Since the new accounting standard for current expected credit losses (CECL) was released by the FASB in June 2016, community institutions have been absorbing the underlying theory, key principles, and the new methodology, which involves a change in approach and mindset from existing rules. Here are a few things to consider as you plan for this change.

Making headway

As we've been on the road working with community institutions on various aspects of adoption, including management training, model development, key decision documentation, data validation, and internal control implications, we've observed that institutions' activities and progress to date have been mixed. Some institutions set a goal to make enough headway in their methodologies to be able to estimate the expected impact of adoption by the end of 2017. Others have made plans to run parallel calculations for one year before the required adoption date (Jan. 1, 2020, for SEC registrants and 2021 for others) and have developed timelines based on those goals.

Not all institutions have reached conclusions on methodology, loan pools, and data needs. However, most community institutions have identified an implementation team and developed a timeline. This is critical, and we encourage all institutions to make CECL implementation a priority and spread the work over the remaining years to adoption.

Delays will put undue stress on your resources during the period leading up to adoption; they also will potentially limit your options in terms of available data to incorporate in your models, since compiling and validating that data may prove a time-consuming part of implementation.

Complex models not required

Representatives from regulatory agencies have reiterated that small and less complex institutions don't need complex models.

Specifically, institutions that calculate their allowance using spreadsheets under the current accounting rules likely can continue to do so under CECL. Another common theme we've heard from regulators is that institutions should think about the key factors considered in underwriting loans, and those factors are a good place to start in pooling loans and tracking data to estimate future losses.

In addition, the agencies have indicated regulators will not be setting any specific expectation for percentage increases or percentage coverage upon adoption, other than a general expectation that coverage will likely increase upon adoption.

Timeline and effective dates

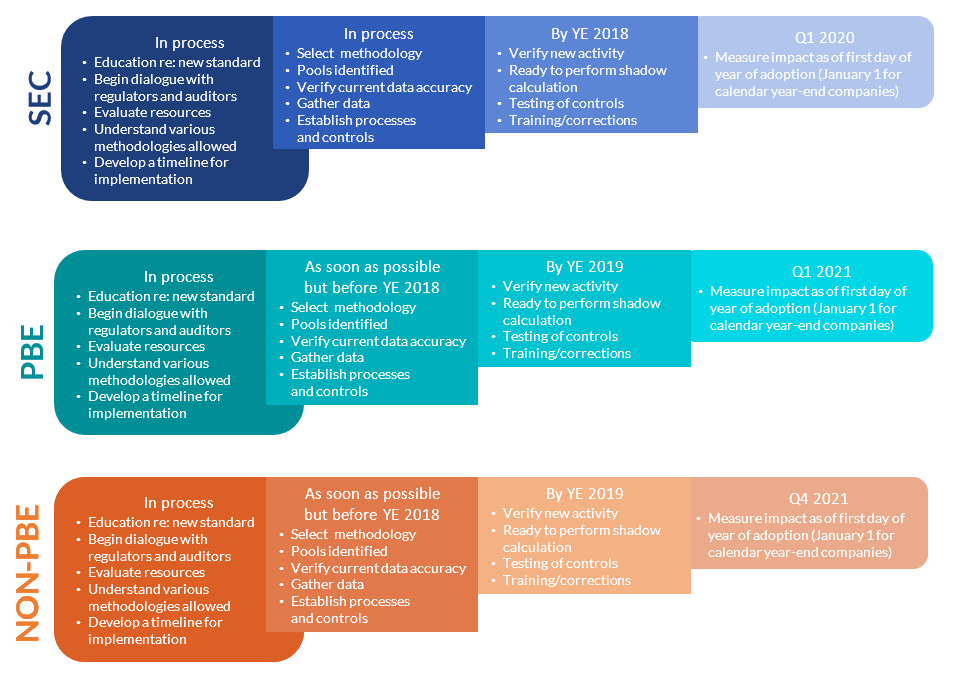

Calendar year-end SEC registrants will measure and record the impact of CECL adoption as of Jan. 1, 2020, so their first quarter 2020 filings will include the adoption adjustment. All other calendar year-end institutions will measure the impact as of Jan. 1, 2021. However, institutions not considered as public business entities aren't required to record this adjustment in interim periods, so they can wait to record the Jan. 1, 2021 adjustment until Oct. 1, 2021. This doesn't impact the amount of the adjustment, just the timing of when it's recorded, which means the first three regulatory filings of 2021 won't include the adjustment for calendar year-end, nonpublic business entities unless early adoption is elected.

Don't wait to start planning. Thoughtful consideration of the new approach and methodology now will ensure you have the data you need and simplify implementation and adoption.

As always, if you have any questions, feel free to give us a call.

Consider the following timeline as your financial institution prepares for CECL adoption: