Coming off surprisingly weak January retail results, the question for retailers was whether February would bounce back or disappoint again, potentially raising concern for a consumer sector that was losing spending momentum.

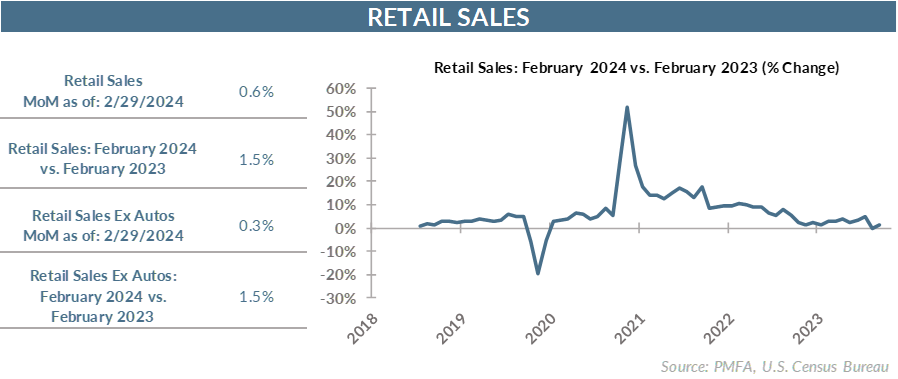

Sales rose at a respectable 0.6% clip last month, a marked reversal from a downwardly revised 1.1% decline in January. Volatile gas prices can skew the top-line sales number but had virtually no impact last month despite a moderate increase in fuel costs. A strong bounce back in vehicle sales provided a lift, as did spending at electronics and building materials-related retailers.

Last month’s increase wasn’t as pronounced as the prior month’s contraction but provides some reassurance that households haven’t thrown in the towel. Even so, sales remain well off their September 2023 peak.

How healthy is the financial position of consumers? Increasingly, that’s a mixed picture. Credit card balances have soared to reach record highs in the past year and continue to climb. Whether that’s indicative of lower-income consumers feeling increasingly stretched and tapping credit out of necessity or simply the impact of high and rising prices lifting monthly credit card spending isn’t clear. It’s likely some of both. Relative to discretionary income, higher credit card balances don’t appear problematic at a macro level.

Further, there are growing indications that the stockpile of excess cash accumulated by consumers during the heart of the pandemic has been significantly eroded. That abundance of savings enabled a period of free-wheeling spending that was further nurtured by post-COVID-19 optimism, falling health risk, and increased mobility. The strength of that intense spending wave has also faded. What remains is a strong labor market and solid wage growth as a source of fuel for continued spending growth.

Retail sales provides a relevant insight into the strength of the consumption, but one that’s incomplete, failing to capture much of the spending on the service economy — the part that experienced a resurgence as goods spending faltered.

On the other hand, the past few months illustrate a continued weakening of demand for goods and a headwind to consumption growth in Q1. That slowdown is even more pronounced against the backdrop of still sticky inflation.

How will this report weigh into the Fed’s policy decision? The breadth of recent data still illustrates an economy that has slowed but seemingly not to the degree necessary for policymakers to start to trim short-term rates. Inflation readings have improved but remain above the Fed’s comfort zone, while showing limited progress since last fall.

Labor demand has eased but conditions remain relatively tight. The persistent strength of wage growth remains a source of potential inflation, particularly in the service sector. Improved productivity has offset those wage gains to a degree though, blunting the likely lift to consumer prices while provided a critical source of fuel for spending.

Taken as a whole, the combination of consumption, inflation, and labor data doesn’t yet look weak enough to prompt Fed policymakers to shift to an easier policy stance in the near term. June is increasingly coming into focus as a more likely time frame for a potential rate cut, giving policymakers a few additional months of data to chew on. It seems likely though that more progress will be needed in price and labor data to convince the Fed that inflation risk has been sufficiently beaten back to allow for a rate cut. That’s still far from a given.

The bottom line? The February bounce back in retail results is in part an offset to weak January results. Taken together, it still suggests that the retail environment continues to be restrained, directly reflecting a diminished consumer appetite to spend on goods.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.