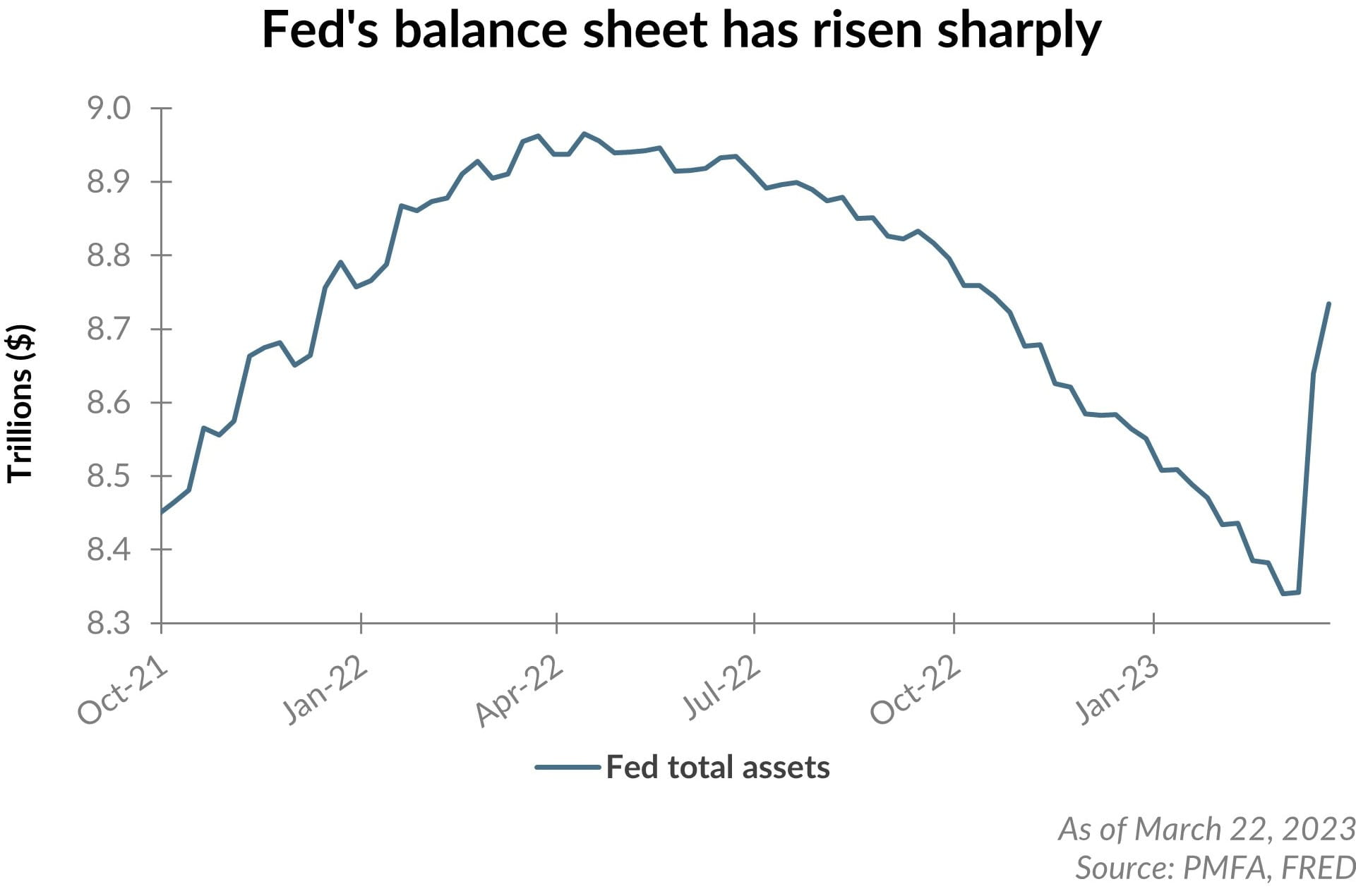

In conjunction with the Federal Reserve’s rate hiking campaign, the central bank has engaged in quantitative tightening (QT) — the systematic reduction of its balance sheet — to remove liquidity from the banking system. QT may not be as apparent as higher interest rates but it’s a meaningful tool used by policymakers to tighten financial conditions. As illustrated in the chart above, the Fed’s balance sheet had been steadily shrinking over the past year. However, the events of the past few weeks and the Fed’s associated response has at least temporarily reversed its balance sheet runoff.

In conjunction with the Federal Reserve’s rate hiking campaign, the central bank has engaged in quantitative tightening (QT) — the systematic reduction of its balance sheet — to remove liquidity from the banking system. QT may not be as apparent as higher interest rates but it’s a meaningful tool used by policymakers to tighten financial conditions. As illustrated in the chart above, the Fed’s balance sheet had been steadily shrinking over the past year. However, the events of the past few weeks and the Fed’s associated response has at least temporarily reversed its balance sheet runoff.

As we discussed in a recent special commentary, the recent emergence of concerns related to banking system stability prompted the Fed to implement measures to assuage bank liquidity concerns, including the introduction of the “Bank Term Funding Program” (BTFP). That program allows banks to directly tap the Federal Reserve for liquidity for up to 12 months via collateralized borrowing rather than being forced to sell securities that lost value as interest rates rose in the past year. In the face of recent deposit outflows, an undisclosed number of banks have accessed the BTFP and other Fed facilities. That injection of cash into the banking system sharply increased the Fed’s balance sheet assets virtually overnight.

The seeming contradiction between additional interest rate hikes and liquidity injections into the banking system illustrates the immediate challenge before the Fed. Effectively balancing its inflation-reduction mandate with fostering stability in the banking system has complicated the picture considerably. For now, the Fed is attempting to thread the policy needle to achieve both. That means ample access to liquidity to encourage stability for the banking sector, while still raising interest rates gradually to slow the flow of credit and raise the cost of borrowing.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.