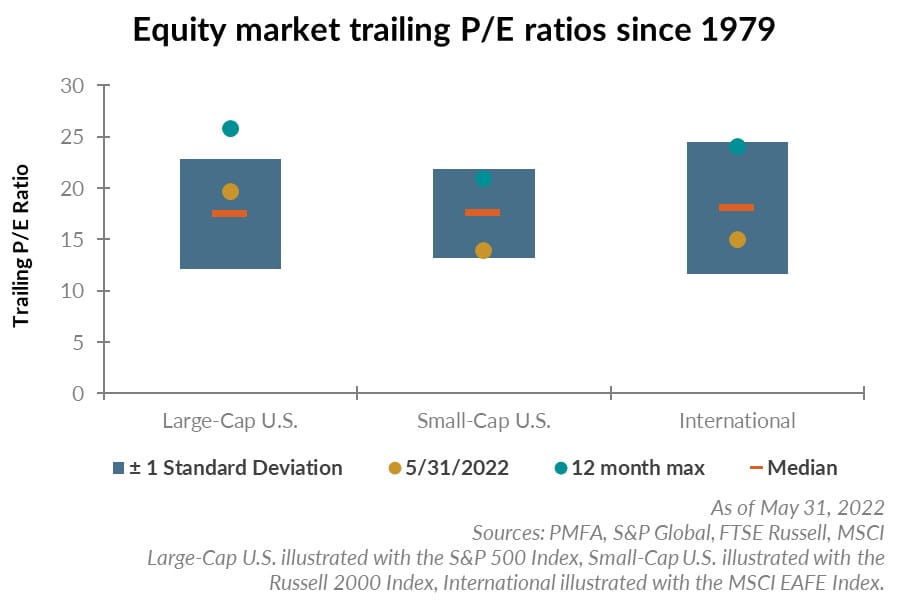

Over the past year, global price/earnings (P/E) multiples have come down considerably from above-average levels for several major indexes to more attractive levels.

Certainly, negative performance has played a role, but continued earnings growth has also contributed to the decline. Large-cap U.S. stocks P/Es remain a bit high compared to the long-term average, although a good degree of froth has come out of the blue-chip market over the past year. More notably, small-cap equities and foreign stocks have also experienced a sharp decline to below-average levels. Small caps are particularly attractive, with valuations now meaningfully below their historical average.

In recent months, questions about the economic, inflation, and interest rate outlook have grown. Uncertainty around those factors have been the driving catalyst behind market volatility this year. A growth slowdown or an outright recession can’t be ruled out, although economic data at this point remains mixed. A more pronounced slowdown would weigh on corporate earnings, a potential outcome that is increasingly being priced in by investors at the same time that higher interest rates are also being absorbed.

As sources of uncertainty clear and the economy reaccelerates, corporate earnings growth will in due time also regain momentum, providing a solid underpinning to equity returns.

Setting aside those cyclical factors, long-term equity returns tend to be stronger when starting with a tailwind of lower attractive valuations than from a starting point of elevated P/E multiples. Today, valuations look better than they have in some time. Whatever the near term may hold, we expect that long-term investors will be rewarded for taking risk and staying invested.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.