In an era of sustained inflationary pressures, persistently elevated interest rates, and an uncertain trade and tariff environment, many private equity firms are experiencing longer hold times on portfolio companies. These expanded time horizons are creating significant pressure to accelerate revenue growth — an adaptive growth path that extends beyond scope of the original investment plan. However, flawed planning in growth initiatives can create a lack of clarity, an increased risk of misallocated capital, stalled initiatives, and missed market opportunities. So how do you start assessing the opportunities?

Understanding your strategic growth paths

For private equity-backed companies, revenue growth typically happens through three distinct strategic paths:

- Vertical expansion within the current value chain by integrating additional capabilities to capture more value.

- Horizontal expansion by entering adjacent markets leveraging core competencies that promise significant growth.

- Deepening existing market presence by expanding product or service lines or consolidating competitors to secure market leadership.

These growth opportunities can be organic — achieved by developing new products or services, enhancing existing processes, and entering new markets through innovation. Or they can be inorganic: acquiring partners or businesses to expand capabilities, complement offerings, or enhance synergies. The pursuit of top-line growth typically involves one or more of these strategies.

Beyond cost reduction: Tapping into core competencies

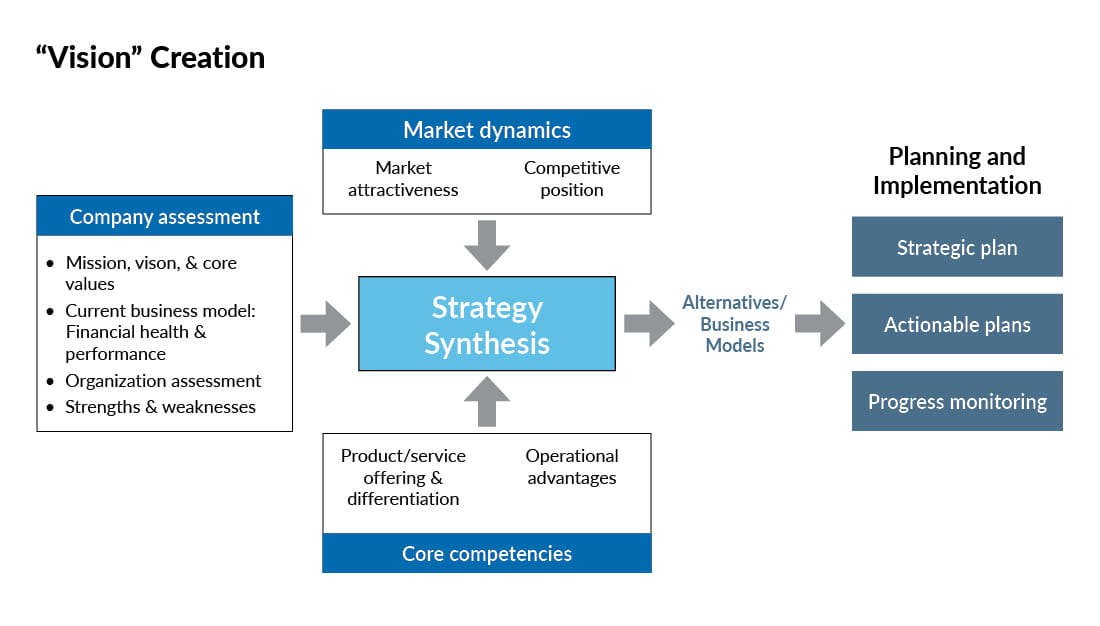

To truly drive sustainable growth, it’s critical to understand, and leverage, your company’s core competencies — those unique strengths that provide a competitive edge and offer avenues for expansion. As illustrated below, a successful strategy for driving revenue growth encompasses several key areas of focus: understanding the market opportunity, the customer, and the competitive landscape; assessing the portfolio company’s capacity for growth with its current operational, pricing, and sales capacity; and developing a strategic roadmap and plan for implementation and monitoring.

1. Evaluate the market opportunity

Embarking on growth requires a comprehensive understanding of market dynamics, which can be broken down into several key components:

- Accurately quantifying the total addressable market and forecasting growth in key segments.

- Mapping the value chains of target markets to pinpoint areas of profitability and value creation.

- Delving into customer dynamics like market shares, purchasing behaviors, and decision-making criteria, including quality, cost, and delivery.

- Analyzing the competitive landscape by identifying competitors’ market share, positioning, and strategic differentiators.

With an understanding of these dynamics, your portfolio company can accurately define its growth avenues.

2. Assess capacity for growth

Operational readiness is the backbone of successful growth. Your company assessment should include a granular analysis of production schedules, capacity limitations, and necessary capital expenditures to support growth projections. In this step, you’ll turn the focus to details such as:

- Operational capacity. This includes a thorough assessment of current capabilities, constraints, and necessary investments to scale operations and sustain growth.

- Sales capacity. Your ability to grow depends on your sales team’s ability to deliver. This in turn calls for sufficient staffing and process capacity to meet growth targets. The evaluation of your sales capacity should include sales pipelines, customer relationships, sales team incentives, and readiness to scale. Key performance indicators (KPIs) must be established to track success effectively.

- Pricing and cost strategies. Businesses should analyze product and service profitability, optimize their offerings, and refine pricing models based on market sensitivity, competitor strategies, and optimal pricing methodologies (value-based versus cost-plus). Preparation for customer pricing negotiations, supported by robust financial analyses and detailed cost justifications, can significantly streamline the negotiation process.

3. Execute and monitor growth strategies

For sustainable growth, execution must align seamlessly with your strategic intent. This is a four-stage process.

- Build a strategic roadmap: Your roadmap should outline specific milestones, timelines, and responsibilities. Initiatives should be prioritized by strategic relevance, feasibility, required resources, and expected returns.

- Create an implementation plan: Craft actionable plans for each initiative, identifying tasks, resources, deadlines, and accountability. Effective cross-functional alignment ensures transparency around strategic objectives and outcomes.

- Measure performance: Establish KPIs aligned with strategic objectives and integrate real-time dashboards for monitoring progress. Regular reviews allow for swift adjustments and strategic course corrections as needed.

- Monitor performance: Foster an environment of continuous improvement, accountability, and adaptability. By consistently analyzing performance data and nurturing feedback loops, companies can refine strategies and pivot in response to market changes.

Expert guidance is essential

Systematic assessment of market opportunities, internal readiness, and execution strategies requires advisors with a broad base of industry experience. They bring external expertise to complement your internal resources in developing a market size and opportunity outlook. They also bring an independent perspective to business cases and growth projections, potentially with suggestions of target companies to consider.

Growth reimagined: Get started now

As you reassess your company’s growth strategy, think critically about how you can exploit current market dynamics to create value. By focusing on core competencies, understanding capacity for growth, and executing intentional strategies, you can maximize your portfolio’s potential to reshape the narrative and achieve transformative growth that not only withstands external pressure but thrives in its midst.