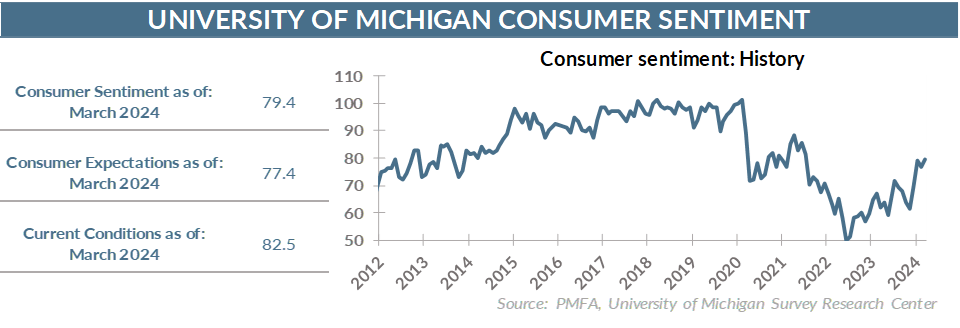

The collective consumer mood perked up a bit in March, as financial conditions improved, the labor economy remained robust, and economic momentum remained surprisingly strong in the face of higher interest rates. That growing optimism lifted the University of Michigan’s gauge of consumer sentiment to 79.4 for the month, easily topping expectations.

As a practical matter, the index has remained in a fairly narrow band in recent months that remains far from its pre-pandemic highs but still rebuilding from its mid-2022 lows.

It’s good news for those looking for improvement, but still suggests that any optimism is still guarded. Consumers are far from enthusiastic in their assessment of the current state of the economy, their personal financial prospects, and the outlook for the economy further down the path.

The fact that consumer sentiment remains constrained against the backdrop of a robust labor economy, strong wage growth, and above-trend economic growth is a direct reflection of the corrosive effects of surging inflation in recent years.

Paychecks may have experienced a nice boost in recent years, but when those additional dollars are going right back out the door to cover the rising cost of rent, food, gasoline, personal services, and a host of other expenditures, it’s no surprise that consumers aren’t more upbeat.

Despite those frustrations, there are continued indications that consumers believe the worst of the inflation scare is in the rearview mirror. Inflation expectations edged lower in March, while still suggesting a belief that a return to the sub-2% inflation environment that helped to define the last expansion isn’t imminent.

That’s music to the ears of the Fed, which views inflation expectations as an important gauge of the effectiveness of rate policy and their credibility with the public. While multiple gauges of inflation have been stuck in a range over the past six months that still tops the Fed’s 2% goal, most still believe that relative stability is likely and that the risk of another surge remains low.

Consumers remain the lynchpin for the positive momentum in the U.S. economy to continue. Although relatively dated, today’s updated estimate for Q4 2023 growth reconfirmed that the economy grew at a brisk clip late last year — well above consensus estimates of trend growth. For that to continue, the burden will fall on consumers to continue to increase their spending — one that they appear ready, willing, and able to assume.

The bottom line? Consumers still feel the sting of the inflationary surge of the past few years — a reality that still hangs heavy over their collective mood. Even so, there’s a growing optimism that the worst is behind us, even if it’s counterbalanced by the recognition that inflation may not return to the pre-pandemic normal in the near term.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.