Editor’s Note: This article was originally published on April 7, 2020, but our National Tax Office team is continually monitoring updated guidance and making applicable updates. During 2020 it was updated to address additional guidance from the IRS related to the payroll tax deferral and the employee retention credit, as well as changes made by the PPP Flexibility Act of 2020. The most recent edit, published on Feb. 19, 2021, incorporates changes resulting from the Consolidated Appropriations Act and other guidance from the IRS and Treasury Department.

The tax incentives discussed in this article were all newly-enacted in 2020 and interpretational guidance continues to evolve. The discussion here is based on our interpretation of the applicable statutory text and the limited guidance issued through the date of the publication listed above. Much of the guidance issued by the IRS is non-authoritative and is subject to change in the future. Employers should consult their tax advisors before taking advantage of any of these incentives.

Background information on legislative developments

Two main pieces of legislation from 2020 provide several tax incentives for employers through the payroll tax system. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on March 27, 2020, and supplemented the Families First Coronavirus Response Act (FFCRA), signed into law on March 18, 2020. See our analysis of the CARES Act and the FFCRA, as well as on-demand webinars on the CARES Act and FFCRA. The programs included in those bills were then significantly modified at the end of 2020 by the Consolidated Appropriations Act, 2021 (CAA). See our analysis of the CAA and a new webinar on what those changes mean for the employee retention credit. In addition, a new employee payroll tax deferral program was implemented through IRS guidance based on an executive order.

The payroll tax provisions include:

- Employee retention credit: For 2020, a maximum $5,000 per employee refundable payroll tax credit was available for certain employers that retained employees. For 2021, the credit retains many of the same features, but the maximum is increased to $7,000 per employee per quarter for the first half of 2021 ($14,000 total credit per employee).

- Employer payroll tax deferrals: Employers were eligible to defer an unlimited amount of employer Social Security taxes on wages paid between March 12, 2020 and December 31, 2020. The deferred taxes will be paid in two equal installments at the end of 2021 and 2022.

- Payroll credit for required sick leave: A refundable payroll tax credit is available in an amount equal to any payments of the new required sick leave. The sick leave mandate only applied to 2020, but the credit extends into 2021 on a limited basis.

- Payroll credit for required family leave: A refundable payroll tax credit is also available in an amount equal to any payments of the new required family leave. The paid family leave mandate similarly expired at the end of 2020, but the credit extends into 2021 on a limited basis.

- Employee payroll tax deferrals: Employees were able to defer their share of Social Security taxes on wages not exceeding an income threshold that were paid between Sept. 1, 2020 and Dec. 31, 2020. The deferred taxes are repaid through additional withholding during 2021.

Four of these incentives provide opportunities for employers to obtain immediate access to cash. When immediate access is not available, employers are permitted to request payroll tax refunds. The CARES Act also created a new Payroll Protection Program (PPP), administered by the Small Business Administration, to provide loans to businesses with less than 500 employees. That program has been modified through subsequent legislation, including the creation of second draw loans pursuant to the CAA.

