The Inflation Reduction Act (IRA) of 2022 substantially revamped the Section 179D tax deduction with important changes going into effect starting Jan. 1, 2023. The slew of changes made to Section 179D not only increase the potential deduction available, but also expand eligibility for various building owners. Section 179D was previously made permanent, so these changes are now here to stay.

The basics of the Section 179D tax deduction

Also known as the Energy-Efficient Commercial Buildings Deduction, Section 179D allows owners of commercial properties to claim an additional tax deduction in the year that energy-saving systems are placed in service. These rules generally require that the energy saving property be depreciable, located in the United States, and installed as part of a plan designed to reduce the building’s total annual energy and power costs by 25% or more compared to an applicable reference standard.

Upgraded property systems include interior lighting systems; heating, cooling, ventilation, and hot water systems; and the building envelope (i.e., roof, walls, doors, and windows). The ultimate deduction is then calculated by applying a stated “per square footage” value to the subject building. For purposes of Section 179D, the square footage of a building only includes “conditioned spaces.” Section 179D was originally enacted in 2005, but it was subsequently modified by Congress on multiple occasions. More recently, the Consolidation Appropriations Act, 2021 permanently extended its life. The IRA has now gone further in expanding the benefits of Section 179D, albeit with key caveats.

What changes were made to the Section 179D tax deduction?

The following points include key changes made to Section 179D that went into effect for tax years beginning after Dec. 31, 2022:

- Relaxed minimum required energy savings standard: Prior to the enactment of the IRA, a project must have resulted in a savings of energy costs of at least 50% as compared to the applicable reference standard. Now, building owners may qualify for the deduction by reducing energy costs by 25% or more.

- Increased deduction amounts: One of the most dramatic changes is the potential for greater deductions. Prior Section 179D rules provided for a partial deduction of $0.60/sq. ft. and a maximum deduction of $1.80/sq. ft. Those values were indexed to inflation, so the 2022 amounts were $0.63 and $1.88, respectively. The IRA eliminated the partial deduction and increased building owners’ potential benefit under a new Applicable Dollar Value Model.

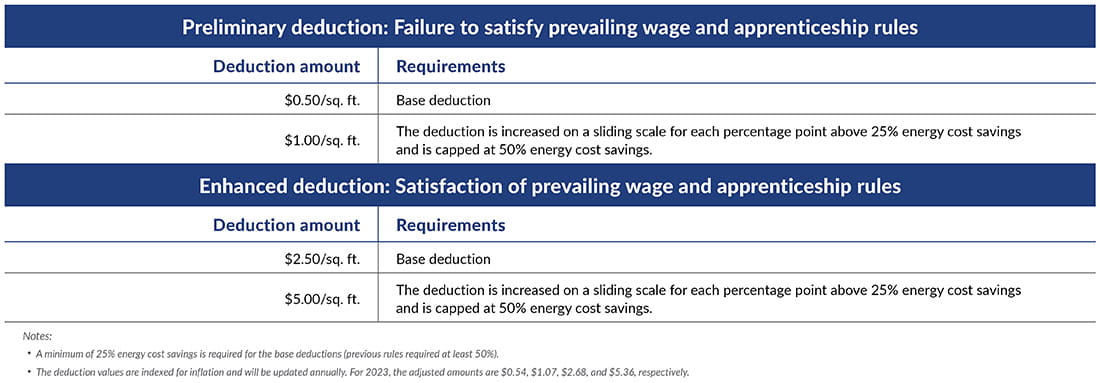

Under the new model, two pathways exist with both being subject to a sliding scale based on energy efficiency, both of which are also indexed for inflation. The initial path involves projects that do not meet prevailing wage and apprenticeship hour requirements. In such case, the deduction begins at $0.50 per square foot and is increased $0.02 for every percentage point over 25% that energy and power costs are reduced — to a maximum of $1.00 per square foot. As such, the deduction is increased on a sliding scale for each percentage point above 25% energy cost savings and is capped at 50% energy cost savings.

The second path is available for projects when construction meets prevailing wage and apprenticeship requirements, which are discussed in more depth below. When applicable, the deduction begins at $2.50 and increases by $0.10 for every percentage point of energy savings over 25%, up to a maximum of $5.00 per square foot. The table below outlines how deductions will be calculated.

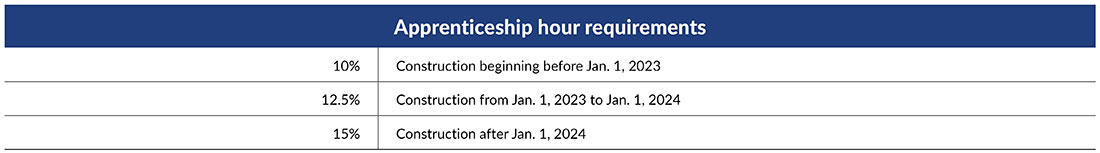

- Prevailing wage and apprenticeship requirements: The essential element to unlock the enhanced 5x deduction under Section 179D is satisfaction of the prevailing wage and apprenticeship hour requirements. Prevailing wage rules require that any laborers and mechanics employed by the taxpayer or any contractor or subcontractor in the construction of any qualifying property must be compensated at minimum hourly wages established by the Secretary of Labor. Prevailing wages are defined as “rates not less than the prevailing rates for construction, alteration, or repair of a similar character in the locality in which such facility is located.” This standard must be met by all contractors and subcontractors involved in a project. Similarly, apprenticeship rules mandate that a specific amount of total project hours be completed by apprentices, which phase-in over time (please see the table below).

