Last imposed during the mid-1990s, excise taxes on several chemicals and hazardous substances were reinstated on July 1, 2022. These taxes will most directly impact manufacturing businesses but have implications for many others throughout the economic supply chain. With the first quarter of application underway, it’s a great time for businesses to revisit these rules and evaluate their potential impact. The rules include some complexity and potential penalty relief, but specific actions can be taken now to manage their impact.

The Infrastructure Act and reintroduction of chemical excise taxes

In November 2021, President Biden signed the Infrastructure Investment and Jobs Act (Infrastructure Act) into law. The main goal of that bipartisan legislation was the funding of a wide range of infrastructure projects. However, it also reinstated two previously expired excise taxes on many widely manufactured and imported chemicals.

Several excise taxes were originally enacted in 1980 under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) to fund a nationwide hazardous substance cleanup program (the Superfund). By imposing those taxes on the users of chemicals, CERCLA accelerated the economic burden of future environmental remediation costs to those that were currently benefitting from the use of such chemicals. The taxes subsequently expired in 1995, and the Superfund has instead been funded through other means. The Infrastructure Act reinstated two of the excise taxes, albeit in slightly modified form. The reinstatement took effect July 1, 2022, and is scheduled to expire, once again, on Dec. 31, 2031.

What can be done now?

The remainder of this article focuses on the technical details of these excise taxes, such as the businesses that are potentially subject to the tax, the chemicals to which the tax is applied, and the tax reporting and payment methods. However, at a more fundamental level, these taxes are expected to have direct and indirect impacts on a variety of businesses. Given their impact on raw materials used in manufacturing and the various exceptions to the rules, simple assumptions about applicability may be difficult to find.

The following questions may help guide a business’s inquiry into these taxes and inform its review of the technical rules:

- Is the business potentially subject to these taxes? The taxes are generally imposed on either: (1) manufacturers, producers, and importers of taxable chemicals; or (2) importers of taxable substances. When reviewing the rules, it’s notable that some actions result in tax liabilities while others do not.

- Are any of the taxable chemicals or taxable substances used in or by the business? These taxes are imposed on specific chemicals and substances, so a careful review of the applicable lists is crucial. In addition, there’s a process to petition for the addition to or removal from the taxable substance list.

- Have internal processes been implemented to calculate the taxes, make deposits, and file the relevant excise tax returns? The degree of effort involved in complying with these excise taxes could vary widely depending on the volume of chemicals and substances used, the existence of excise tax processes within the business, and current staffing levels.

- What actions have been taken to document the analyses and conclusions about the applicability of these taxes? Businesses should consider documenting their conclusions irrespective of the outcome of an excise tax analysis. This would be especially critical for those that could be viewed as being subject to the taxes but have reached alternative conclusions.

- Has a process been set up to monitor changes in the business or in the rules as either evolve? The substances subject to tax can change over time, and the inputs that a business imports or manufactures may also change over time. Making conclusion on this tax generally shouldn’t be a one-time event, so ensuring that processes are in place to periodically review the business’s positions can serve as an important quality control mechanism.

When considering the answers to the above questions, please consult the technical details in the later sections as well as the IRS frequently asked questions. Even businesses that conclude they are not subject to the excise taxes still need to consider whether others in their supply chain may be subject to it. If they are, a supplier may pass-through the excise tax cost and it may be necessary to review contractual terms to determine how such an action should be managed. In any case, longer-term pricing would likely be adjusted to reflect these taxes in the future.

