Last year, the FASB issued guidance that eliminates the concept of a troubled debt restructuring (TDR) for financial reporting purposes and introduced new disclosure requirements for certain loan modifications. These amendments are effective for fiscal years beginning after Dec. 15, 2022 — this year for most companies.

What’s changing?

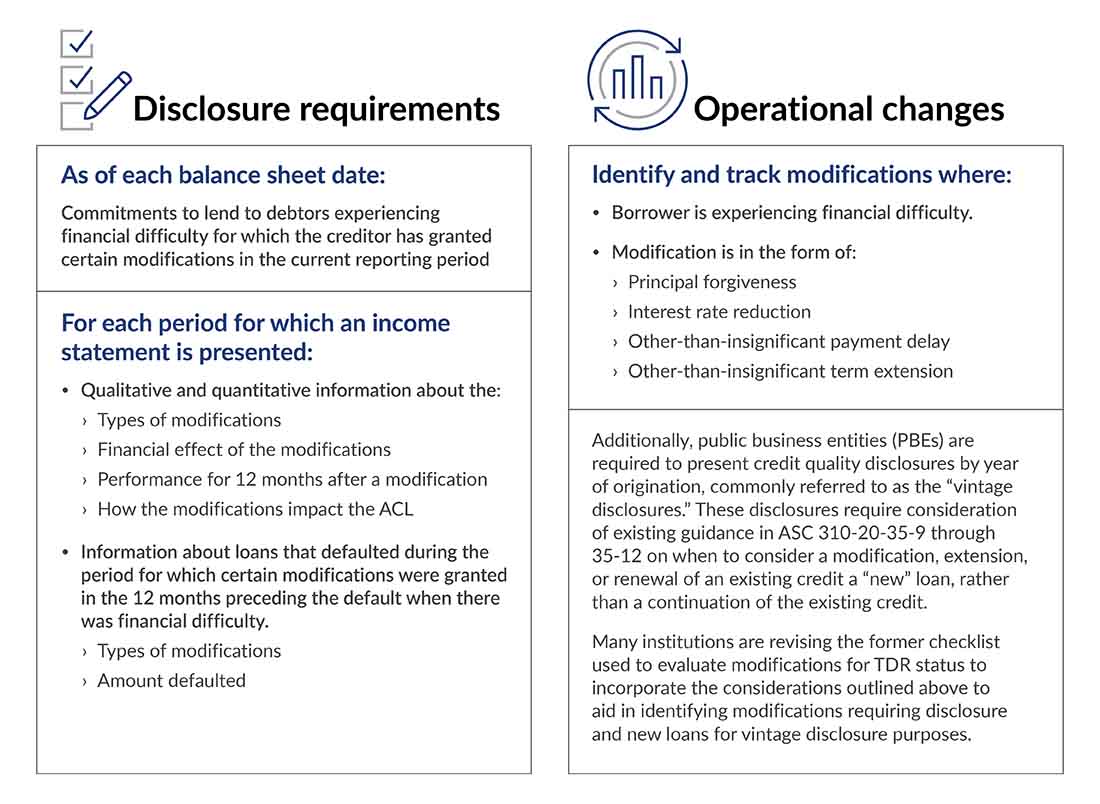

The requirement to identify, track, and disclose TDRs has been eliminated, along with the assumption that these loans are “impaired” and need to be accounted for separately within the allowance for loan losses. While TDR accounting has been eliminated, new disclosure requirements provide information about certain modifications to borrowers experiencing financial difficulty. This information remains relevant to users of the financial statements.

How should previously identified TDRs be treated?

