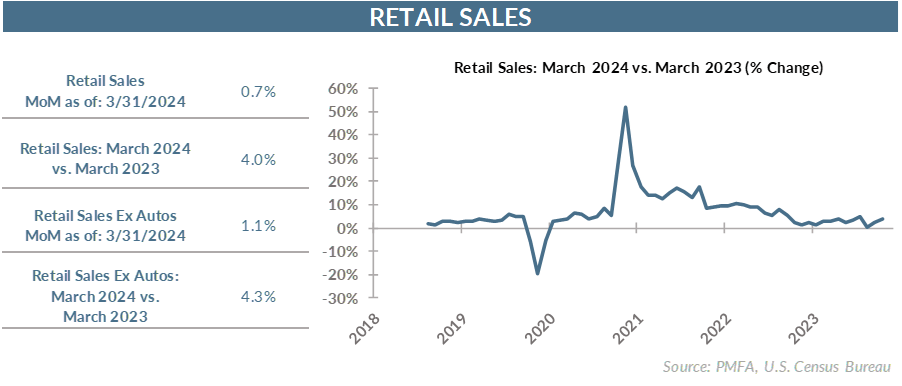

Consumers shied away from spending on big-ticket items in March but more than made up for it nearly everywhere else they could. The result? Retailers should be feeling a bit less pessimistic to close out the first quarter, as top-line sales grew at a brisk 0.7% clip in April. Taking vehicle sales off the table, sales growth topped 1% for the month. The February gain was also revised up to a solid 0.9% advance from a previously reported 0.6% gain.

The increase easily topped forecasts for a more pedestrian 0.4% advance for the month — an upside surprise for a sector that had little to cheer about to start the year. The strong March tally was enough to lift quarterly sales gains modestly into the black, but the 0.1% quarterly increase relative to Q4 2023 still reflects a challenging start to the year for retailers.

Despite the strength of top-line growth, the underlying details painted a much more mixed picture of the reality across the sector. Nonstore retailers, which includes online commerce, surged by 2.7% in March and have grown by double digits over the past year. That’s no surprise, as the secular trend toward spending online remains intact.

Even so, general merchandise retailers still saw a solid 1.1% gain for the month, confirming that the resurgence in spending wasn’t limited to e-commerce.

Gas stations also posted an outsized 2.1% increase in sales in March, largely a reflection of surging gasoline prices. Higher prices at the pump, if sustained, could create a headwind for consumer discretionary spending on other goods, making it more difficult for other retail sectors. For March at least, that wasn’t readily apparent.

Despite widespread recession fears early last year, the economy has continued to defy expectations, led by resilient household consumption. Solid household balance sheets and strong wage growth has provided the fuel, while a sharp decline in the pace of consumer inflation since 2022 has been a source of relative relief.

The economy has clearly come off the boil, but the resiliency of the labor market and strong consumer spending have contributed heavily to the forward momentum for growth. At the same time, various inflation gauges have been stuck in a range since last fall that remains well above the Fed’s 2% target.

That one-two punch of sticky inflation and above-trend growth have policymakers, consumers, and investors recalibrating their expectations around when the time will be right for the Fed to begin to trim rates. The strength of recent data has now pushed expectations toward the June FOMC meeting at the soonest, but increasingly toward the latter half of the year.

Whether the Fed can deftly use its policy tools to guide inflation back to a more palatable range without disrupting growth remains to be seen. In the near term, neither growth nor price pressures appear to be abating, even to the point of whispers of another rate increase being a possibility. Given the improvement in some of the data and a growing sense that recession risk has receded, the potential for further tightening to fully tamp down inflation can’t be ruled out.

The bottom line? Strong sales growth in March salvaged an otherwise mediocre quarter for retailers. Q1 growth isn’t going to generate a round of high-fives, but closing out the quarter on a strong note should allow for a sigh of relief and a glimmer of hope that that momentum could carry through into the coming months.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.