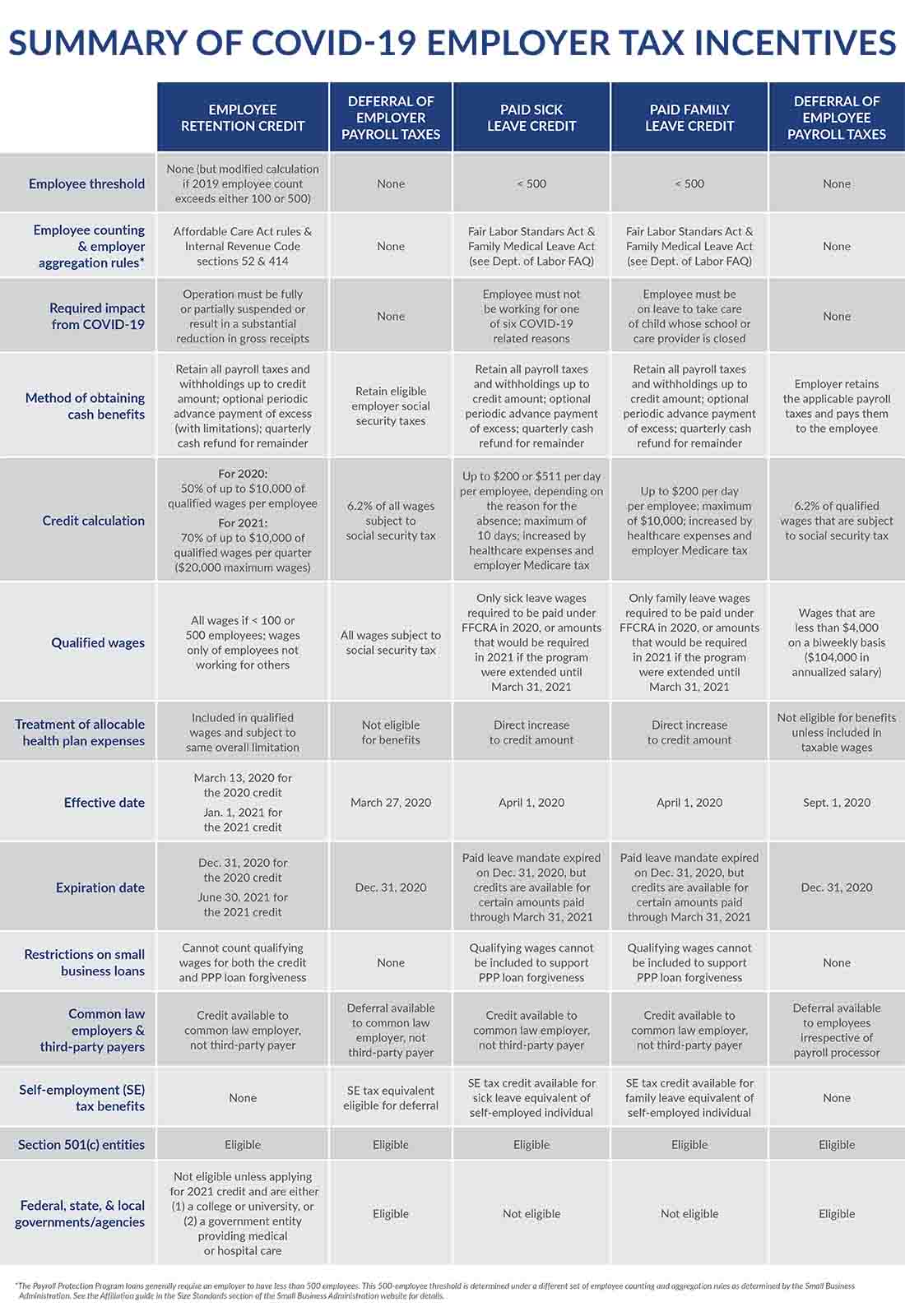

While these tax incentives provide a much-needed source of liquidity for many businesses, they have also created a good deal of confusion regarding their application, interaction with each other, and interaction with the small business loan programs. In some cases, the utilization of one program precludes the use of others, and there are anti-duplication rules to prevent duplicate benefits from being claimed. This alert is intended to help address this confusion through a detailed analysis of each of the employer incentives. This includes illustrative examples throughout and a comparative summary table at the conclusion. That table is especially helpful as a reference guide.

While this alert doesn’t directly address the Payroll Protection Program, see our PPP analysis.

To navigate to a specific section, click the link below. Keep reading normally for the full alert.

- Employee retention credit – 2020 and 2021

- Employer payroll tax deferrals – 2020 only

- Payroll credit for required paid sick leave – 2020 and 2021

- Payroll credit for required paid family leave – 2020 and 2021

- Employee payroll tax deferral – 2020 only

- Summary of COVID-19 employer tax incentives

Employee retention credit – 2020 and 2021

The CARES Act created a new employee retention credit to incentivize employers to continue paying employees adversely impacted by the COVID-19 outbreak. This program was modified and expanded by the CAA with some of those changes having retroactive effect into 2020. The 2020 credit is available to eligible entities and is equal to 50% of up to $10,000 of qualified wages per eligible employee paid after March 12, 2020, through Dec. 31, 2020. The 2021 credit is available to eligible entities during the first two quarters of 2021 and is equal to 70% of up to $10,000 of qualified wages per employee per quarter. Thus, the maximum credit per employee is $5,000 in 2020 and $14,000 in 2021.

Entities eligible for the retention credit

Entities which are either (1) carrying on a trade or business during 2020 or (2) a Section 501(c) organization are potentially entitled to the credit. For 2021, governmental entities are also potentially eligible if they (1) are a college or university or (2) provide medical or hospital care. In addition, the eligible entity must be economically affected by the COVID-19 pandemic, which can be demonstrated in one of two ways:

- The entity’s operations must be fully or partially suspended as a result of a government order that imposes limitations upon travel, commerce, or group meetings due to the COVID-19 pandemic.

- The entity suffers a decline in gross receipts for a calendar quarter when compared to the same quarter in the 2019 calendar year. To qualify for the 2020 credit, the employer must initially suffer a greater than 50% reduction in gross receipts. However, for 2021, there only needs to be a 20% reduction in gross receipts. These tests are discussed in greater detail below.

Full or partial suspension

The full or partial suspension must be related to an order, proclamation, or decree from the federal government or any state or local government with jurisdiction over the employer’s operations. The order must be mandatory and not merely a suggestion or recommendation. In certain circumstances, a multi-location employer is permitted to apply procedures from a government order in one jurisdiction to all its locations and treat all locations as fully or partially suspended. Otherwise, a business that is shut down under a government order in one jurisdiction but allowed to fully operate in another jurisdiction is still considered partially shut down due to a government order.

A business deemed essential under the applicable government order is not partially shut down, but such business may qualify under this standard if its suppliers are not deemed essential and are unable to supply critical goods or services. An employer is partially suspended if (1) the government order requires it to suspend a portion of its operations even though it may continue the remainder of its operations (e.g., restaurants must close but carry-out and delivery orders are permitted), (2) its hours are required to be limited, or (3) if employees are not permitted inside of the workplace and are not able to work remotely in a comparable manner. However, an employer is not fully or partially suspended due to a government order even if it must shutdown because its customers cannot frequent the business as a result of a government order. Employers that are essential businesses that are permitted to remain fully operational are not considered fully or partially suspended.

In general, an employer that is fully or partially suspended will remain eligible only until it’s no longer suspended due to the government order. The facts of a situation are critical for determining eligibility under this standard. The IRS has provided a number of frequently asked questions that describe common fact patterns related to suspension of business operations.

Reduction in gross receipts

An employer can also be an eligible employer if it meets the gross receipts test even if its operations are not fully or partially suspended. There is no requirement to show that a reduction in gross receipts is attributable to COVID-19 or a government order. To measure a gross receipts decline, different tests apply to 2020 and 2021.

- 2020 gross receipts testing: The 2020 gross receipts test requires the employer to initially suffer at least a 50% decline in gross receipts for a calendar quarter as compared to the comparable calendar quarter in 2019. If an employer is eligible under the substantial reduction in gross receipts test, it remains eligible through the quarter in which gross receipts exceed 80% of the gross receipts from the same calendar quarter in 2019 (but in no cases can this extend beyond Dec. 31, 2020). An employer that acquires a business during 2020 can include the gross receipts of the acquired business in its 2019 quarterly gross receipts as long as it can reasonably determine what the prior owner’s gross receipts were for that period. Additionally, all related businesses are required to be combined for purposes of measuring this test. Tax exempt organizations include gross receipts from all operations, including total sales, amounts received for services, investment income, dues and assessments, and the gross amounts received as contributions, gifts, grants, or similar items.

