The volatility in bond markets over the past few years has created a challenge for investors, even to the point of raising questions about their place as a diversifier and potential safe haven during periods of equity market turmoil. Should investors give up on bonds? We believe that the answer is a resounding “no.” Stocks may be the primary source of growth, but high-quality core bonds remain a foundational piece in a broadly diversified portfolio. The long-standing case for owning bonds, including diversification, income, and enhanced return potential compared to cash, remain valid. If anything, these benefits have become even more compelling following the rapid reset higher in yields since 2022.

Bonds are key to meeting long-term investment objectives

Diversification

One of the stronger arguments for owning fixed income within an investment portfolio is its ability to effectively diversify risk assets. This may be most clear when economic growth is slowing or when a “risk-off” event triggers a flight to high-quality assets. Because fixed income instruments are structured to preserve capital and provide steady income, their lower risk profile usually acts as a portfolio stabilizer during an equity market drawdown. In addition, bonds can serve as a source of capital for rebalancing in these periods, allowing investors the opportunity to reposition risk or buy stocks at deeper discounts.

In 2022, the historical diversification dynamic between bonds and stocks was challenged by surging prices. The biggest inflation scare in four decades was the catalyst for a regime change in Federal Reserve (Fed) policy from the ultra-accommodative policy bias that had dominated since the onset of the Global Financial Crisis in 2008. Monetary policy reversed course in 2022 in the form of a rapid tightening that lifted the Fed’s effective policy rate to its highest point since 2001. That sharp increase in short-term rates in turn rippled through the capital markets, negatively impacting high-quality bonds, public equities, real estate, and a host of other asset classes.

However, the experience of 2022 was unusual. More often than not, the bond market has served as an effective diversifier during periods of equity market volatility, as illustrated in the table below. Since 1987, the Bloomberg U.S. Aggregate Bond Index delivered an average cumulative return of about 9% in periods when the S&P 500 had a cumulative peak to trough loss of 20% or more. While the range of returns over these four episodes was fairly broad, the magnitude of bond outperformance versus stocks during those periods was consistently very wide, ranging from about 35–78%.

Bonds may not deliver the degree of long-term growth potential that stocks can, but they typically serve as a valuable hedge against the volatility of risk assets, making them an effective portfolio diversifier.

Income

The next benefit of bonds may be obvious, but it’s a crucial one. High-quality bonds, such as government, corporate, and municipal instruments, typically have a fixed coupon rate for the life of the bond, providing investors with a predictable cash flow stream. These payments can be used to meet spending needs or to reinvest into the portfolio.

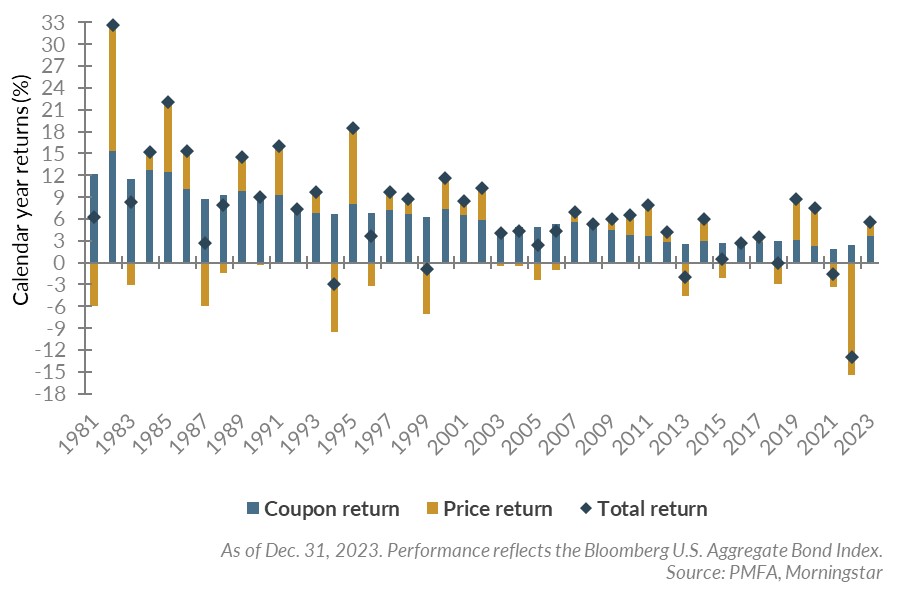

The attractive feature about coupons is that they are always positive (assuming the issuer does not default) and account for virtually all of fixed income portfolio returns over time. The chart below illustrates the historical composition of total return for the Bloomberg U.S. Aggregate Bond Index between coupon and price fluctuations since 1981. Over that period, coupon payments accounted for over 95% of the index’s cumulative return. The takeaway is that while bonds will experience mark-to-market price fluctuations as interest rates rise or fall, coupon payments will remain positive and generally very predictable, as will the return of principal upon maturity.

