The manufacturing sector has been in contraction for over a year — an exceptionally long period for an economy that has been in expansion. Like much of the economic data in recent years, it’s been muddled by the unusual, staged recovery since the brief but harsh recession in 2020 that favored spending on goods early on but has tilted toward services more recently.

Evidence is growing though that there are better days ahead for the nation’s manufacturers.

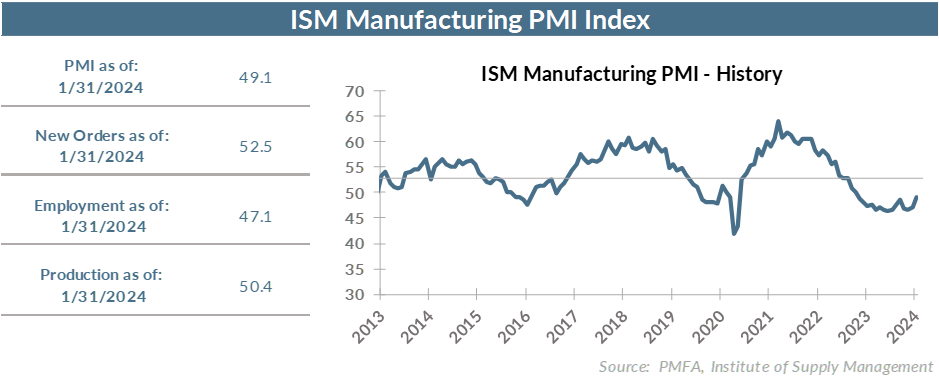

The ISM Manufacturing Index topped expectations in January, rising to 49.1 from a revised 47.1 in December. A reading above 50 is indicative of expansion in the manufacturing sector, while a reading below 50 is consistent with contraction. That was the strongest reading for the index since it first slipped into contractionary territory in November 2022 and stood in contrast to weaker readings from recent regional manufacturing surveys.

Headlining the report was the first expansionary reading on New Orders since August 2022. The New Orders index rose over 5 points to 52.5 in January, with 20% of survey respondents reporting an increase in orders. Despite the improvement, order backlogs shrunk for the 16th consecutive month.

Improvement in new order books also contributed to a modest uptick in production, but employers remain slow to hire. The employment index weakened last month to 47.1. Just 11% of respondents reported adding to their payrolls in January, compared with 18.4% that indicated that they made cuts.

Stronger order volume, if sustained, should provide a bit of a lift to hiring, but for now at least, manufacturers appear to be able to absorb that modest uptick in demand with their existing workforce. The 2.3% increase in manufacturing productivity in Q4 reflects that recent trend but masked a decline of 0.8% for the year, suggesting that there’s still potentially some room to increase output without adding workers.

Conversely, there were some reasons for caution in the report. Delivery times continue to extend, perhaps reflecting the impact of disrupted shipping channels and hostilities in the Red Sea. That’s forced more ships to be rerouted to avoid the region, extending shipping times. Increasing material costs may indicate that the disinflationary benefit of weaker goods demand could be waning — a factor for the Fed to consider as policymakers contemplate the timing of interest rate cuts.

The bottom line? The manufacturing sector was hit hard by changing consumer spending patterns in recent years, favoring the service sector after the initial buying binge on goods in the early days of the 2020 recovery. Having weathered that storm, there’s growing evidence that the manufacturing sector may be close to finding a bottom as the economy more broadly decelerates toward trend growth.

The biggest risk? Monetary policy that’s too tight for too long, potentially pushing not just the manufacturing sector but the economy more broadly into recession. A broad view of economic indicators today can be used to create convincing arguments for either a soft landing or hard landing scenario. The surprising strength of consumer spending in the latter half of last year kept the economy on a firm footing but appear more vulnerable as labor conditions ease. Going forward, a continuation of the expansion appears to be a tug-of-war between labor market and wage strength supporting spending and Fed policy aimed at cooling inflation and taking some of the heat out of pace of growth and labor demand.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.