Newly issued — ASU 2025-08: Purchased Loans

We’ve long awaited anticipated guidance to amend the accounting for purchased financial assets, a primary topic of discussion the past couple years. That wait ended on Nov. 12, 2025, when the Financial Accounting Standards Board (FASB) published Accounting Standards Update (ASU) 2025-08, Financial Instruments — Credit Losses (Topic 326): Purchased Loans.

Refresher: Guidance prior to ASU 2025-08

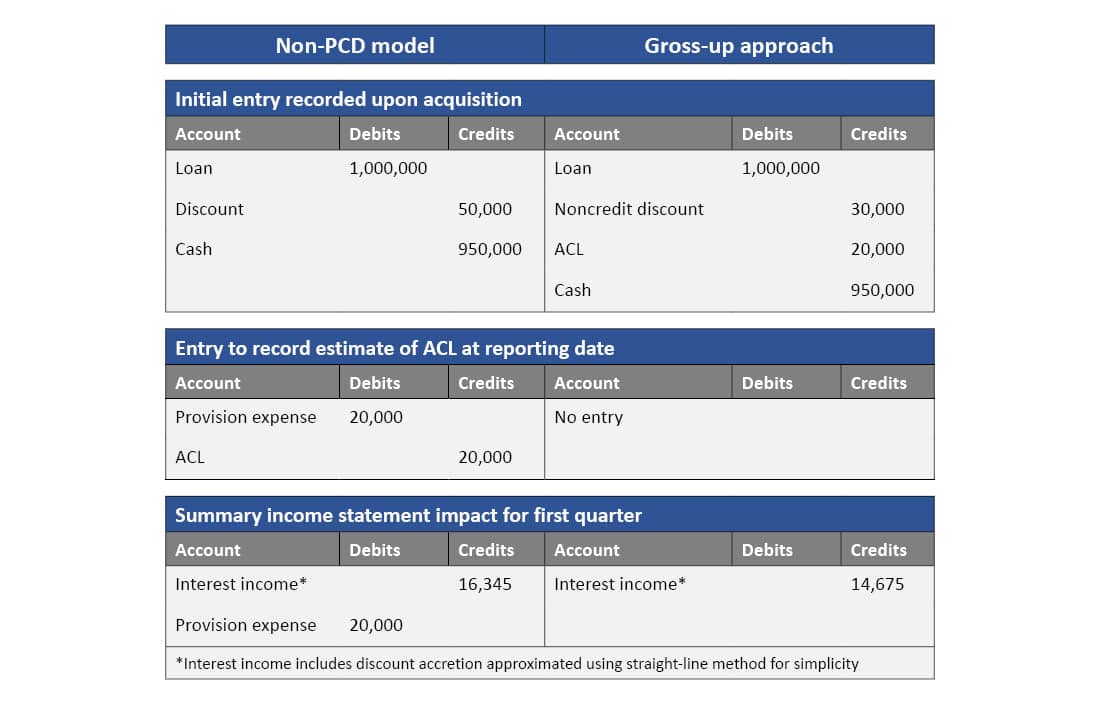

Institutions were required to evaluate each purchased financial asset individually to determine if it met the more-than-insignificant credit deterioration criteria to require classification as purchase credit deteriorated (PCD). The method of accounting for purchased financial assets differed depending on classification as PCD or non-PCD.

PCD assets accounted for using the gross-up approach. The initial ACL is added to the asset’s purchase price (i.e., grossed-up) to arrive at the amortized cost basis. No provision for credit loss expense is recognized upon acquisition, as the credit-related portion of the fair value mark is recorded as the initial ACL with the remainder recorded as the discount.

Primary concerns with non-PCD model

- Non-PCD double count - Requirement to recognize the credit portion of the fair value mark as part of the accretable discount and a separate ACL often seen as double counting expected credit losses.

- Income statement geography - The discount is accreted into interest income over the life of the loan, leading to concern about whether accretion of the credit-related portion of the discount for non-PCD loans is representative of interest income activity.

- Diminished comparability - Criteria for PCD identification is subjective, resulting in inconsistent application from entity to entity.

Non-PCD assets also require an initial ACL to be established; however, this was recognized with a Day 1 entry to record provision expense. The full fair value mark, including the credit-related portion, was recorded as the discount and accreted to interest income over the life of the loan.

Amendments of ASU 2025-08

- Scope - Limited to loans, excluding credit cards.

- Simplification: Gross-up approach only - Still required to individually evaluate each loan as PCD or non-PCD, but PCD and “seasoned” non-PCD will be accounted for using the gross-up approach.

- Seasoning criteria - Non-PCD loans are assessed to determine if they represent purchased seasoned loans:

- Loans acquired in a business combination are always deemed seasoned.

- All other non-PCD loans are seasoned if both:

- Purchased 90 days or more after origination.

