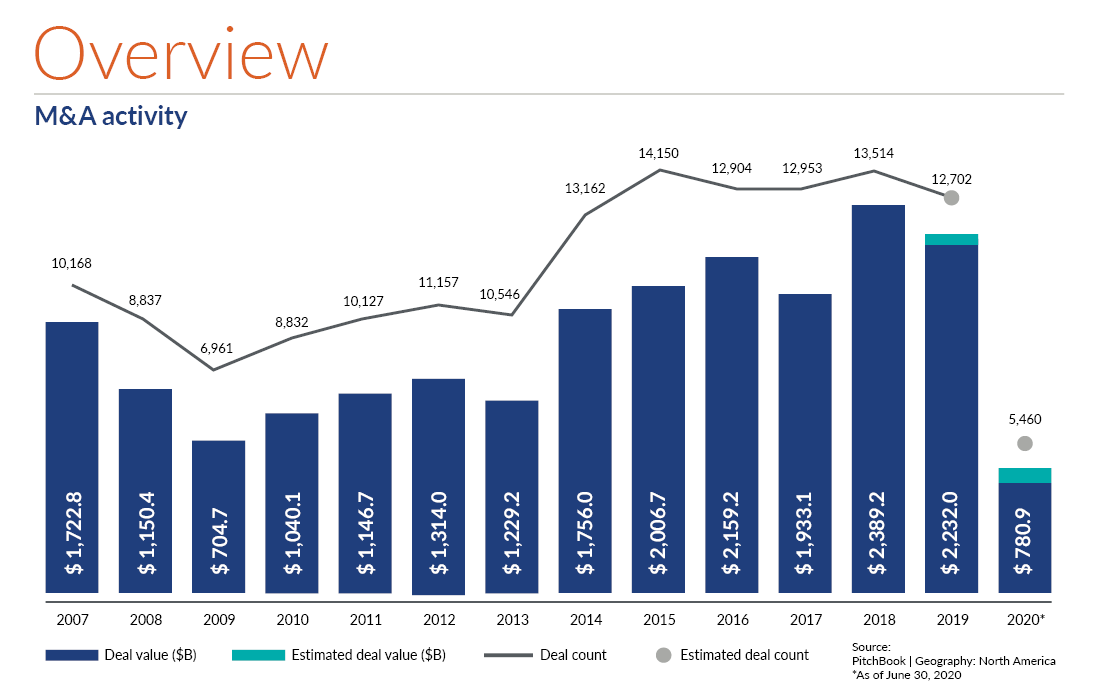

In the second quarter of 2020, 2,025 deals were closed for a value or $336.8 billion, a decline of 41% in the number of deals and 24% in value from an already-anemic Q1 2020, according to Pitchbook. The first half of 2020 saw 5,460 deals in North America, with a combined value of $781 billion. To put this into perspective, if that pace continues for the rest of the year, the value and number of deals will have fallen to levels unseen since 2011–12.

It appeared that the economy was stabilizing over the summer. Unemployment leveled off, consumer spending rose, and the stock market steadily climbed back up to pre-pandemic levels. Nevertheless, the International Monetary Fund projects an 8% decline in worldwide GDP this year. According to the Commerce Department’s latest estimate, U.S. GDP fell by 31.7% in the second quarter. COVID-19 is likely to remain a significant factor in deals for the mid-term, at least until an effective vaccine is developed and made widely available.

Individual deals underway before the pandemic fell into one of three possible scenarios. First, one or both parties walked away due to the changes induced by the pandemic and related economic disruption. Second, the parties were willing and able to renegotiate an acceptable price after considering the impacts of COVID-19. Or third, the parties moved forward with minimal impact from COVID-19 because the company being sold continued to perform during the pandemic.

Bottom line: As buyers and sellers adjust to the new reality, we’re seeing continued deal activity in certain categories and under certain conditions.

Uptick in select circumstances

After the initial overall drop, deals have picked up in some areas. The activity depends on individual circumstances of the companies and the specific subvertical in which they do business. In healthcare, for example, dental practices saw activity drop to near zero during the shutdown, but as the economy opened up patients came back. However, medical practices with significant business in elective surgery haven’t recovered as well (see “Pandemic’s business impact varies widely”).

