The qualified small business stock (QSBS) exclusion under Section 1202 is a great tax tool for increasing return on investment to investors in investment funds, including private equity (PE) and family offices. By getting to know the requirements, you can make sure to capitalize on a Section 1202 strategy when opportunity comes knocking.

The gain exclusion under Section 1202 is designed to incentivize investment in small and medium-sized businesses through permanent tax savings on the exit. Eligible investors selling C corporation stock originally issued from the company and held for at least three years may now qualify to exclude up to 100% of the gain from taxable income. For stock issued on or after July 4, 2025, the exclusion is phased in based on the holding period, allowing for a 50% exclusion after three years, 75% after four years, and up to 100% after five years. The corporation and the investor must meet all of the requirements of Section 1202 to take advantage of the gain exclusion, including the size of the corporation at the time of investment, the form of the investment, the activities of the corporation, and the type of investor.

How do you know if a Section 1202 strategy is right for your next investment in a portfolio company? These top six factors will help you weigh the Section 1202 tax benefits for your investment group against the limitations.

1. Investor qualification

Whether widely or closely held, the composition of your investor group can have a big impact on the benefit of a Section 1202 strategy. Section 1202 is designed for noncorporate U.S. taxpayers such as individuals, trusts, or estates. Investors with a tax profile that won’t qualify — like corporations, nonprofits, retirement plans, and foreign shareholders — won’t realize the benefits of a Section 1202 strategy. However, while they may be indifferent to the Section 1202 qualification, some investor types may be aligned with the Section 1202 structure if they prefer investing in C corporations over flow-through entities. In addition, equity held through a carried interest or management equity incentive plan might have the potential to qualify for Section 1202.

2. Entity choice: C corporation vs. flow-through

Direct formation of a C corporation satisfies Section 1202 requirements for entity type, but it’s not the only option. Alternatively, limited liability companies that elect to be taxed as a C corporation may also qualify for Section 1202. Forming a limited liability company also allows the company to temporarily operate as a flow-through entity and later elect to be taxed as a C corporation. The advantages and disadvantages of this strategy are heavily impacted by the timing of the conversion to ensure the company qualifies for Section 1202.

It’s important to weigh the benefits of operating as a C corporation versus a flow-through entity. While C corporations are required and offer potential tax-free gains under Section 1202, businesses structured as partnerships typically will miss out on this benefit. The decreased corporate tax rate compared to the increasingly complexity of flow-through taxation can be favorable factors for investors. However, tax savings under Section 1202 are maximized when selling C corporation stock which has the potential to adversely impact the price on exit. A comprehensive decision should account for the full spectrum of implications on the company’s structure, operations, and eventual exit strategy to ensure alignment with long-term goals.

3. Size matters: $50 or $75 million asset limitation at time of investment

The size of the target is important in evaluating the Section 1202 strategy. For stock issued before July 5, 2025, the corporation must have less than $50 million of assets at the time the stock is issued and all times prior to the issuance. For stock issued after July 4, 2025, the threshold increases to $75 million. As the company grows and later exceeds the applicable threshold, the stock issued prior to exceeding the threshold remains qualified.

When determining the threshold, asset values are typically measured by their tax basis. Since tax basis is often less than book or fair value, this may allow businesses to qualify for Section 1202 even when their valuations have continued to skyrocket. However, assets received in a contribution, such as seller rollover, are measured by their fair market value at the time of the contribution.

The dollar threshold is measured based on gross assets, not equity value, sometimes causing unexpected disqualification. For example, a corporation formed with business assets worth $50 million and $10 million of new cash, the stock would qualify. However, if the contributed business was worth $50 million but comprises assets worth $70 million, netted with debt and operating liabilities of $20 million, then the new corporation would have assets over $75 million when combined with the new cash investment, and the stock issued wouldn’t qualify for Section 1202.

4. Doing business (qualified activities)

When evaluating targets for a Section 1202 strategy, it’s important to look at companies operating in qualifying industries. Generally, businesses that often qualify include manufacturing, technology, construction, and retail. The business must be engaged in qualified activities during “substantially all” of the investor’s holding period.

