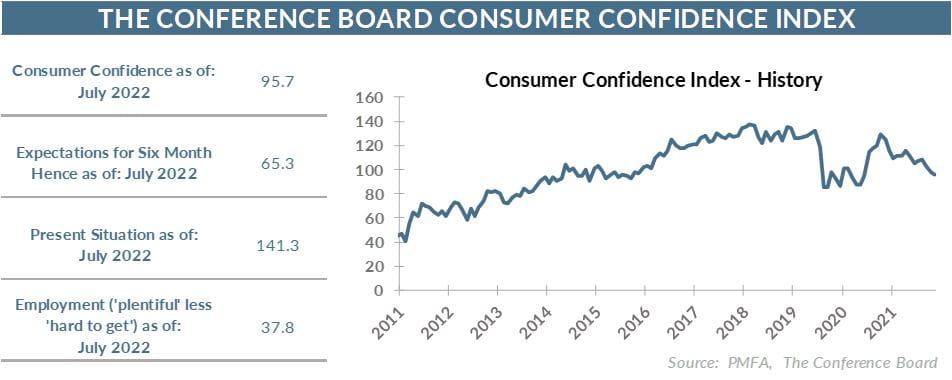

The Conference Board’s measure of consumer confidence dipped to 95.7 in July, roughly in line with the consensus forecast for 96.0. The index is now near its long-term historical average of around 95. It marked the third consecutive monthly decline in the index, as U.S. consumer confidence slipped to its lowest level since February 2021.

The index is comprised of two readings: one gauging consumers’ assessment of current conditions and a second that attempts to forecast the outlook six months out.

If there was a relative bright spot, it was in the Expectations Index, which eased modestly, perhaps suggesting that the pessimism around the near-term outlook for the economy could be nearing a bottom.

Conversely, the primary driver of the decline was a softening in the Present Situation Index. High inflation that continues to trend upward is taking a toll on household spending, particularly for those Americans whose wages have not kept pace with rising costs. Some Americans have been able to tap into savings to supplement their paychecks, while others have leaned on available credit. For those households that are already living paycheck to paycheck, rising fuel and food costs are forcing tougher decisions around discretionary spending.

There’s no question that inflation remains a major concern for consumers, but rising interest rates and the growing risk of recession are also creeping into the assessment.

A recession now or in the near term would end what would be an unusually brief expansion that was characterized in part by a period of explosive growth on the back of a stimulus-fueled consumer spending blitz on goods. That spending spree helped to power the economy out of a steep recession, but with fiscal stimulus now exhausted and the Federal Reserve removing the punchbowl as well, consumer confidence and spending have faded relatively quickly. Data is mixed though, and the jury is still out on the recession verdict. In the meantime, labor market conditions remain relatively good, although the pace of layoffs has ticked higher and job creation has slowed in recent months. Still, neither appear to be close to levels typically associated with recession, making the labor market a relative bright spot compared to other data that suggests a more pronounced slowdown in the economy.

The bottom line? The dimming of the collective consumer mood isn’t surprising given the corrosive effects of high inflation and mounting recession risk. As the Fed prepares to unveil another likely interest rate hike tomorrow, the focus will be on any indications of how policymakers are viewing the relative risk of inflation and recession and how that will influence their near-term decisions around interest rate policy.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.