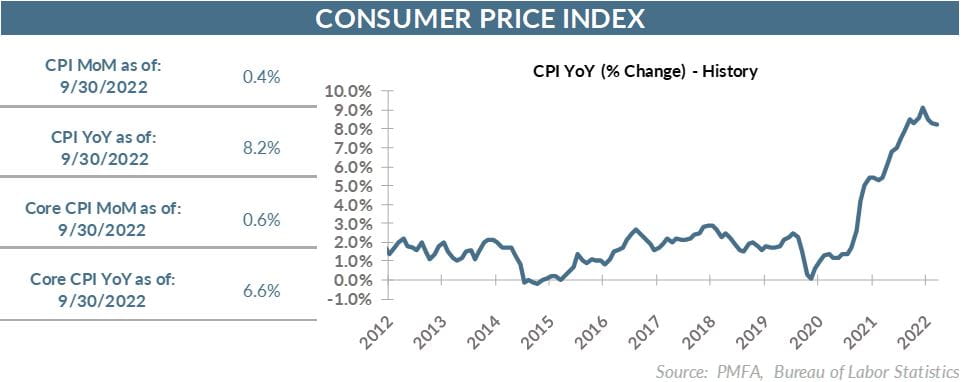

The consumer price index (CPI) increased by 0.4% in September, roughly doubling up economists’ expectations. On a 12-month basis, the headline index eased modestly to 8.2%, the third consecutive decline since the index peaked at 9.1% in June.

Economists had called for a more substantial easing of price pressures, driven in part by a third consecutive month of falling gas prices. Energy prices did fall as anticipated, but their impact was blunted in part by its comparatively small weighting in the index. Most of the other underlying components continue to advance.

Food prices rose again in September by 0.8%, providing no relief to families who are feeling the pinch at the grocery store. Prices have increased by more than 11% over the past year.

Higher food and energy prices typically hit consumer budgets hard but can reverse course comparatively quickly. Perhaps the greater concern is that core components of the index are still rising at an uncomfortable pace. Core inflation, which excludes more volatile food and energy prices, rose by 0.6% for the month and 6.6% over the past year.

At a weighting of more than 40% of the index, shelter costs rose by 0.7% last month. That’s bad news for renters, although many homeowners won’t feel the effect directly if they are locked into a fixed-rate mortgage.

Booming demand for housing since the onset of the pandemic, coupled with years of underinvestment in the aftermath of the global financial crisis, were powerful catalysts behind the nationwide surge in home prices. Higher prices and a spike in mortgage rates have led to a considerable cooling of activity, but the effect is only apparent in the consumer price index with a lag. For now, shelter prices have considerable upside momentum that will put a floor under month-to-month CPI results.

Beyond the direct challenges posed by inflation, the lack of more tangible progress in taming prices also raises questions and concerns about the execution of monetary policy and the level of interest rates. The fact that the Fed has ratcheted up rates very quickly this year reflects the resolve of policymakers to address the inflation threat but also the recognition that the Fed had fallen behind the curve and has needed to play catch-up.

The speed of that transition from ultra-accommodative to increasingly restrictive policy has created a significant source of uncertainty. Higher policy rates will in time have the desired effect of cooling the economy but will only become apparent gradually over time. Along with quantitative tightening, rate hikes have already resulted in tighter financial conditions, but the full impact of those moves has not yet been felt.

Staring down the barrel of a 50-year low in unemployment and inflation that has yet to show signs of sustainably rolling over, policymakers are left with a decision that could define the Powell Fed. Recognizing that their previous actions haven’t been fully absorbed into an already-slowing economy, how much further should they go in tightening policy? With echoes of the 1970s weighing heavily, the Fed appears committed to “whatever it takes” to breaking the back of this new inflation, even if that means sending the economy into recession.

Will they do too much? That will only be clear with hindsight. What’s clear is if they can’t stick the landing perfectly — an improbable outcome — policymakers are overwhelmingly committed to doing too much rather than failing to do enough. Coupled with the most recent jobs report, the September CPI report clears the path for the Fed to announce another outsized rate hike on November 2.

The bottom line? Neither side is blinking yet in the standoff between inflation and central bank policymakers. Ultimately, the Fed has the weapons needed to win the battle. But how far will they need to go to give them the confidence that they’ve won, and how much collateral damage might result? Those are the unanswered questions.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.