- 2021 gross receipts testing: The 2021 gross receipts test is simplified and only requires an employer to have experienced a 20% decline in gross receipts for a calendar quarter in 2021 as compared to the comparable quarter in 2019. Additional flexibility has been created for 2021 by allowing an employer to elect to use its gross receipts from the immediately preceding calendar quarter to test eligibility. However, such amounts are still compared to the comparable calendar quarter in 2019 (see Example #4 for details). Quarterly gross receipts are not something that most businesses are ordinarily required to measure for income tax purposes and may require additional accounting and tax procedures. For example, an employer with book-tax differences in its gross receipts may need to compute those on a quarterly basis or an employer that has an interest in a flow-through entity may need to obtain gross receipts information from that other entity. The ability to use the prior quarter’s gross receipts for 2021 may be especially beneficial for employers wishing to claim the credit in 2021 on a contemporaneous basis. The IRS has not issued guidance clarifying whether the election to utilize the prior quarter’s gross receipts must be used consistently for each quarter in 2021. In the absence of such guidance it appears that employers can make this election independently for each quarter of eligibility.

These tests are illustrated in the examples below:

- Example #1: ABC, Inc. operated a trade or business in 2020 and previous years. As a result of government orders in State X which restricted travel, ABC was required to suspend its operations from March 10, 2020 through April 30, 2020. Assuming all other eligibility requirements were met, ABC is eligible for the credit for wages paid during the first and second calendar quarters of 2020. Note, however, that only wages paid after March 12, 2020 and through April 30, 2020, can qualify for the credit. See Example #2 for the application of the gross receipts test.

- Example #2: Assume the same facts in Example #1 and that ABC restores its business operations on May 1, 2020 after the state order is lifted. For the first calendar quarter, ABC’s gross receipts were 85% of gross receipts received for the first quarter in 2019. Gross receipts for the second and third calendar quarters were 45% and 90%, respectively. Because gross receipts fell by more than 50% for the first time in the second quarter, ABC met the gross receipts test for the second quarter of 2020. ABC was already an eligible employer for the first month of the second quarter because of the state order. Still, meeting the gross receipts test for the second quarter allows ABC to continue to be an eligible employer for the entirety of the second quarter and for the third quarter even though there was no state order during the third quarter. Since gross receipts increased above the 80% threshold in the third quarter, ABC is not an eligible employer for wages paid after the third quarter. As a result, ABC is an eligible employer for the first quarter (partial/full suspension), second quarter (partial/full suspension and gross receipts test), and third quarter (gross receipts test).

- Example #3: Assume the same facts as Examples #1 and 2 except that the third-quarter gross receipts for 2020 were 60% of the gross receipts received for the third quarter in 2019. Since an employer only loses eligibility under the gross receipts test after the quarter in which its gross receipts exceed 80%, ABC was still an eligible employer during the third and fourth quarters. Gross receipts do not have to be determined for the fourth quarter, because even if gross receipts exceeded 80% of the gross receipts for the fourth quarter, that really only drives the qualification for the subsequent quarter and different rules apply in 2021.

- Example #4: DEF, LLC operated a trade or business in 2021. As a result of government orders in State Y which restricted travel, DEF partially suspended its operations, suffering a reduction in operating capacity from Jan. 10, 2021 through Feb. 15, 2021. DEF projects that its gross receipts for the first quarter in 2021 will be 85% of those in the first quarter of 2019. However, DEF’s gross receipts for the fourth quarter of 2020 were only 70% of those in the fourth quarter in 2019. DEF is not an eligible employer based on the projected gross receipts for the first quarter of 2021 but is an eligible employer by electing to utilize the gross receipts from the prior quarter. DEF is also an eligible employer during the period that it was subject to the governmental order. Therefore, DEF is an eligible employer for the entirety of the first quarter due to its gross receipts decline under the alternative test.

- Example #5: Assume the same facts as Example #4 except that DEF’s gross receipts for the second quarter in 2021 are projected to be 75% of those in the second quarter of 2019. DEF was an eligible employer in the first quarter based on the alternative gross receipts test, which utilized the gross receipts from the fourth quarter of 2020. In the absence of additional guidance DEF appears to be able to utilize either its actual gross receipts from the second quarter of 2021 or the gross receipts from the prior quarter when evaluating its eligibility in the second quarter of 2021. In this case, DEF’s actual gross receipts in the second quarter of 2021 meet the required decline but its gross receipts in the first quarter would not support eligibility. Therefore, DEF will utilize its current quarter gross receipts and is an eligible employer in the second quarter.

- Example #6: GHI, Inc. is an automobile repair service business. It is an essential business and is not required to close its locations or suspend its operations. Due to a governmental order that limits travel and requires members of the community to stay at home except for certain essential travel, such as going to the grocery store, GHI’s business has declined significantly. GHI is not considered to have a full or partial suspension of operations due to a governmental order. However, GHI may be considered an eligible employer if it has a significant decline in gross receipts.

- Example #7: JKL, LLC is a software development company that maintains an office in a city where the mayor has ordered that only essential businesses may operate. JKL’s business is not essential under the mayor’s order and must close its office. Prior to the order, all employees at the company teleworked once or twice per week, and business meetings were held at various locations. Following the order, the company ordered mandatory telework for all employees and limited client meetings to telephone or video conferences. JKL’s business operations are not considered to be fully or partially suspended by the governmental order because its employees may continue to conduct its business operations by teleworking.

Businesses not eligible for the credit

The CARES Act created a new Payroll Protection Program to provide loans primarily to businesses with less than 500 employees. Employers that received this new type of loan — regardless of the date of the loan — were originally ineligible for the employee retention credit. However, the CAA modified the PPP and ERC programs to remove this prohibition. This change is retroactive to the date of the CARES Act, so many employers may be retroactively eligible for the retention credit in 2020.