On the buy side, we and our investment banking affiliate, P&M Corporate Finance, see activity in two categories: private equity add-ons and strategic acquisitions by financially healthy corporations. Financial sponsors are selectively launching new platforms in this environment, but they’re aggressively buying add-on companies to integrate into and strengthen buy-and-build strategies of existing platforms. Pitchbook reports that add-on acquisitions made up over 70% of all PE deals in the second quarter. In addition, large corporate buyers with strong balance sheets and long-term hold periods continue to acquire companies that bolster their business strategies.

On the sell side, the lion’s share of activity comes from investment bankers marketing independent, family-owned companies that have fared well during the pandemic. They may be performing well in spite of COVID-19, or maybe even because of COVID-19 if they’re deemed to be an essential service or product. However, overall, there are fewer quality assets on the market, which makes good quality companies coming to market in high demand, putting investment bankers in a better position to sell solid companies. We also see large companies actively pursuing acquisitions that have a long-term strategic benefit rather than the requirement to achieve a certain equity return within a short window of time as equity funds do.

Symptoms of COVID-19-era deals

Deals going forward are contending with new challenges. First, lenders are more conservative. They have tightened lending availability and raised interest rates. To compensate, sellers either need to agree to a lower price or the buyer “over-equitizes” the capital structure to fund the deal, paying more of the purchase price in equity with an expectation of making it back through healthy EBITDA growth or subsequent recapitalization of the balance sheet. The pandemic has created an environment that makes determining the value of a company difficult. Companies generally had good visibility to support continued growth, which is a key value driver. Today, uncertainty in the outlook for growth across many sectors makes valuing businesses difficult. Where valuation gaps emerge, parties have several ways of dealing with lower valuations, the simplest of which is to negotiate contingent considerations into the deal to allow the seller to still realize the value if it does materialize. Alternatively, buyers agree to a COVID-19 add-back, agreeing to add earnings lost during the pandemic back into the valuation, essentially treating the deal as if COVID-19 never happened. This may be an acceptable option, but only when the business has already fully rebounded and the seller has substantial adequate documentation to prove its assertion that the pandemic will not impede future revenue.

Another option is to restructure the deal by using earnouts, which make a portion of the purchase price payable contingent on specific EBITDA growth targets. In any case, it’s more important than ever to conduct careful due diligence, paying special attention to these factors:

- Recent modifications of core accounting policies

- Revenue projections

- Long-term agreements or commitments that could impact performance

- Consistency between year-to-date financial results and year-end reporting

- The pandemic’s impact on cash conversion cycles

Post-sale disputes more likely

Even with the best due diligence, post-sale price adjustments could be more contentious than usual given the uncertainties inherent in today’s environment. Expect extra scrutiny and more disputes. The effects on the closing working capital determination and the associated purchase price adjustment may not necessarily represent a threat to the business, but they could alter how much the buyer may owe in the deal and how much the seller may receive from the deal.

In response to these uncertainties and added scrutiny, there are several areas that deserve extra attention:

Stimulus funds: Did the business receive loans from the Paycheck Protection Program (PPP) or other stimulus under the Coronavirus Aid, Relief, and Economic Security (CARES) Act? Make sure you back out such loans and other stimulus payments from financials, because they artificially prop up the balance sheet. Most importantly, it’s not yet clear whether and to what extent PPP loans will be forgiven. If the company received a PPP loan, make sure you negotiate which party is responsible for paying it back. And use an attorney well-versed in the CARES Act to draw up the purchase agreement. Most private equity firms aren’t eligible to receive PPP loans.

Timing: The close date of a deal is especially important. Questions about whether COVID-19 impacts existed as of the close date can lead to disagreements over whether estimates of account balances in the working capital calculation need to be refined. The value of uncollectible receivables reserves or the net realizable value of inventory, for example, can vary considerably depending on that timing.

Earnouts: Similar to working capital adjustments, earnouts are affected by the pandemic’s financial impacts. In many cases, sellers are subsequently out of luck if earnout targets in the purchase agreement are no longer achievable. But purchase agreements often require the buyer to operate the business in a manner consistent with past practice. If the purchase agreement includes such a covenant, disputes can ensue over whether a buyer’s actions in managing the effects of COVID-19 on the business during the earnout period are consistent with the covenant. Under these circumstances, the buyer needs to demonstrate that such actions were in response to dealing with the economic pressures of the pandemic rather than preventing reaching earnout targets.