Excise tax on the sale or use of taxable chemicals

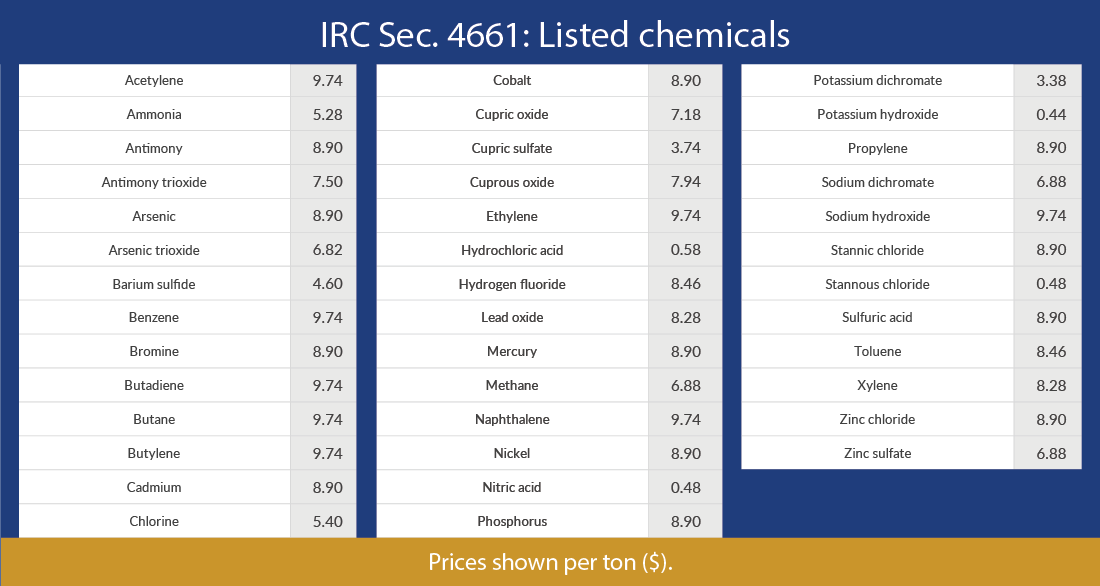

Under Section 4661, an excise tax is imposed on the sale by manufacturers, producers, and importers of 42 taxable chemicals (see table below for a list of those chemicals). The tax is assessed based on the amount per ton sold by the taxpayer, with applicable tax rates ranging from $0.44 per ton to $9.74 per ton. The highest of the listed tax rates are applied to petrochemicals, such as acetylene, benzene, butane, ethylene, and propylene.

The primary trigger for application of this tax is either: (1) the manufacture or production of a taxable chemical in the United States; or (2) the importation of a taxable chemical into the United States for consumption, use, or warehousing. Any business that manufactures, produces, or imports a taxable chemical and uses such chemical itself is subject to the tax in the same manner as if the chemical were sold, although general exceptions are provided for the uses outlined below. In addition, manufacturers that export taxable chemicals may be exempt from the tax or provided a credit for taxes that have been previously paid on the exported chemical.

Specific exceptions and credits are applicable to this tax pursuant to Sec. 4662(b), including:

- The sale or use of methane or butane used as a fuel.

- Substances used in the production of fertilizer.

- Sulfuric acid produced as a byproduct of air pollution control.

- Substances derived from coal.

- Substances used in the production of motor fuel.

- Certain substances that have a transitory presence during the process of smelting, refining, or extracting substances other than taxable chemicals.

- Any separated isomer of xylene, unless it is imported into the United States or exported from the United States.

- Recycled chromium, cobalt, and nickel.

- Substances used in the production of animal feed.

- Hydrocarbon streams containing mixtures of organic chemicals that are otherwise listed under Sec. 4661.