The modified rules include anti-duplication provisions to coordinate the employee retention credit with PPP loans. Specifically, employers can only claim the employee retention credit on any eligible wages not used to support PPP loan forgiveness. Wages that could count toward both provisions can be applied to either, but not both, at the election of the employer.

Federal, state, and local governments, subdivisions, and agencies are not eligible to claim the credit. However, for 2021, certain governmental entities are eligible if they are a college or university or an entity with the principal purpose of providing medical or hospital care. In addition, certain tribal governments may be eligible in both 2020 and 2021 with respect to business operations.

Amount of the credit

The credit is determined on a per-employee basis and with respect to “qualified wages” paid to eligible employees. Qualified wages include both gross wages subject to FICA tax as well as costs for employer-provided healthcare. For 2020, the credit is equal to 50% of up to $10,000 of qualified wages per employee that were paid after March 12, 2020 through Dec. 31, 2020. For 2021, the credit is equal to 70% of up to $10,000 of qualified wages per employee per quarter. Currently, the retention credit only applies to the first two quarters in 2021, so the maximum qualified wages per employee for the 2021 calendar year is $20,000.

The amount of healthcare expenses taken into account generally includes both the portion of the cost paid by the employer and the portion of the cost paid by the employee with pre-tax salary reduction contributions. However, the expenses should not include amounts that the employee paid for with after-tax contributions. For employers exceeding the 100 employee or 500 employee thresholds, all healthcare expenses allocable to time where an employee is not providing service can be included in qualified wages. For example, if an employer furloughs its employees but continues to pay their healthcare expenses, those healthcare expenses can be included in qualified wages even though no wages are being paid.

Qualified wages do not include amounts that are utilized by the employer to support PPP loan forgiveness. Employers that obtained PPP loans and wish to claim the employee retention credit will be required to coordinate these programs and choose which wages will be utilized for each. The employee retention credit program requires employers to elect to exclude wages that will be utilized for PPP loan forgiveness. However, additional guidance is needed to confirm the procedural steps for making such elections and determining precisely which payroll costs supported PPP loan forgiveness if more wages were paid than were necessary to support the forgiveness of the PPP loan.

The rules for determining qualified wages differ depending upon the number of individuals employed by the employer during 2019. For this purpose, the employee threshold is 100 when claiming the 2020 credit, and the employee threshold is 500 when claiming the 2021 credit. However, in either case, the number of employees is determined based on 2019 rather than the number of employees during the year for which the credit is being claimed. Thus, for example, an employer with 250 employees in 2019 would be above the employee threshold for the 2020 credit but below the employee threshold for 2021 regardless of the number of employees maintained throughout 2020 or 2021.

- Rules applicable to employers with employees equal to or less than the threshold number (100 or 500): Qualified wages include all wages paid to all employees during a period of full or partial suspension due to a government order or during any quarter that the employer meets the gross receipts reduction test.

- For example, in Example #3 above, ABC was a qualified employer for the first, second, and third quarters and was shut down due to a government order beginning March 10. If it had 100 or fewer employees in 2019, then all wages and healthcare expenses paid from March 13, 2020 through Sept. 30, 2020, are qualified wages, subject only to the $10,000 limit per employee. If, alternatively, ABC had 300 employees during 2019, then it would exceed the employee threshold for purposes of the 2020 credit. However, it would meet the 500 employee threshold for 2021.

- Rules applicable to employers with more employees than the threshold number (100 or 500): Qualified wages only include wages that are being paid to employees on account of services not being performed due to the circumstances that cause the entity to be an eligible entity — either on account of a government order or a substantial reduction in gross receipts. Therefore, only an employer that is paying wages on account of employees that are not working for the hours paid can have qualified wages.

- For example, an employer paying an employee for 40 hours despite the employee only actually providing services for 30 hours will be able to claim qualified wages with respect to the 10 hours of non-working time (plus the healthcare expenses allocable to those 10 hours). The same principles apply with respect to salaried employees but the determination of the time where services are not being provided must be made using a reasonable methodology. A methodology will not be considered reasonable if it uses the productivity or output of an employee to estimate the time not worked. For example, if a salaried employee working at home is estimated to be only 80% productive based on the work they are able to accomplish, the 20% of non-productive time cannot be assumed to be time where services are not being provided without further documentation to show that the employee was not actually working. Employers may consider instituting timesheets or other similar reporting mechanisms to contemporaneously track this time.

To illustrate these concepts, let’s focus back on Example #3 above. In that example, ABC was an eligible employer for the first, second, and third quarters but was only shut down from March 10, 2020 through April 30, 2020. If it has more than 100 employees, only wages paid to employees while they were not working (or who had a reduction in hours) during the shutdown period are qualified wages. Wages paid to employees for services performed (e.g., working from home or those few employees maintaining the business while all others were away) would not be qualified wages. From May 1, 2020 through Sept. 30, 2020, ABC was operating but was still at a reduced capacity. Therefore, any wages or healthcare expenses paid to employees that ABC could not yet bring back to work would be eligible wages. Wages for excess hours not worked with respect to employees who were brought back below their normal level of work (e.g., a full-time hourly employee working 30 hours per week but still getting paid for the 40 hours per week that they weren’t working would cause 10 hours to be excess hours) would also appear to be eligible wages. In any case, wages paid to ABC’s employees for the time they did work during any part of the first, second, or third quarters are not eligible wages.

The following additional rules also apply in determining qualified wages:

- Employers exceeding the employee threshold may not treat amounts paid to employees for paid time off for vacations, holidays, or sick days as qualified wages. However, employers whose 2019 employee count was at or below the employee threshold are permitted treat these wages as qualified wages, assuming all other requirements are met.

- Payments, including severance payments, made to former employees after a termination of employment will never be considered qualified wages.

- When applying the 2020 credit, employers with more than 100 employees may not treat as qualified wages any increase in wages when compared to the wages paid during the 30 days prior to the point that the employer becomes eligible. However, this limitation does not apply to the 2021 credit.

