Peak inflation may be in the rearview mirror, but the January report on consumer prices is a reminder that there will be some meaningful bumps on the path back to the Fed’s 2% inflation target.

Peak inflation may be in the rearview mirror, but the January report on consumer prices is a reminder that there will be some meaningful bumps on the path back to the Fed’s 2% inflation target.

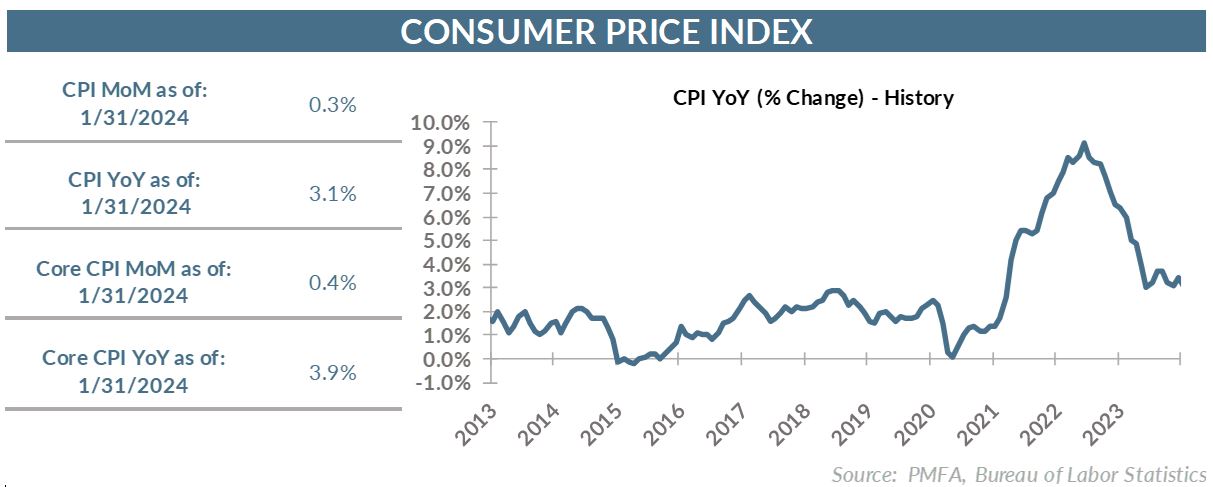

The consumer price index accelerated in January to 0.3%, a result that was fractionally higher than the consensus forecast of 0.2%. That may seem like a small difference, but the immediate and sharply negative equity market reaction provides some indication of its weight for investors.

While the one-month CPI increase was surprisingly strong, the index still eased to 3.1% on trailing 12-month basis — a silver lining for those seeking good news and any evidence that price pressures continue to gradually ease.

The surprising uptick comes despite a decline in energy prices, which dropped by nearly 1% in January. It also comes despite a meaningful decline in core goods prices, which dipped by 0.3% last month.

Less encouraging was the 3.9% year-on-year increase in core inflation, which has hardly shown improvement and has been stuck near 4.0% since October. Its surprising 0.4% increase in January was its largest monthly gain since last May.

Often, inflation surprises can be chalked up to a temporary surge in volatile food or energy costs. That’s not the case in the current report, which suggests that shelter and service costs were the primary catalyst, rising at a rapid clip to start the year. It also suggests that a quick reversal is unlikely.

What will persistently sticky inflation — let alone the risk of a reacceleration — mean for the Fed? Policymakers have been clear that they believe the top is in for short-term rates and the evolution of the inflation picture should allow them to begin cutting this year. The timing of cuts? That’s the question, and one for which expectations have whipsawed since last fall.

To that end, policymakers have also been working hard to rein in initial hopes for rate cuts early this year. In response, investors have been increasingly looking past March to the next Fed meeting in May as a potential launch point for rate cuts; even that’s looking increasingly optimistic given the tenor of recent labor and inflation data. The futures market has priced in a growing probability that the Fed may wait until June to make its first move, leaving four meetings in the back half of the year for policymakers to cut rates two more times should they stick to their current projections.

The timing and magnitude of any rate cuts will hinge on other expectations being met: a moderation in growth, further loosening in labor market conditions, and more convincing evidence that upward pressure on prices has meaningfully eased. A reacceleration in inflation may not lead the Fed to reverse course and raise its policy rate further, but it could forestall anticipated cuts.

It’s that uncertainty about the timing of cuts that’s weighing heavily on the stock market this morning. Inflation remains a risk that’s firmly within the Fed’s focus. Policymakers fear cutting rates too soon only to see an inflation resurgence that would force them to reverse course and tighten further, damaging their credibility in the process. The other risk that can’t be overlooked is that policymakers keep rates too tight for too long — ultimately besting inflation but taking the economy into recession in the process. The soft landing argument gathered momentum last fall with the shift in Fed tone, prompting a sharp rally in risk assets. The reality is that a soft landing is still not a lock, and the exuberance around that potential outcome is now being dampened by the reality of the challenge that the Fed still faces.

The bottom line? There’s still a viable path to a soft landing, but the January inflation report is a reminder that getting there won’t be a walk in the park. Deviating too far off the optimal policy path could lead to one of two undesirable outcomes. A resurgence in inflation is a risk, but isn’t the only one; the potential for a policy-induced recession — even if mild — still can’t be dismissed.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.