Excise tax on importers that sell or use taxable substances

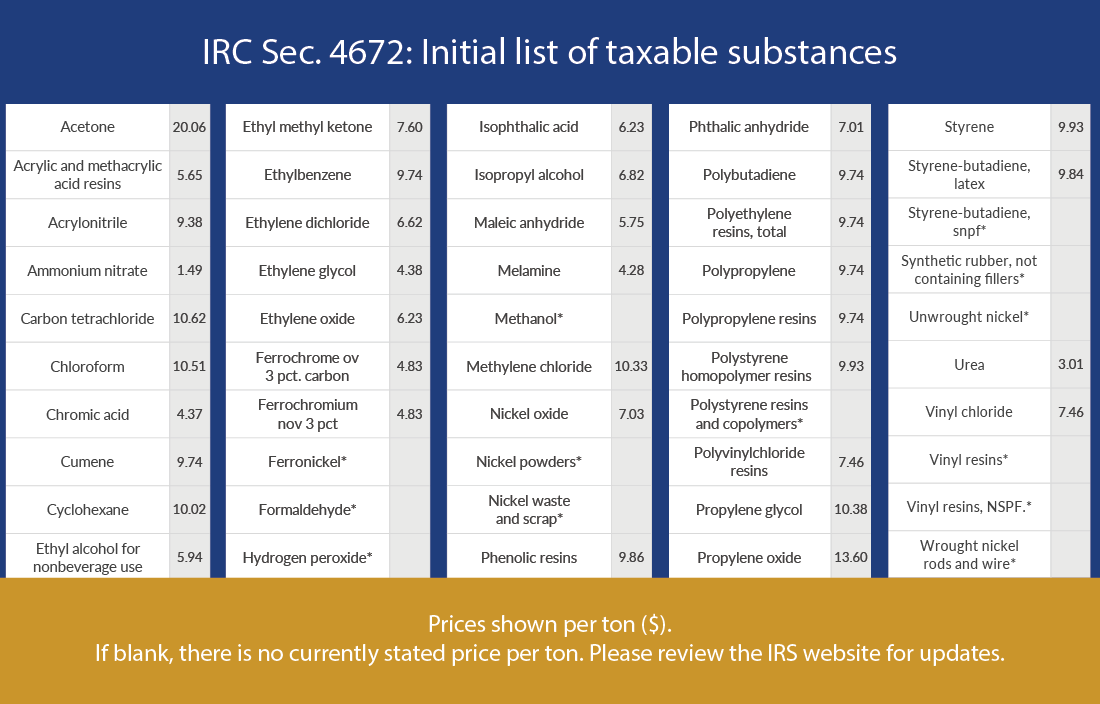

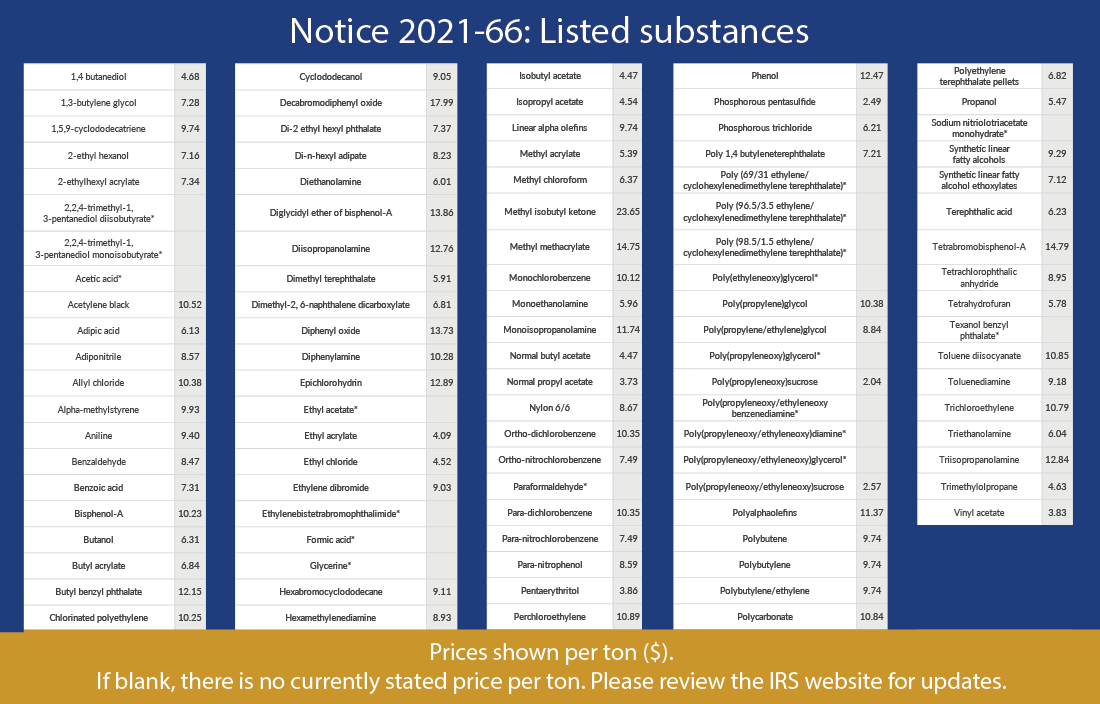

Under Sec. 4671, an excise tax is also imposed on the sale or use of taxable substances (see tables below for a list of those substances). Sec. 4672 provides an initial list of 50 taxable substances but also delegates authority to the Secretary of the Treasury to add or remove substances. Pursuant to that authority, Treasury published Notice 2021-66 in December 2021, certifying a list of 101 additional taxable substances that will be subject to tax. Moving forward, importers will be able to petition the Treasury Department to add or remove substances from this list by following the process in Revenue Procedure 2022-26.

The amount of tax imposed on an importer is generally equivalent of the amount of tax that would’ve been imposed under Sec. 4661 if such taxable substance had been manufactured and sold in the United States. The IRS maintains a list of tax rates for many of these substances. However, if the IRS hasn’t prescribed a tax rate, then the importer is required to calculate the tax as equal to 10% of the appraised value of the substance at the time it’s entered into the United States.