- Qualified wages do not include wages paid to dependents of, or certain other “related parties” of a person that owns, directly or indirectly, 50% or more of the employer.

- An employee may not be taken into account for the employee retention credit for any period during which the employer is eligible to claim a work opportunity tax credit for that employee.

- Wages included in the employee retention credit cannot be taken into account for the paid family medical leave credit under Section 45S (note that this credit was originally enacted for 2018 as a part of tax reform and is different than the FFCRA credit for paid family leave discussed below).

- Wages cannot be included in the employee retention credit if they are included in the paid sick leave credit or family medical leave credit enacted by the FFCRA discussed below.

Rules for counting employees

For purposes of determining whether there are more than 100 employees, the rules of Section 4980H apply. These are the same rules that apply for the purposes of determining the number of employees under the Affordable Care Act provisions. In general, only full-time employees are counted which includes an employee who, with respect to any calendar month in 2019, had an average of at least 30 hours of service per week or 130 hours of service in the month. An employer that operated its business for the entire 2019 calendar year determines the number of its full-time employees by taking the sum of the number of full-time employees in each calendar month in 2019 and dividing that number by 12. Employers that began their business in 2019 only count full months that they were in operation and those that began in 2020 use a similar rule but applied to current year employees.

In counting employees, the aggregation rules of Sections 52(a), (b), 414(m), 414(o) also apply. Therefore, all entities treated as a single employer under those sections are considered one employer for the employee retention credit. These aggregation rules are the same rules that apply in determining whether a business is a small business for various other income tax accounting concepts, including the exemption from the business interest limitation of Section 163(j) and whether the business qualifies for the small business exception which would allow the cash receipts and disbursements method of accounting to be followed. Even though these rules can be very complex, many businesses will have already made these determinations for other purposes and may simply need to refer back to previous analyses.

Cash flow from the credit

The retention credit is a refundable payroll tax credit. An employer is permitted to retain payroll taxes and withholdings up to the amount of the credit in order to take advantage of the credit contemporaneously with when wages are paid. An employer is permitted to retain any amounts that would otherwise be due to the federal government, which consists of employee and employer Social Security taxes, employee and employer Medicare taxes, and employee federal income tax withholdings. The retained amounts can be related to any wages paid for the period and do not need to relate to the qualified wages.

To the extent that there are not enough withholdings to cover the full amount of the credit, the employer can either (1) wait until the end of the quarter and request a cash refund with its quarterly payroll tax return, or (2) file Form 7200 to obtain an advance refund for the credit in the current quarter. Advanced payments of credits were broadly available for the 2020 credit. However, for the 2021 credit this has been restricted to employers that did not exceed the 500-employee threshold in 2019. Those employers may obtain a maximum quarterly advanced refund amount of up to 70% of the average quarterly wages paid by the employer during the 2019 calendar year. For this purpose, special rules apply to seasonal employers and those that were not in existence in 2019.

The employee retention credit can also be claimed retroactively for a prior quarter by filing an amended quarterly payroll tax return. The amended filing option may be particularly helpful for employers that obtained PPP loans in 2020 and are retroactively eligible for the retention credit in that year. In addition, this may be helpful in cases where an employer is unsure about its eligibility during the calendar quarter and simply wishes to wait until the quarter has concluded to revisit retention credit opportunities.

The IRS has issued Notice 2020-22, providing that an employer will not be subject to any failure to deposit penalties with respect to payroll taxes retained in an amount equal to the anticipated credit. It’s not clear how this penalty relief will apply in situations where an employer miscalculates the available credit or where it loses its eligibility at a later date. It’s also not clear how the failure to pay penalty would apply as well.

Employers should consider whether the possibility of failure to deposit penalties being assessed on any required credit repayments would be mitigated by requesting advance payments of credits rather than retaining payroll taxes. While the instructions to Form 7200 state that employers “should first reduce…employment tax deposits to account for the credits,” the language doesn’t prevent the employer from filing Form 7200 instead of reducing deposits. Employers without good data to calculate credits or that are at a high risk of becoming disqualified may also consider only taking advantage of the credit by requesting refunds on quarterly payroll tax filings to potentially avoid the imposition of additional penalties. Further penalty relief guidance is expected from the IRS to clarify these matters. In any case, the credit is reported and reconciled on each quarterly payroll tax filing. Retroactive claims for any prior calendar quarter will be claimed through the filing of an amended payroll tax filing (e.g., Form 941-X) for the applicable quarter.

Employers using PEOs and other third-party payers

The common-law employer of the employee who is paid qualified wages is entitled to the retention credit. This is true regardless of whether the employer uses a third-party payer (such as a payroll service provider, professional employer organization, certified professional employer organization, or Section 3504 Agent) to report and pay federal employment taxes. The third-party payer is not entitled to claim the credit regardless of whether the third party is considered an “employer” for other purposes.

A common-law employer that is a client of a third-party payer can retain applicable withholding taxes that the third-party payer would have otherwise collected. If the third-party payer files aggregate payroll tax filings for multiple clients, it would reconcile all such amounts from all clients on that filing.

A common-law employer is also permitted to request the advance payment of the retention credit on Form 7200 even if its employment tax return information is included on the aggregate employment tax return of a third-party payer. The employer is required to provide the third-party payer copies of the Form(s) 7200 so it can reconcile the credits on the aggregate employment tax return. The third-party payer also may request an advance refund on its client’s behalf.

A third-party payer is required to maintain a documentation regarding its client’s eligibility for any credits claimed so the parties must work closely together to fully take advantage of the retention credit.

Impact of credit on taxable income

If the employer is subject to the income tax, the amount of the credit must be included in the employer’s taxable income computation. As a result, the net benefit of the credit is reduced by the entity’s marginal tax rate. Still, the business is permitted to obtain the full cash benefit of the credit through the payroll tax system, and any additional income tax is paid through estimated taxes, which may not be due until much later than when the credit is received. The impact of this income adjustment may also be deferred to the extent that in 2020 it reduces net operating losses that cannot be carried back because income does not exist in the previous five years, or in 2021 it reduces net operating losses that are no longer permitted to be carried back.