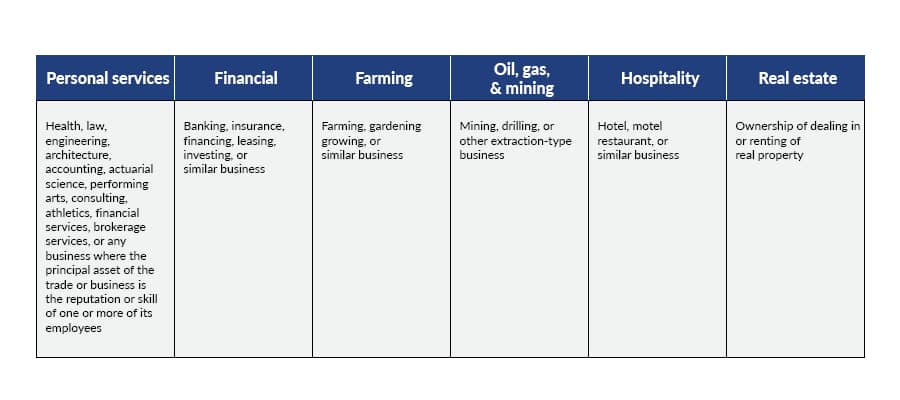

A qualified trade or business is any trade or business other than:

It’s possible for a business to have some qualified activities and some nonqualified activities, so careful paying attention to the lines of business and revenue streams is important. Keep an eye on the balance sheet as well. At least 80% of the fair market value of the corporation’s assets must be used in qualified businesses. Investment securities, investment real estate, nonbusiness receivables, excess cash/working capital, and assets used in disqualified activities can trip up your qualification. Therefore, investment funds should review whether an acquisition target or a pivot in business strategy could cause the business to diversify into activities or otherwise accumulate nonqualified assets.

5. Funding and ownership changes in a partnership holding company

QSBS must be held for five years, and it can be tricky to maintain qualification as the ownership and structure of the company changes over time, particularly in the event of capital raises and add-on acquisitions. Some of the key ways to proactively protect QSBS are through regular examination and documentation.

Investment funds will need to monitor Section 1202 qualifications at the time of the initial platform acquisition and as subsequent funding rounds or add-on acquisitions take place. If the gross asset threshold is exceeded as a result of new funding or an add-on acquisition, then any equity issued to new and existing shareholders to fund the acquisition won’t qualify for Section 1202. In this case, it may be more beneficial to utilize debt funding rather than equity funding from existing shareholders to avoid diluting the existing shareholders’ future eligible gain. In some cases, alternative structures, such as separate sister C corporations, might be considered.

Section 1202 considerations may differ for direct and indirect owners of the company. QSBS held through a partnership may still qualify for Section 1202 if the investor held interests in the partnership at the time the partnership received the QSBS and their proportional interest in the stock remains static. However, additional rounds of funding and changes in indirect interests in the corporation can erode the benefit of Section 1202 and make the structure less tax-efficient. This issue is unique to structures with partnership holding companies and don’t apply to investors directly owning C corporation stock. C corporations held directly can engage in multiple rounds of funding without diluting Section 1202 benefits of the other shareholders, even if the company has already exceeded the $50 million asset test or plans to exit before the new equity meets the five-year holding period requirement.

When there’s a partnership holding company in the structure, capital raises can create ambiguity under Section 1202 even when cash is contributed pro rata without altering ownership percentages. Such contributions might be construed as issuing new partnership interests, potentially violating the original issuance requirement by granting new partners a stake in historical stock. While there might be arguments available to avoid this conclusion, if the company needs additional funding, it may be advisable to create a second partnership for that purpose to isolate the funding and issuance from the original investor.

Overall, typical investment fund structures have the potential to qualify for Section 1202 benefits, but extreme care must be taken over the life cycle of the investment to ensure that the benefits realized on exit are maximized.

6. Selling QSBS and maximizing return

If the QSBS is owned through a partnership, the exit must be structured as a sale of QSBS by the partnership. Sale of the partnership interests themselves won’t qualify for Section 1202.

For investors seeking a significant return on exit, retaining cash within the company to fuel growth and maximize the sale value is typically more advantageous under Section 1202 than paying dividends which don’t qualify for Section 1202 benefits. Even if a buyer doesn’t want to acquire the cash on the balance sheet, an exit transaction can be structured to permit the corporation to distribute the cash at closing in a manner that still results in capital gain that can qualify for Section 1202. Care must be taken to ensure that the transaction is structured properly to achieve this result.

If the partnership doesn’t wish to sell the entirety of the QSBS, there are opportunities for individual partners to take advantage of Section 1202 in a partial exit. The partnership may distribute a partner’s share of the QSBS to the partner without disqualifying the distributee partner or harming the remaining partners. These distributions must be carefully structured and documented to preserve the QSBS qualification for both the distributee and the other partners.

Is Section 1202 right for your next investment?

Section 1202 can create a tax advantage for private equity funds and family offices that regularly invest in small to midsized businesses by increasing after-tax dollars on the sale of the investment. This has the potential to draw greater investor interest than investment funds that don’t focus on this strategy. When taking advantage of this strategy, details matter and paying close attention to those details is critical. By understanding the issues and considerations, investment funds can structure their investments to maximize tax savings, protect QSBS status, and plan effective exit strategies. For detailed guidance on how you can navigate the complexities of Section 1202 in an investment fund structure, reach out to our advisors today.