This tax is imposed on persons that import the taxable substance for consumption, use, or warehousing into the United States. Special exceptions and credits are available for:

- Substances used in the production of fertilizer.

- Substances used in the production of motor fuel.

- Substances used in the production of animal feed.

Tax reporting considerations

The taxes on taxable chemicals and substances are paid and reported through the federal excise tax system. Accordingly, affected businesses are required to report the excise taxes on Form 6627, “Environmental Taxes,” which is attached to Form 720, “Quarterly Federal Excise Tax Return.” The first quarter of applicability is the third quarter of 2022 due to the July 1 effective date for these excise taxes. Therefore, the initial tax returns for the calendar quarter ending on September 30 is due by October 31. The tax return for each subsequent quarter will be due at the end of the first month after each quarter end (i.e., April 30, July 31, October 31, and January 31). Additional reporting information may be found in the IRS’ recently published FAQs covering common questions as well as the instructions for Form 720 and Form 6627.

Furthermore, registration is required by select taxpayers that are seeking any engagement in tax-free sales or exchanges of specific chemicals. That registration is completed via Form 637, “Application for Registration (For Certain Excise Tax Activities).” This registration should occur soon since many of these benefits aren’t available if a company isn’t registered.

Tax payments and deposits

Affected taxpayers are required to make semimonthly deposits of Superfund chemical excise taxes. The taxes due for the first 15 days of a calendar month are due on the 29th of that month and taxes due for the remainder of the month are due by the 14th day of the subsequent month. Those days are extended if they fall on a Saturday, Sunday, or federal holiday. Businesses that do not timely deposit at least 95% of their net excise tax liabilities for the semimonthly period are subject to failure to deposit penalties under Sec. 6656. A safe harbor payment amount exists in order to avoid penalties, but it looks back to the second preceding quarter (e.g., two quarters prior to the current quarter), so it won’t be available for the Superfund excise taxes until Q1 2023. In the interim, two types of special penalty relief have been provided by Notice 2022-15:

- Penalty relief — Broad relief is provided for the first three quarters of these excise taxes (Q3 and Q4 2022 and Q1 2023). Specifically, businesses will be deemed to meet the reasonable cause standard for penalty relief if: (1) timely deposits are made, even if the amounts deposited are incorrect; and (2) the total underpayment for the quarter is paid in full by the due date for filing Form 720.

- Safe harbor — The IRS will also allow businesses to fully utilize the look-back safe harbor for the first three quarters of 2023 provided that the standard for penalty relief stated above was satisfied. The safe harbor generally requires: (1) each semimonthly deposit to be at least 1/6 of the net tax liability in the look-back quarter, (2) each deposit must be made timely, and (3) any underpayment for the quarter to be fully paid by the due date for Form 720.

These forms of penalty relief are especially helpful to businesses that find themselves subject to the Superfund excise taxes but are struggling to determine the amount of taxes to be paid. Making some degree of deposits on a semimonthly basis will ultimately provide additional time to compute the actual tax liability prior to the end of the calendar quarter. However, a business that doesn’t make any deposits might have to rely on the general reasonable cause standards to avoid penalties.

Key takeaways

Businesses haven’t been required to consider these Superfund excise taxes in over 25 years, so they will be unfamiliar to many. At the same time, it’s expected that these won’t impact all businesses uniformly. Regardless of the impact, it’s a great time to ask the key questions discussed earlier and begin taking any required actions. Potential impacts can likely be categorized in the following manner:

- Direct impacts — Businesses that are directly subject to the excise taxes on taxable chemicals and substances likely fall into two groupings. The first are businesses that are already subject to excise taxes and that have internal processes for dealing with them. Those businesses will likely have a much easier time adapting to the reinstated taxes. The second group includes businesses that are now subject to excise taxes but haven’t historically paid similar taxes or filed excise tax returns. Those businesses will face the steepest learning curve as complicated new rules must be considered. In order to take advantage of the failure to deposit penalty relief, such businesses should consider immediately implementing processes to make semimonthly deposits of some amount while the deeper analyses proceed.

- Indirect impacts — Other businesses that aren’t directly subject to the Superfund excise tax rules may still find that these rules will have an indirect effect on their businesses. For example, those that that fall just outside of the rules, whether it’s through an exception or for other reasons, may need to document such tax positions. Other businesses will find indirect impacts in the form of additional tax costs being imposed on their suppliers who may be importers or users of taxable chemicals or substances. Those businesses should review their existing contracts to determine the impact that the excise taxes could have on their pricing.