Prior to the adoption of current expected credit losses (CECL), TDRs were considered impaired loans for purposes of estimating an allowance for credit losses. With the adoption of CECL, the concept of an impaired loan has been eliminated. Institutions are now required to measure the allowance for credit losses (ACL) on a collective basis when similar risk characteristic(s) exist and evaluate loans individually if they don’t share risk characteristics with other loans. Each institution’s ACL policy should include consideration of how they will identify loans that should be individually evaluated under CECL. In many cases, loans previously modified as TDRs may have similar risk characteristics as other loans in the portfolio and therefore may not meet any of the institution’s criteria to require individual evaluation. If modification as a TDR was previously a criterion used by the institution to identify loans for individual evaluation under CECL, management should evaluate existing TDRs at adoption of ASU 2022-02 and conclude on whether these continue to require individual evaluation or whether they can be included with other loans collectively evaluated for impairment.

How are newly modified loans treated when estimating the ACL?

Institutions should refer to their ACL policy to determine whether the loan continues to share similar risk characteristics with others in the portfolio for purposes of determining whether the loan should be collectively or individually evaluated for impairment. If the loan is individually evaluated for impairment, there are no requirements on how to measure the ACL. Similar to other individually evaluated loans, if foreclosure is probable or repayment is expected through operation or sale of collateral, the ACL is based on the fair value of collateral.

If a discounted cash flow method is used to measure expected credit losses, projected cash flows should be discounted using the post modification contractual interest rate to derive the effective interest rate, a change from previous guidance for TDRs.

Is a loan that’s modified always treated as a modified loan?

Legacy TDR guidance required continued tracking of TDRs over the life of the loan as that loan was considered impaired until repaid or re-underwritten. While the need to modify a loan to a borrower experiencing financial difficulty may suggest the loan has different risk characteristics from others in the portfolio, there is no requirement to individually evaluate these loans for purposes of the ACL under CECL.

It’s expected that most institutions will use other credit characteristics to identify loans that should be individually evaluated under CECL. As such, tracking these modifications will only be relevant for loans modified during the current year and for the 12 months subsequent to the modification.

How should the modification of multiple terms on a loan be treated?

The new modification disclosures require presentation of certain information by type of modification (i.e., principal forgiveness, interest rate reduction). When modifications of multiple terms are granted, these loans should be presented in a separate group that reflects the combination of modification types (i.e., combination: term extension and principal forgiveness). This provides insight into the extent of the modification and keeps the same loan from being presented in multiple categories. For an illustration of this disclosure, see Example E in our CECL guidebook: Preparing financial statement disclosures.

Is the accumulated impact of multiple modifications considered when evaluating whether payment delays are significant?

If the loan was previously restructured, the cumulative effect of the past restructurings within the 12-month period preceding the current restructuring is considered when determining whether a delay in payment resulting from the most recent current restructuring is significant. This is a change from previous guidance that required institutions to consider all past modifications.

How should other loans in the same relationship/to the same borrower be treated?

The disclosures related to certain modifications would only include the impact of the loan that was modified — not the full relationship. However, the nature of the full relationship should be considered when determining whether or not the loan continues to share similar risk characteristics with others in the portfolio for purposes of determining whether the loan and relationship should be collectively or individually evaluated for impairment. Management should consult their credit risk-rating policies to determine how a modification of a single loan within a larger relationship impacts risk ratings on the remaining loans in the relationship.

How do I transition to accounting for modifications under ASU 2022-02?

The standard allows for either prospective or modified retrospective adoption of this standard.

- Prospective: Continue to apply legacy TDR guidance to the existing pool of TDR designated loans until those loans are settled.

- Modified retrospective: Reassess loans previously identified as TDRs under the institution’s current ACL policy. If this results in a change in ACL, record an entry to retained earnings as of the first day of the period (January 1 for calendar-year-end institutions) for the adjustment. Changes in ACL related to this reassessment could be driven by (i) reclassification of loans from individually evaluated to collectively evaluated or (ii) a change in the method for estimating credit losses on former TDRs that are classified as individually evaluated loans but no longer subject to legacy TDR measurement guidance.

The new disclosure requirements are effective beginning in the year of adoption. Institutions should continue to present the legacy TDR disclosures for comparative periods before the adoption of this standard.