- Acquirer not involved in origination.

The table below demonstrates the differences in accounting under both methods. This example assumes the purchase of a fully amortizing loan with a three-year remaining term, consistent monthly loan payments, and a 5% interest rate.

Transition guidance

- Required to adopt in 2027 - ASU effective for all entities for annual reporting periods beginning after Dec. 15, 2026, and interim reporting periods within.

- Can early adopt now - Early adoption permitted in an interim or annual reporting period in which financial statements have not yet been issued or made available.

- Election for application period - If adopted in an interim reporting period, can elect to apply amendments as of the beginning of that interim reporting period or the annual reporting period.

- Prospective - Amendments to be applied prospectively to loans acquired on or after initial application date.

What this transition guidance means for you

This transition guidance is unique and purposefully structured to allow institutions the opportunity to immediately recognize the intended benefits of this ASU without having to go back and restate previously filed financial statements.

For example, if an entity completed a business acquisition in August 2025 and elects to early adopt for their annual reporting period ending Dec. 31, 2025, the amendments are applied to the loans acquired in that business combination for purposes of the annual financial statements, but the Form 10-Q previously filed for Q3 2025 isn’t restated. Rather, this would be cleaned up when issuing the Form 10-Q in the following year, which in this example would involve recasting the comparative disclosures as of and for the nine months ended Sept. 30, 2025, in the Q3 2026 Form 10-Q. Further, because transition is prospective only, comparative balances and disclosures from the year before adoption remain unchanged.

Newly effective — ASU 2023-09: Improvements to Income Tax Disclosure

The FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, in December 2023, so this information is not new; however, it’s time to revisit this ASU as it becomes effective for public business entities (PBEs) for annual reporting periods beginning after Dec. 15, 2024, which is the 2025 financial statements for calendar year-end PBEs. Non-PBEs have another year before adoption is required.

This ASU enhances disclosure of the factors contributing to the difference between effective tax rate and statutory tax rate. This objective is the same for PBEs and non-PBEs, but the requirements for each differ significantly.

Requirements specific to PBEs

The primary impact for PBEs is expanded requirements for the income tax rate reconciliation disclosure, including:

- Disclose both amounts and percentages.

- Disaggregation of reconciling items into 8 specified. categories (see right).

- Further disaggregation by nature of reconciling items. within those defined categories based on quantitative 5% threshold (defined below).

- Further disaggregation of foreign tax effects by jurisdiction and nature using 5% threshold.

- Disclosure of any reconciling items not included in the 8 categories that exceed the 5% threshold.

The 8 categories

- State and local income tax, net of federal income tax effect

- Foreign tax effects

- Effect of changes in tax laws/rates enacted in current period

- Effect of cross-border tax laws

- Tax credits

- Changes in valuation allowances

- Nontaxable or nondeductible items

- Changes in unrecognized tax benefits

The 5% threshold is defined as 5% of the amount computed by multiplying income (or loss) from continuing operations before income taxes by the applicable statutory federal income tax rate.

In addition to income tax rate reconciliation improvements, PBEs required to disclose:

- Qualitative description of states and local jurisdictions that make up more than 50% of the category.

- Application guidance: Start with the jurisdiction of largest effect and continue to add jurisdictions in descending order until reaching the 50% threshold.

- Explanation, if not evident in rate reconciliation, of individual reconciling items’ nature, effect, cause, and/or judgment used to categorize.

- Application guidance: When more than one presentation may be permissible, consider the need for explanatory disclosure.

Requirements specific to non-PBEs

Non-PBEs are required to qualitatively disclose: (1) the nature and effect of the eight specified categories of reconciling items identified above, and (2) individual jurisdictions that result in a significant difference between the statutory tax rate and the effective tax rate. Numerical reconciliation isn’t required.

Requirements for all entities

All entities are now required to disclose: (1) pretax income (loss) from continuing operations disaggregated between domestic and foreign; (2) income tax expense (benefit) from continuing operations disaggregated by federal, state, and foreign; (3) specific cash flows related disclosures each annual reporting period.

Cash flows related disclosures

- Amount of income taxes paid disaggregated by federal, state, and foreign.

- Amount of income taxes paid to each individual jurisdiction of 5% or more of total income taxes paid.

Application guidance

- Income taxes paid calculated net of refunds received.

- Location of these disclosures not specified, presumed acceptable on the face of the statement of cash flows or within the notes to the financial statements.

Transition guidance & takeaways

Entities may adopt the amendments of this ASU prospectively, which is recommended, leaving comparative prior year disclosures unchanged, but with the option to elect retrospective application. The disclosure requirements of this ASU aren’t overly impactful for financial institutions, but institutions should be familiar with these disclosure requirements and work with tax provision preparers to ensure they have all necessary information.