The COVID-19 health crisis hit the global automotive industry in waves. First, the steep decline in demand and production in China, the world’s largest automotive market, which led to supply chain disruptions around the globe. Next, Europe imposed countrywide lockdowns in March, continuing into April. And now, in North America, OEMs have announced assembly plant closures through April, with restart dates as yet unclear.

Even without a specific target date, the question on suppliers’ minds remains: How do we restart the industry?

Restarting automotive production after the immediate COVID-19 crisis will be like no other restart in modern history. In prior economic downturns, production went down and came back in staggered phases — shift by shift, plant by plant. In response to COVID-19, however, assembly operations all simultaneously shut down within a week.

Coming back, schedules will be prioritized to fill depleted inventories of the most popular and profitable vehicles as well as prioritized based on available part supplies. Suppliers will need to prepare for the restart as if concurrent new-program launches across all customers are occurring at the same time. And, while ramping up, suppliers need to prepare for significant working capital demands, since cash from revenue will lag behind operating expenses.

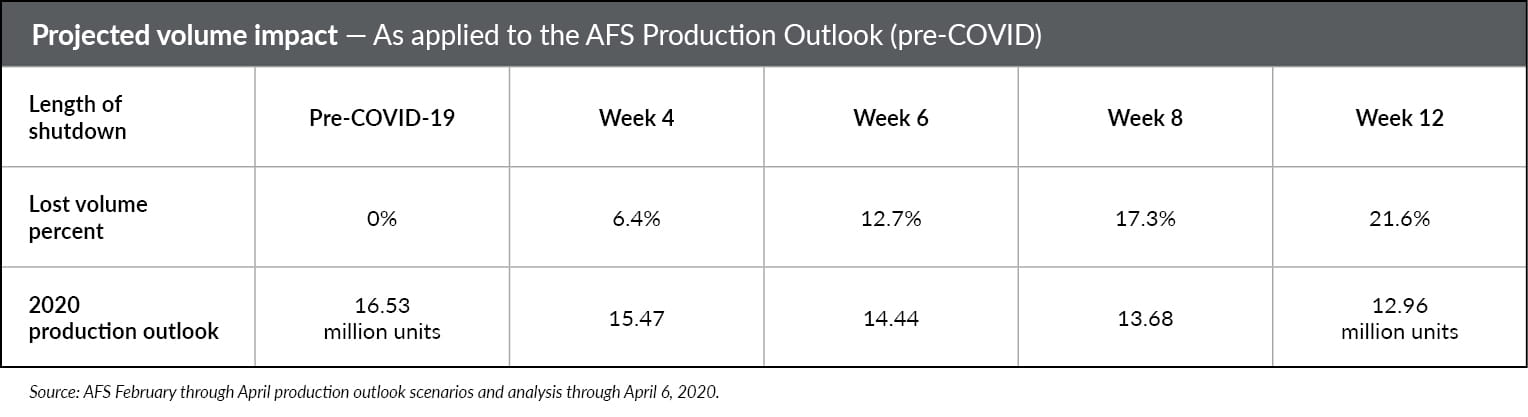

In partnership with Auto Forecast Solutions (AFS), we’ve been reviewing North American production scenarios. These are based on key factors such as COVID-19 case curves, when the industry might return to reasonably normal production schedules, and the time left in the year — for available production capacity and capabilities — to make up lost production. There is no positive scenario.

The February pre-COVID-19 production outlook for North America in 2020 was 16.53 million units. Not surprisingly, and as you can see in the table below, the length of the shutdown leads to increasing and dramatic reductions in vehicle production volume. For example, if the shutdown continues for 12 weeks, 2020 annual production would decline 21.6% to below 13 million units.

Across North America, all OEMs have announced significant shutdowns through mid- to late-April. Several are already planning to close through May. Production volume impacts due to supply chain disruption and preventative actions by organized labor continue to be key drivers, more than actual infection rates. However, when the threat of COVID-19 is identified at a production facility, vehicle manufacturers will need to heed the side of caution immediately through plant closures and extensive cleaning procedures. With widespread unemployment, the resulting combination of reduced demand and dealer orders may further reduce the 2020 outlook.

While it may feel like the distant future, the automotive industry will emerge from the COVID-19 crisis, and it’s crucial for suppliers to be prepared. Preparation begins with a well-planned roadmap to restart your plants and thinking beyond the current state of crisis. Organizations will need to restructure how to operate in a new normal that includes social distancing and personal protection. While the crisis has created uncertainty, confusion, and risk, suppliers who can hit the ground running will be far ahead of those who wait.

To help you restart, we’ve developed guidelines for suppliers that cover how to:

- Assess your organization for COVID-19 safety requirements and compliance.

- Restructure office and plant operating processes in this new-normal environment.

- Reengineer the workplace structure for personal protection and safety.

- Enforce personal protection procedures.

- Implement your restart action plan to protect your company’s future.

As you begin to develop your plans, we’ve partnered with AFS to support your forecasting needs, and we can help you revise your financial plans in preparation for your restart.

Our COVID-19 crisis management guide will help you respond, restart, and be ready. As always, if you have any questions, feel free to contact us anytime.

Plante Moran and AFS will present an OESA-hosted webinar looking at the impact of the COVID-19 pandemic on the global automotive industry, including production volumes and how to prepare for resuming production in a new operating environment. You can register here.