State income tax consequences from receiving the credit will vary. Many states permit a subtraction for the increase to income resulting from employment-related federal tax credits, but it’s possible that some states would need to update their laws to cover this particular credit.

Comprehensive examples

- Example #8: MNO Foundation employed an average of 50 workers in 2019. On April 4, 2020, a government “shelter in place” order required MNO to temporarily close its doors and it was not able to operate on a remote basis in a comparable manner. That order ended on June 30, 2020, and MNO re-started its activity on that date. The foundation continued to pay wages to its 50 employees, none of whom were eligible for sick pay or family medical pay. During the shutdown, MNO paid $50,000 in wages ($1,000 per employee) and continued paying healthcare insurance premiums on behalf of employees in an amount of $20,000 ($400 per employee).

- Because MNO’s employees in 2019 averaged less than 100, all wages paid for the period during the shutdown are qualified wages. This amount is $1,400 per employee or $70,000 in total. The credit is determined on the basis of 50% of qualified wages, so the amount of the credit allowed with respect to each employee is $700. Because 50 employees were paid wages after the shutdown and no employee’s wages exceeded $10,000, the amount of the credit is $35,000.

- The withholding for the payroll paid during this period was $11,000. MNO was eligible to retain the $11,000 and not deposit such amounts when it would otherwise have been required to deposit those amounts with the federal government. The remaining $24,000 credit could either be claimed as a cash refund on a payroll tax return or MNO could file Form 7200 to obtain an advance payment of the excess credit even before payroll tax return was filed. If MNO is retroactively claiming the credit, then it will request a refund with an amended quarterly payroll tax return for the second quarter of 2020. Note that these results could differ slightly depending on how frequently MNO deposits taxes with the government and what amount of credit is generated during each deposit period.

- Example #9: PQR, LLC employs 300 people, more than 100 employees, and was partially shut down beginning March 12, 2020, as a result of a government order. During that time, it was able to maintain some operations, by employees working on a remote basis, but certain employees who weren’t able to work remotely because direct customer-facing operations weren’t permitted to continue during the shutdown period. From March 13 to March 31, 30 employees who were no longer working but were paid $1,000 and $400 of health plan expenses were still paid. All other employees were working remotely on a full-time basis.

- Because PQR is an employer with more than 100 employees, qualified wages only include wages and healthcare plan expenses paid to employees who weren’t working. Each employee who was not working had qualified wages of $1,400 during this period. As this is less than the $10,000 limit, PQR is eligible for a 50% credit on all of these wages, or $21,000 ($1,400 * 30 employees not working * 50%). PQR had total payroll taxes and withholding of $300,000 for the period (including payroll taxes and withholdings on wages for employees who were still working) so it could simply not deposit $21,000 of that amount in order to obtain immediate access to the credit.

- Example #10: PQR, LLC from the previous example was not subject to a government order during 2021, but its gross receipts for the fourth quarter of 2020 were more than 20% below its gross receipts for the fourth quarter of 2019. PQR elected to use the fourth quarter of 2020 to determine its eligibility for the first quarter of 2021. Since PQR has less than 500 employees, all of its wages and healthcare expenses paid during the quarter are qualified wages, subject to the $10,000 per employee cap. PQR’s employees receive an annual salary of $42,000 and PQR incurs $3,000 of healthcare expenses for each employee, all of which are paid evenly throughout the year. PQR’s qualified wages for the first quarter of 2021 are $11,250 for each employee, so they are limited to the $10,000 cap. PQR is eligible for an employee retention credit of $2,100,000 in the first quarter of 2021 ($10,000 * 300 employees * 70%).

- Example #11: PQR, LLC from the previous example continued to experience depressed gross receipts during the first quarter of 2021 compared to the first quarter of 2019, a reduction of more than 20%. PQR made the election to look to its first quarter gross receipts for purposes of the second quarter, meaning that it is still an eligible employer for the second quarter of 2021. PQR is eligible for another $2,100,000 of employee retention credit for the second quarter.

IRS guidance

The IRS has issued Notice 2020-22, discussing how employers can retain payroll tax and other withholdings without being penalized, a frequently asked question list discussing a variety of rules, Form 7200 and its instructions discussing advance repayments, and an updated Form 941 and its instructions. The IRS continues to update the FAQs. While the FAQs are merely informal guidance posted to the IRS website, it does confirm the current interpretations of several key questions by the IRS. It is unclear whether the IRS will undertake a more formal guidance project for the retention credit, but we would expect future guidance to closely follow the logic of these FAQs.

Our employee retention credit resource center and the IRS Coronavirus Tax Relief site will continue to be updated with all guidance on the employee retention credit.

Employer payroll tax deferrals – 2020 only

Unlike the employee retention credit that’s limited to employers who are affected in two defined ways by COVID-19, all employers were eligible to defer the 6.2% FICA portion (Social Security) of the employer’s employment taxes for any payroll paid on March 27, 2020 through Dec. 31, 2020. Please note that this program has not been extended for deposits on payroll paid after Dec. 31, 2020. This rule permits eligible employers to pay 50% of the deferred amount on Dec. 31, 2021, and the remaining 50% on Dec. 31, 2022. Governments and government agencies are eligible for this deferral despite being ineligible for other programs under the CARES Act and FFCRA.

The payroll tax deferral could be calculated prior to calculating any of the other payroll tax credits discussed in this alert. By calculating the deferral-amount first, an employer was able to maximize the cash flow from each of these incentives. For example, assume that an employer had $50,000 in total payroll tax deposits, $10,000 of the deposits were eligible for deferral (as the employer’s share of Social Security), and it was eligible for $45,000 of other payroll tax credits. This employer was permitted to retain the $10,000 under this deferral provision, retain the remaining $40,000 of withholdings under the payroll tax credit provisions, and then apply for a refund for the remaining $5,000 of payroll tax credits. By doing this, the employer would obtain the full $55,000 of cash flow benefits. If the tax credits were applied first, the employer would have absorbed most or all of the amount that would have been eligible for deferral, leaving little or nothing left to defer.

