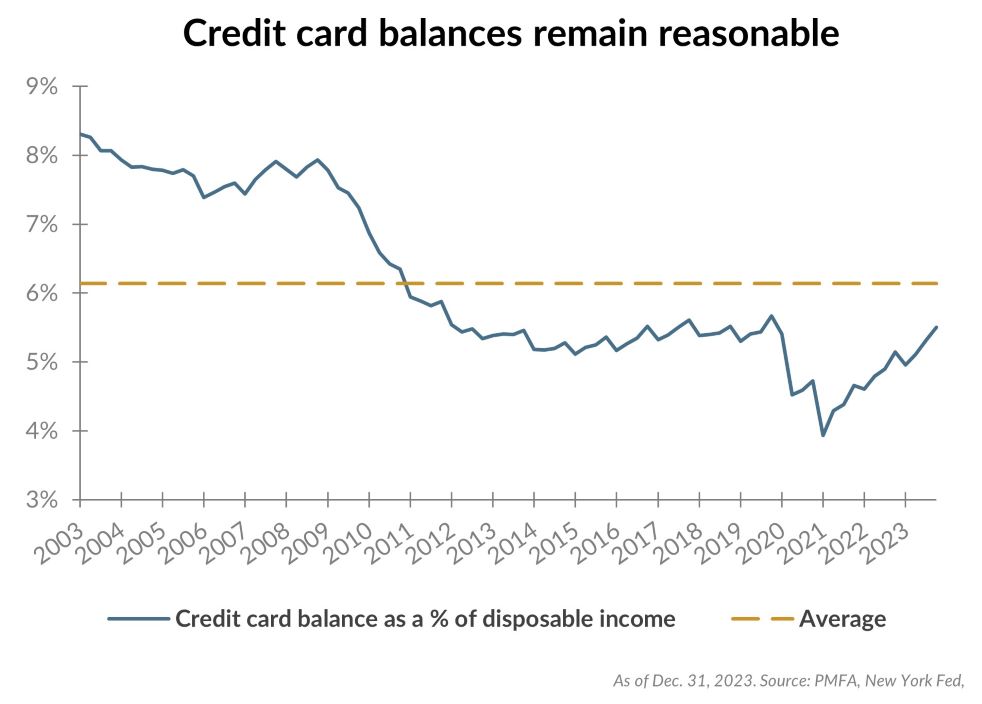

Aggregate credit card debt for U.S. consumers has been climbing rapidly over the past three years, recently surpassing the $1 trillion mark for the first time in history. This rapid growth in outstanding credit card debt has raised questions about the ability of U.S. consumers to continue spending. As the primary driver of economic activity in the United States, the state of consumer finances has significant implications for the economic outlook. In 2023, spending was more robust than anticipated, providing an unexpected catalyst for growth to surprise to the upside. However, if consumers have been leaning on credit cards too heavily, is the pace of spending set to slow in the quarters ahead?

In short? Not necessarily. The chart above shows aggregate credit outstanding as a percentage of total disposable income. While credit card balances have certainly been rising rapidly, household disposable income has risen significantly as well. Consequently, relative to income, credit card debt still appears quite manageable today, with the ratio hovering around its average over the past decade.

What does this mean for the outlook for consumption? Rising credit card debt has received attention, but it’s not yet reached a level that appears unsustainable. Higher balances will be an impediment for some consumers but shouldn’t derail household consumption growth broadly. Lower-income and more highly indebted households are more likely to feel the pinch, but most consumer spending comes from middle- to high-income households who are less dependent on credit card borrowing to fund spending.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.