The economic outlook has become increasingly uncertain in recent months, with recession fears now festering. While a near-term contraction is not yet a foregone conclusion, a primary concern for investors is what one would mean for their investment portfolios.

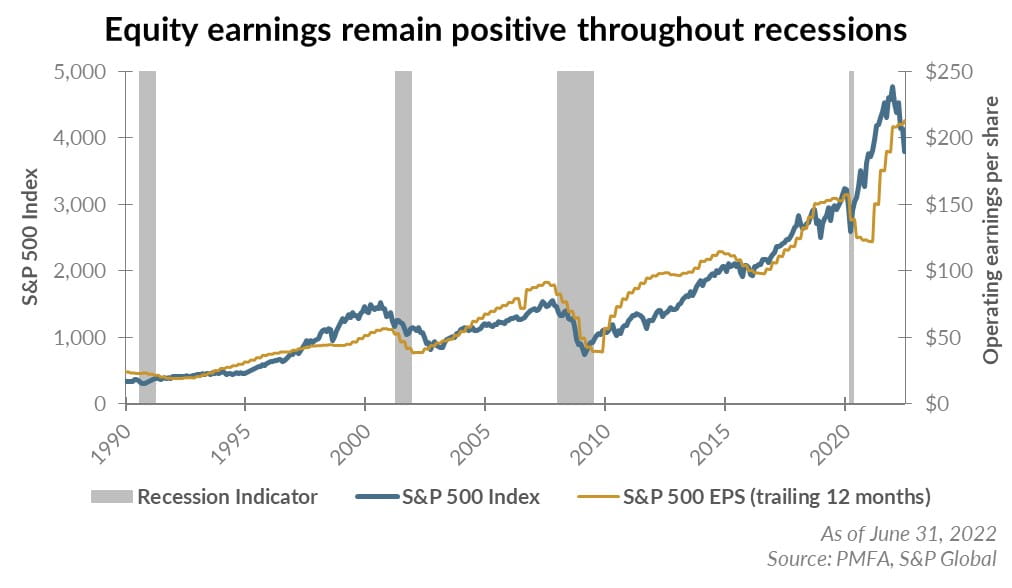

Clearly, the profitability of publicly traded companies is impacted by the ebb and flow of the economic cycle. As shown above, recessions soften demand, curtail sales revenue, and erode margins. Profits are typically reduced, but companies still tend to generate positive earnings even through economic downturns. In fact, the S&P 500 Index hasn’t produced a negative 12-month earnings print in the past 50 years — even in the depths of the global financial crisis in 2008 or during the virtual economic shutdown in 2020.

Like private businesses, public companies have historically shown resilience across economic cycles and have been quick to pivot during difficult periods to cut costs, improve productivity, and position themselves to weather the storm and to prosper when conditions improve. Consequently, earnings tend to rebound quickly as the economy recovers, sales growth accelerates, and margins expand.

Over the past six recessions, earnings have declined by an average of about 25% peak to trough but have tended to fully recover within a few years, rising to new highs as each expansion progresses. Since 1990, S&P 500 operating earnings have compounded at an annual rate of about 7%, rising from about $25 to over $200 per share over that period. Persistent earnings growth across multiple cycles has been the primary driver of equity returns over time, showing resiliency in spanning recessions, market bubbles, wars, a global financial crisis, a pandemic, and a multitude of other challenges along the way.

Regardless of the timing or probability of a recession, attempting to time equity price movements isn’t advisable. The market tends to move well in advance of economic peaks or troughs as we address further in our corresponding piece.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.