If the uncertainty caused by current events has taught business owners and middle-market managers anything, it’s that liquidity and cash flow matter most. While stimulus funds provided a much-needed shot in the arm, they’ve also contributed to the highest inflation seen in 40 years. And, with rising operating costs, rising interest rates, and a looming recession, company leaders are reminded of the adage that “cash is king.”

Businesses that emerged from the pandemic are leaner and meaner. They’ve reduced costs, embraced work-from-home strategies, raised prices, restructured their real estate lease and debt obligations, and implemented other cost reductions — strategies that allowed them to conserve precious cash. And many may still have untapped liquidity generation opportunities that will be needed in a downturn. What’s the secret to tapping that potential liquidity? The answer can be found in a less well-understood and underappreciated financial metric — the cash conversion cycle (CCC).

Understanding the cash conversion cycle

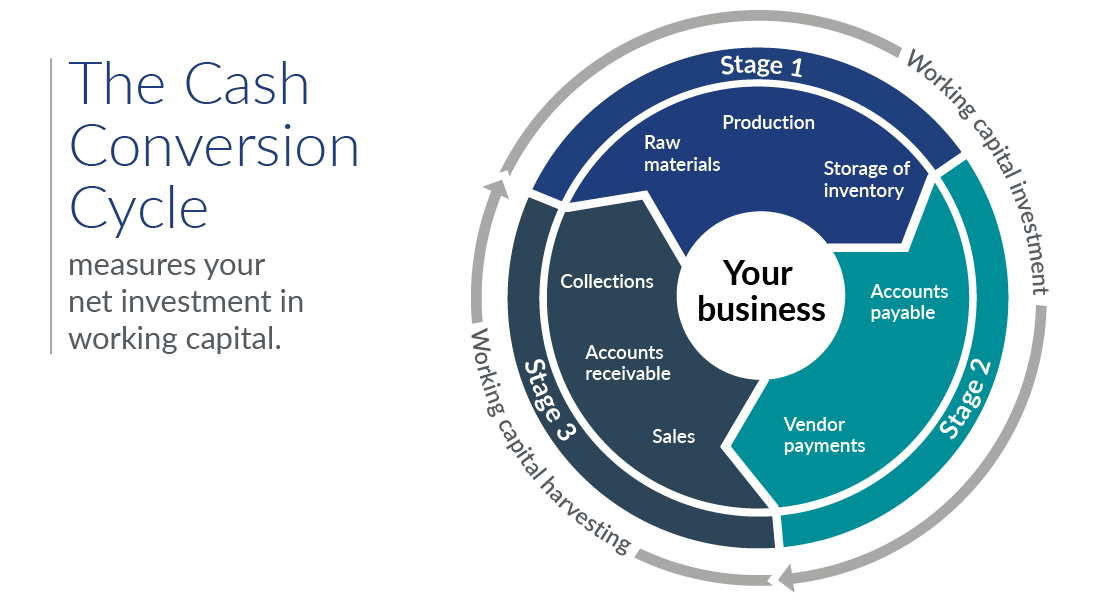

The CCC can be an impactful metric for gauging overall changes in working capital and liquidity, getting cash back into an owner’s hands in the form of dividends. In financial terms, the CCC is the length of time that a company needs to finance operations to run the business.

The CCC comprises three subcomponents:

- Days sales outstanding (DSO): The average number of days required to collect receivables.

- Inventory days on hand (DOH): The average number of days that inventory, including raw materials, WIP, and finished goods, is held on the balance sheet before it’s sold and converted into receivables.

- Days payable outstanding (DPO): The average number of days a company can defer payments to trade creditors for goods and services received.

Combining the three together in a simple equation gives a full picture of your CCC: DSO + DOH – DPO = CCC.

A negative cash conversion cycle is great. It means the company doesn’t require external financing to fund its working capital and growth, a highly favorable (but extremely rare) situation. Ultimately, the lower the cash conversion cycle, the better for the organization. Companies with a short cash conversion cycle have greater liquidity, resilience against unexpected economic turbulence, and are better insulated from ripple effects of weaker peers in their ecosystem falling into insolvency.

Actively managing and improving CCC

The first of the three metrics, DSO, is often where much of the low-hanging fruit resides for companies beginning to develop their internal CCC improvement culture. Here are three tips to reduce DSO:

1. Know your customers’ billing cycle and optimize for it.

Customers with significant purchasing power pay what they want, when they want. But that doesn’t mean all hope is lost when it comes to getting paid adequately. When you know how your customers process their payables, you can ensure that all invoices are issued with enough lead time to clear their A/P department in time for the customers’ next check or wire run. (Another bonus pro-tip: Ask your suppliers to match or give better payment terms than received from your customers.)

2. Appoint a bloodhound to be your collections czar.

As the saying goes, if it’s everyone’s responsibility, then it’s no one’s responsibility. To ensure proactive follow-up on aging receivables, appoint a single dedicated individual and place this duty toward the top of their short list of responsibilities. One person with ownership of collections ensures a consistent point of contact for disputes, follow-ups, and communication.

Further, the collections czar will know your customers’ AP payment cycle, will be able to identify problems more quickly, and can communicate with all internal parties to elevate issues before the credit department orders a halt in services or goods delivery. No one wants this last scenario — it results in a costly business interruption and potential damage to customer relationships.

3. Manage credit extended to customers.

While extending credit to customers in your industry may be common practice, it’s important for your company to establish credit limits for each and to develop a comprehensive credit review process to identify customers who aren’t credit-worthy. By putting these customers on (credit hold) cash in advance or cash on delivery you can reduce collections problems and write-offs.

A solid credit review process encompasses customer financials, references from other vendors, or reports from third-party monitoring agencies such as Dun & Bradstreet. Remember, extending credit can be a relationship-building tool you can leverage and a privilege for customers and shouldn’t be given away freely.

Other components of CCC

If you already have a handle on DSO and are ready to optimize the other legs of the equation, DOH and DPO, the following high-level tactics can get you started in these areas:

- Optimize your S&OP process to reduce excessive safety stock and obsolescence. The panic purchasing that took place during the pandemic has subsided, and many organizations’ inventory levels are disjointed. Finding appropriate inventory levels and disposing of excess and obsolete SKUs can generate much needed cash to fund operations regardless of the impact to the income statement.

- Evaluate your manufacturing processes to increase salable throughput by reducing conversion time, rework, and scrap.

- Enhance sourcing and purchasing department operations and policies to improve your supply chain.

- Monitor and maximize payment discounts for failure to comply with purchase order terms and identify critical vendors versus those over whom the company may have greater power to negotiate favorable terms.

CCC for success

In a competitive global business environment, companies need to be effective stewards of their working capital. Actively monitoring changes in your CCC, and benchmarking to industry peers, can allow you to identify trends early and anticipate strategic pivots on the path forward. Optimizing CCC is powerful: It enables you and your business to be nimble and undertake the transformations required for a profitable, more sustainable future.