There are no guaranteed ways to avoid such disputes, but parties can reduce the risk by considering and incorporating the following into the purchase agreement before closing the deal:

- Carefully consider historical information and future performance when establishing target working capital.

- Include a collar limiting the purchase price adjustment from working capital adjustment to certain thresholds.

- Include very specific criteria and parameters on accounting policies and practices used to measure certain COVID-19-impacted accounts that roll up into working capital.

Pandemic’s business impact varies widely

Like the virus itself, COVID-19’s impact on companies varies depending on the condition and circumstances of their individual business. Some companies were initially hit hard, but rebounded quickly, others continue to suffer lasting effects. Take distribution, for example. Distributors of aerospace components have seen a significant downturn likely to last. Auto parts distributors saw an initial dive, but now seem to be recovering. Food distribution to grocery chains are booming.

Here’s how the pandemic has been playing out in three vertical segments.

Healthcare: Nonessential medical services, such as dental or dermatology, saw an immediate drop when such businesses were shut down. However, business returned to normal as they reopened, as patients that had postponed their semiannual dental checkups rescheduled, for example. Medical facilities that offered elective procedures and surgeries are still seeing reduced demand. Nursing homes, most of which are still locked down, have virtually no new patients/residents. Most healthcare practices of all types are seeing an increase in bad debt, making careful management of revenue cycles and improved collection functions critical.

Industrial: Unless they were deemed essential services, industrial companies were forced to shut down, causing substantial interruptions of manufacturing and supply chains, leading to inventory shortages of some goods. When they reopened, it took time and money to reconfigure workflows to ensure adequate social distancing, implement new sanitation procedures and provide necessary personal protective equipment. Manufacturers, already experiencing labor shortages, are finding it difficult to bring back employees that, in some cases, are receiving more in unemployment and stimulus payments than their regular wages. Meanwhile, manufacturers and distributors in select categories, such as hand sanitizing products, are greatly increasing. Their biggest challenge is keeping up with increased demand and consequent growth, at least for now. Long term, some wonder how long the boom will last, and how much they should scale up systems and workforce to accommodate the growth. Does it make sense to invest in a new ERP system, for example? Should they build more warehouses?

Business services: Companies selling security software or video-conferencing services have seen sales increase dramatically. Cleaning services are doing well. Professional services such as consulting may have some projects on hold, so staff utilization is down. Nevertheless, most are maintaining staff levels in expectation of a return to normal business levels. Some services for manufacturing, think transportation services for the automotive industry, are down because production and/or sales have slowed or stopped. But transportation services related to refrigerated food delivery to grocery chains are up. All services related to e-commerce are up.

Opportunities in the new normal

We expect M&A activity to increase as businesses adjust to the pandemic. In fact, a backlog is building of deals that were put on hold due to economic uncertainty. Buyers are preparing for possible windows of opportunity as infection rates wane or vaccine development time frames shorten. Smart firms want to be ready to relaunch deals when the time is right.

In the meantime, we can help you navigate the uncertainty of the next 12 to 18 months.

Improve strategy and operations through de-risking and cost optimization: Ever-changing technology, industry consolidation, security and globalization create more risk than ever. Our consultants conduct assessments to identify risks and offer ways to mitigate them. They also suggest ways to save money by identifying waste and overlooked opportunities, such as reducing inventory, rationalizing SKUs, and eliminating or automating processes to create efficiencies.

Use technology and analytics to drive efficiency: Old, underperforming ERP systems often hinder business performance and growth. We can evaluate and implement modern ERP systems that gather and analyze data to better inform decisions and enable growth. We integrate systems and streamline reporting through practical features like dashboards that enable data-driven insights to guide strategic decisions. This is particularly important with private equity firms executing a buy-and-build strategy for their platforms.

Provide sell-side diligence: Sell-side due diligence is more important in today’s uncertain environment than ever. Our transaction advisory services vet your financials, including COVID-19-related impacts, and prepare you for sale by uncovering potential issues and opportunities and their related EBITDA impacts to ensure you get the best price for your company.