First, the bottom line? Economic angst not yet apparent in claims data

- For all the talk of tariffs, job cuts, and a slowing economy, the labor market is still showing few signs of stress. However, that doesn’t mean that it may not still be coming, as the fallout from policy uncertainty to this point has been unambiguously apparent in surveys of consumers, investors, CEOs, and small businesses alike.

- The hard data impact is yet to come, making high-frequency data, such as weekly claims, important to monitor closely in the near term. For the time being, there’s no indication from claims of a concerning uptick in layoffs.

By the numbers: First-time claims steady; recurring claims grind higher

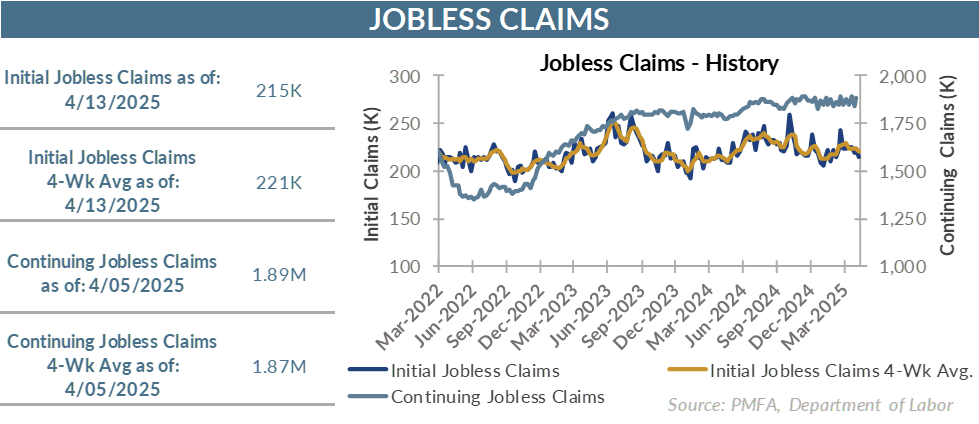

- Initial jobless claims declined by 9,000 to 215,000 for the week ended April 12. A better-than-expected result, the weekly dip also pulled the four4-week moving average down to 220,750.

- That smoothed pace of claims lands it firmly within its range over the past few years, well below its recent cyclical peak of around 250,000 in 2023.

- Despite the relative stability of first-time claims, continuing claims rose by nearly 40,000 for the week ended April 5 to 1.885 million. Recurring claims have edged back toward their highest level since the COVID-19-era disruptions eased, and the labor market roared back.

- Despite the relative firmness of first-time claims, the steady grind higher in recurring claims suggests that displaced workers may be having a harder time finding a job.

What’s the story? Still relatively quiet on the jobs front despite growing concerns

- The fog of policy uncertainty has weighed heavily on the collective mood in recent months, with surveys of consumers, investors, CEOs, and small businesses all pointing to a dimmer view of the near-term economic outlook.

- That concern reached a boiling point in recent weeks after the announcement of wide-ranging tariffs against America’s trade partners that exceeded most expectations.

- Even with President Trump’s subsequent decision to push back the implementation of most of the threatened levies by 90 days, the administration simultaneously doubled down on tariffs against China. Further, there’s little reason to believe that expectations won’t continue to change; the rules of the trade game are likely to remain in flux for the foreseeable future. As a result, wariness about what higher taxes on imports will mean for inflation and the growth outlook remain at the top of the list of economic concerns.

- To this point, the fallout has been most apparent in two places: the “soft” (sentiment) based data and on Wall Street, where stocks have taken investors on a roller-coaster ride in recent weeks.

- The “hard” data — actual readings on inflation, labor market conditions, consumption, and the like — haven’t yet shown material evidence of being affected.

- Even so, there’s a broad expectation that will change in the coming months, with inflation edging higher alongside a simultaneous slowdown in growth.

- Most economists have been revising their growth forecasts lower over the past month, although the significant uncertainty about the timing and magnitude of tariffs alone makes that a challenging task subject to a wide distribution of potential outcomes.

- That uncertainty has also prompted more economists to raise their estimated probability of a potential recession in the coming year, though few are ready to make it their baseline view.

- Yesterday’s comments from Fed Chair Jerome Powell revealed little that wasn’t already understood but reinforced the Fed’s message that anyone that expects the Fed to quickly ride to the rescue does so at their own risk.

- Fed policymakers remain focused on near-term inflation risk and are acutely aware of the mistakes of their predecessors in the 1970s who eased too early, allowing price pressures to become even more deeply rooted at the time. By all indications, the current Fed has no intention of making the same mistake.

- That means that even if greater evidence of weakness in consumption or labor conditions emerges, it may not move the needle for Fed rate cuts in the near term.

- For now, at least, labor conditions are easing, but the shift in tone is more apparent in the continued decline in job openings and a slower hiring pace than in layoffs.

- The question is how soon the negativity in the survey data may start to manifest itself more clearly in the hard data. If today’s claims report is any indication, the answer is “not yet.”

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.