With the importance of yield in mind, fixed income investors should welcome the opportunity to reinvest into today’s more attractive interest rate environment. This can allow core fixed income to contribute significantly more to a portfolio’s target rate of return, while potentially allowing an investor to take less equity risk than has been the case in many years. The path to higher yields wasn’t easy for investors , but it set the stage for a more constructive fixed income return outlook. As a result, investors who lived through the extended low-yield environment and were challenged by rising interest rates should be encouraged by the more normalized yield environment today.

Enhanced return potential versus cash

A third reason to own bonds is that they typically provide a higher yield than cash-like instruments such as money market funds. Because of their price susceptibility to rate fluctuations and potential exposure to credit risk, bonds typically provide a yield premium to compensate investors for assuming these risks. The exception occurs when the yield curve inverts and cash yields are higher — a dynamic that occurs periodically but is atypical compared to the normal, long-established, positive slope to the curve over time. The yield differential between core bonds and cash may not always look significant at a point in time, but it can be meaningful over a long-term investment horizon. In fact, the Bloomberg U.S. Aggregate Bond Index has cumulatively outperformed cash by an average of 2.3% per year over the past 30 years ended December 2023. That additional return increases the probability of meeting an investor’s long-term return objective while also increasing the probability of the portfolio’s return outpacing inflation and preserving an investor’s purchasing power.

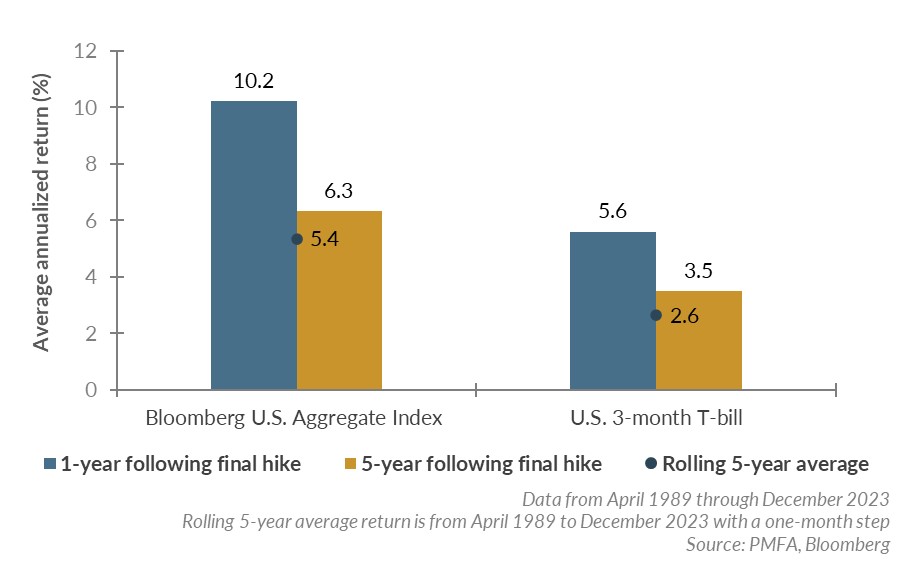

How does this benefit stack up in the current environment? And should investors consider moving away from high-quality bonds while cash is offering a competitive yield? For investors with at least a three- to five-year time horizon, holding core bonds rather than cash should still prove beneficial. Furthermore, dovish turning points in prior Fed hiking cycles have typically set up an attractive environment for bonds compared to cash, as seen below. Since 1989, the average annualized return for bonds one year following the Fed’s final rate increase was 10.2%, compared to 5.6% for short-term instruments comparable to cash.

This dynamic was also clear in the fourth quarter last year after yields peaked in anticipation of a Fed pivot toward lower policy rates in the coming year. The Bloomberg U.S. Aggregate Bond Index returned 6.8% for the quarter, while the Bloomberg 1-15 Year Municipal Index returned 6.4% — both of which easily exceeded money market returns of just over 1% for that period.

It’s important to remember what cash is best suited for: managing near-term liquidity needs. For investors with a longer-term investment horizon, holding excess cash may create a drag on the portfolio’s return potential. Investors should keep in mind that cash yields move virtually in tandem with changes in the Fed funds rate. The rapid increase in this rate in the past two years provided a significant lift to cash yields, but the widely anticipated reduction in the central bank policy rate would also reduce cash yields to a comparable degree. Furthermore, any relative yield attractiveness can quickly diminish when the Fed reaches the peak of its tightening cycle, a turning point that has typically signaled a subsequent appreciation tailwind for bonds and a more beneficial environment for extending portfolio duration.

Conclusion

High-quality bonds remain an important building block within a well-diversified investment portfolio. While it may feel as if the asset class has lost appeal since 2022 when some proclaimed that the traditional 60/40 balanced portfolio was dead, we believe that viewpoint was shortsighted. High-quality fixed income remains an attractive asset class for investors with a longer-term time horizon given its ability to diversify risk assets and deliver predictable income. Looking ahead, the outlook for the high-quality fixed income market is as strong as it’s been in many years, buoyed by more attractive yields and the possibility for additional appreciation should inflation return sustainably to a more normalized range and monetary policy turns more accommodative.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.