The payroll tax deferral was initially reported on the second- quarter payroll tax filings (e.g., Form 941). The IRS forms and instructions have been updated to report this deferral.

Due to a change in law made by the PPP Flexibility Act of 2020 enacted on June 5, 2020, employers that received loan forgiveness under the Payroll Protection Program or under Section 1109 of the CARES Act became eligible for the deferral of payroll taxes. Prior to the PPP Flexibility Act, employers that received PPP Loan Forgiveness were ineligible to defer payment of certain employer payroll taxes.

The IRS indicated that only amounts that had not yet been paid were eligible to be deferred. Therefore, employers were not permitted to catch-up on deferrals that they may have been eligible for at a later date by claiming a credit on a payroll tax filing for amounts previously paid even though the employer may have been eligible for deferral on that amount. It was critical that employers closely scrutinized any payroll tax filings, including those done by a third-party payer, to ensure that they were timely taking advantage of this provision.

Likewise, an equivalent portion of self-employment taxes was eligible for deferral. The self-employed individual was permitted to adjust estimated tax payments for 2020 to take this into account. The same Payroll Protection Program limitations applies to self-employed individuals. Similar rules apply whereby amounts cannot be deferred after they have already been paid. However, as self-employment taxes are paid via estimated tax payments but are not separately distinguished as payments are made, the last tax dollars due for the 2020 year are deemed to be the self-employment tax. Therefore, if a self-employed individual is fully paid in with its 2020 tax return, it will not be eligible for any deferral. However, if that individual had $4,000 of self-employment tax eligible for deferral and owed $6,000 with the return, then the full $4,000 that is eligible for deferral would be considered a component of the tax due and would be eligible for deferral.

In general, employers will only be able to deduct these payroll taxes against their taxable income in the year that they are paid. However, employers wishing to accelerate tax deductions for these deferred payroll taxes into a year earlier than 2021 or 2022 may consider advanced payment options.

IRS guidance

The IRS has issued an FAQ document and updated Form 941 and its instructions discussing a variety of rules. The IRS Coronavirus Tax Relief site will continue to be updated with all guidance on the payroll tax deferral.

Payroll credit for required paid sick leave – 2020 and 2021

The paid sick leave credit is also a refundable payroll tax credit similar to the employee retention credit. For 2020 the credit was allowed in an amount equal to 100% of the qualified sick leave wages paid by the employer during the calendar year. Qualified sick leave wages only included those wages required to be paid by an employer under the FFCRA. An employer who voluntarily paid sick leave, paid sick leave prior to the April 1, 2020 effective date, or paid an amount in excess of the required amount was not eligible for credits on those amounts. The CAA provided a narrow extension of this credit program into 2021. Specifically, an employer is eligible for the credit on qualified sick leave wages that would have been required to be paid if the FFCRA program had been extended until March 31, 2021. The CAA did not extend the mandate to provide paid sick leave in 2021. Thus, the credit is available for employers that choose to extend such leave and would have been subject to the mandate if the program had been extended. Please see Example #11 below for clarification.

In addition to the credit, employers are not subject to payroll taxes on qualified wages. The 6.2% Social Security tax is entirely abated while the 1.45% Medicare tax is still assessed but an equivalent amount is added to the credit, thereby negating its impact. In effect, this credit is meant to entirely make the employer whole with respect to those wages that the FFCRA required it to pay. These Social Security and Medicare tax provisions are applicable to all employers in 2020 that were required to provide paid sick leave. However, for 2021, those provisions only apply to employers that are eligible for the payroll tax credit. Thus, for example, government employers cannot exclude 2021 wages from the Social Security taxes.

In general, only employers with less than 500 employees were required to provide such sick leave. Under the FFCRA, the counting of employees and the aggregation of separate employers as a single employer is determined under the Fair Labor Standards Act and the Family Medical Leave Act. This is a different approach to counting and aggregation than applies for the employee retention credit.

The FFCRA required an employer to continue the pay of employees under certain circumstances but they were not required to pay any more than $511 per day. These circumstances included employees that (1) were subject to a federal, state, or local quarantine isolation order related to COVID-19; (2) had been advised by a healthcare provider to self-quarantine due to concerns related to COVID-19; or (3) were experiencing symptoms of COVID-19 and were seeking a medical diagnosis. The cap on pay was reduced to $200 for employees that were (1) caring for an individual subject to a quarantine isolation order or who had been advised to self-quarantine (as discussed above), or (2) caring for the employee’s son or daughter if the school or place of care of the son or daughter had been closed, or the childcare provider of such son or daughter was unavailable due to COVID-19 precautions. In both circumstances, wages were only required to be paid (and employers were eligible for the credit) with respect to a maximum of 10 days (or 80 hours) for all of 2020. Employers were permitted to pay amounts in excess of these limits, but those amounts wouldn’t be eligible for credits.

Amounts paid up to the $200 daily limit (or $511, where applicable) were fully eligible for the 100% credit. In addition, a proportionate share of healthcare expenses (determined in the same manner as discussed above with respect to the employee retention credit) was creditable on top of the $200 or $511 daily limit. With the 10-day limit taken into consideration, the maximum credit is $2,000 or $5,110, plus the amount of healthcare expenses allocable to those 10 sick days (plus the Medicare taxes on those wages as discussed above).

These per employee amounts were not increased for determining credit eligibility in 2021. Therefore, an employer that provided a full 10-days of FFCRA paid sick leave to an employee in 2020 is ineligible to obtain a 2021 credit for additional paid sick leave since the maximum required leave has already been provided. The amount of the credit is required to be included in the taxable income of the employer, which effectively negates the deduction claimed for the underlying wage and healthcare expenses.

The credit is not allowed to the federal government, the government of any state or political subdivision, or any of their respective agencies or instrumentalities. However, not-for-profit entities are eligible for the credit. Wages included in this credit may not be included in any other employment-related credits such as the Work Opportunity Tax Credit or the employee retention credit.

An employer is able to obtain cash with respect to the credit using the same procedures as with the employee retention credit discussed above. That is, it can retain any payroll taxes and withholdings otherwise required to be deposited in an amount up to its anticipated credit (including payroll taxes and withholdings on amounts unrelated to qualified sick leave). Common-law employers using third-party payers are eligible for the credit. See the discussion on the employee retention credit above for further details.

The IRS has issued a detailed FAQ on this credit, Form 7200 and its instructions discussing advance repayments, and updated Form 941 and its instructions. The IRS Coronavirus Tax Relief site will continue contain all up-to-date guidance.

- Example #12: STU, LLC paid $100 of sick leave to one employee for 10 days during August 2020, paying $1,000 of wages in total. For that 10-day period, STU also paid $100 of healthcare expenses determined by dividing its total healthcare expenses for the year pro rata among all employees and then prorating the expenses for this one employee pro rata among the total days that the employee would have ordinarily worked during the period. When STU paid the wages, it withheld $200 of income taxes, $14.50 of Medicare taxes, and $62 of Social Security taxes. STU didn’t owe employer Social Security taxes on these wages but did owe $14.50 in employer Medicare taxes. The healthcare expenses were a tax-free benefit, and no employment taxes were due on this amount. Therefore, STU had a total cash expenditure of $1,114.50 (net pay of $723.50 to the employee, $276.50 of employee withholdings, $14.50 of employer Medicare tax, and $100 of healthcare expenses).

- STU’s paid sick leave credit for this employee was $1,114.50 consisting of $1,000 of wages plus the $100 of healthcare expenses plus the $14.50 of employer Medicare taxes. STU was able to retain up to $1,114.50 of payroll tax and withholdings from all employees in order to take advantage of this credit. If this was STU’s only employee and no other wages were paid, then STU could retain the $291 otherwise owed to the federal government and then either apply for an advance refund for the remaining $823.50 using Form 7200 or wait until the end of the quarter and apply for a cash refund as a part of the payroll tax filing process.

- Example #13: Assume the same facts as Example #11 except that the employee took a further 7 days of paid sick leave during January 2021 due to a positive COVID diagnosis. STU was not required to provide paid sick leave to this employee under the terms of the FFCRA. That employee had already exhausted the mandated 10-days of leave in 2020. Accordingly, STU is not entitled to any payroll tax credits for the additional paid sick leave that was provided in 2021.

Payroll credit for required paid family leave – 2020 and 2021

The family leave credit works in an almost identical manner to the sick leave credit, as it is also a credit equal to 100% of any wages and healthcare expenses that an employer was required to pay under the FFCRA. An employer was only required to pay up to $200 per day in 2020 under the required paid family leave, and the tax credit is limited to this amount. The only category of employee that’s eligible for paid family leave under FFCRA are those who were unable to perform services (including telework) because of a need to care for a child whose school or place of care was closed or whose childcare provider was unavailable due to COVID-19. Any wages paid in excess of $200 were not eligible for the credit. Any healthcare expenses are creditable in addition to the $200 per day, and the credit was increased by Medicare taxes owed on qualified wages. The maximum limit is $10,000 (which represents the 10 weeks of paid family leave, measured at five days per week, at $200 per day required to be provided by the FFCRA) plus healthcare expenses and the Medicare tax.

This credit is also available for paid family leave that is provided during the first quarter of 2021 to the extent that the employer would have been required to provide such leave if the program had been extended until March 31, 2021. Similar to the paid sick leave provisions discussed above, the mandate to provide paid family leave expired at the end of 2020.

All of the provisions applicable to the sick leave credit discussed above apply to the paid family leave credit as well, including employee counting and aggregation, the method in which the credit is converted to cash, the fact that qualified wages are not subject to employer Social Security taxes, and the treatment of common-law employers and third-party payers. The calculations in Examples #12 and #13 above would work in the same manner for the family leave credit as well.

The IRS guidance listed above with respect to the sick leave credit also covers the family leave credit.

Employee payroll tax deferral – 2020 only

A final payroll tax-based program implemented during 2020 provided a deferral opportunity for employee payroll taxes. While the employer would have implemented this program, it is the employee that retained the benefit of the deferred taxes, not the employer. This program was initially implemented through the issuance of Notice 2020-65 and was subsequently modified by the CAA and Notice 2021-11. Under this program, employees could retain the 6.2% payroll tax on applicable wages paid between Sept. 1, 2020 and Dec. 31, 2020. For this purpose, applicable wages include amounts that were less than $4,000 on a biweekly basis (or, less than $104,000 in annualized salary). The deferred payroll taxes are then required to be repaid between Jan. 1, 2021 and Dec. 31, 2021. Notice 2021-11 indicates that the repayment is completed through ratable withholdings from paychecks during the repayment period. Any deferred taxes not paid by Jan. 1, 2022, will be subject to penalties. Participation in the deferral program required an affirmative choice by both the employer and the employee.

- Example #14: VWX, LLC decided to allow its employees to participate in the employee payroll tax deferral program if they chose to do so. One employee earning $75,000 in annualized base compensation elected to participate as soon as the program began. VWX processes its payroll twice per month, so for each pay period the employee was paid gross compensation of $3,125. Under the deferral program the employee retained $193.75 per paycheck from Sept. 1 through Dec. 31. This resulted in a total deferred payroll tax liability of $1,550. Beginning in January 2021, the employee began repaying this amount through additional withholdings. This equals a reduction in net pay of $64.58 per paycheck ($1,550 repaid over 24 paychecks).

See this article for further details.

Summary of COVID-19 employer tax incentives