The IRS has released initial guidance interpreting these rules in Notice 2022-61. A key date established by that notice is Jan. 29, 2023. Projects for which construction began prior to such date will not be required to satisfy the prevailing wage and apprenticeship hour requirements.

- Alternative for retrofit property: The decreased energy savings threshold discussed above is expected to allow the installation of more property to qualify for Section 179D. However, the IRA also added an alternative deduction that is calculated based on the energy usage rather than energy costs. This alternative deduction requires calculations of the energy use intensity of the building both before and after the installation of qualifying property. A final certification is required to confirm that the energy use intensity was decreased by 25% or more compared to the baseline. Where applicable, the amount of the alternative deduction is limited to the lesser of (1) the amount calculated above (substituting energy use intensity for energy and power costs) or (2) the adjusted basis of retrofit property placed in service.

- Who is now eligible for Section 179D? Historically, building-owner taxpayers were generally eligible to claim the deduction so long as the subject property was depreciable by the taxpayer. This limited the deduction to taxpaying individuals and entities. Although a special rule allowed deductions related to property owned by a federal, state, or local government to be allocated to the person primarily responsible for designing the property. The IRA expanded that allocation rule significantly to also include Indian tribal governments, Alaska Native Corporations, and any tax-exempt entities. Consequently, this more expansive list of tax-exempt organizations can now allocate the Section 179D deductions to the “designer” of the upgrades. This is expected to ultimately reduce the cost of applicable building upgrades as such tax benefits are factored into the fees charged by the designer. Finally, the rules applicable to Real Estate Investment Trusts (REITs) were also modified to provide corresponding tax benefits starting in 2023.

- Continued improvements to the Section 179D tax deduction: Prior to the IRA, Section 179D was seen as a one-time benefit. In other words, taxpayers were generally only able to claim the deduction once and it could not be generated again in subsequent years for additional upgrades. However, as modified, Section 179D now allows eligible taxpayers to periodically claim deductions for new eligible improvements. For taxable entities, additional qualifying improvements can be made after three years. For governmental and tax-exempt organizations allocating such benefits to others, the waiting period is four years.

- Reference standard rules: As previously mentioned, Section 179D requires that the subject property be installed as part of a plan designed to reduce the total annual energy and power costs of the building by 25% or more. The reduction is viewed in comparison to a reference building that meets the minimum requirements of Reference Standard 90.1. For almost 50 years, reference standards have played an important benchmark for building codes. To this point, Reference Standard 90.1, published by the American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE), assists taxpayers in determining the correct deduction under Section 179D. The IRA amended Section 179D to require that projects be measured based on the more recent of either (1) Standard 90.1-2007 or (2) the most recent version of Standard 90.1 finalized within the four years prior to the property being placed in service. This means that the applicable ASHRAE standards will continue to evolve over time. Based on current IRS guidance, Standard 90.1-2007 will apply to qualifying property placed in service before Jan. 1, 2027. Conversely, property placed in service after Dec. 31, 2026, will be subject to Standard 90.1-2019 (unless construction began before Jan. 1, 2023).

How to take advantage of the modified Section 179D tax deduction rules

The changes to Section 179D are expected to have a long-lasting impact on energy-efficient building upgrades for the foreseeable future. Due to these modifications, Section 179D provides a great cost-benefit opportunity to a wide range of building owners. With these potential benefits come various points to remember as building owners plan upgrades.

- Deduction overlap: One of the most significant Tax Cuts and Jobs Act (TCJA) provisions included 100% bonus depreciation. For years since the passing of TCJA, taxpayers enjoyed the benefit of a 100% first-year deduction for assets placed in service during the tax year. There is a definitional overlap between bonus depreciation and other deduction rules. As such, Section 179D was less impactful for certain properties in comparison to 100% bonus depreciation. However, starting in 2022, 100% bonus depreciation began to phase out to the tune of a 20-point decrease each year until 2027. Therefore, while a 100% (or even 80%) bonus depreciation likely outweighed Section 179D, building owners may begin to reconsider comparing the two deductions and could see the benefit in claiming a Section 179D deduction in the immediate future.

- New eligible building owners: As discussed above, tribal entities, tax-exempt organizations, and governments may now have greater interest in Section 179D. Because the benefit was unavailable to many of those entities in previous years, some confusion may exist in how to best take advantage of the opportunities. Further, navigating the process with designers, architects, and engineers could be difficult when determining the best outcome for both parties. Consequently, governmental entities and other nonprofits should consult with their tax advisor to determine the appropriate strategy in claiming and allocating the deduction.

- Documentation for Section 179D: The benefits of the expanded Section 179D come during an era of increased scrutiny by the IRS and other taxing authorities. These rules are also complex and require satisfaction of technical energy efficiency tests. For these reasons, building owners should plan carefully, document all related construction information, and maintain appropriate records about Section 179D tax positions. This is especially true when considering enhanced deductions under the prevailing wage and apprenticeship rules given the need for coordination with contractors and subcontractors.

Furthermore, because building owners rely on independent engineers to certify and document that energy and power cost savings meet the ASHRAE requirements, it is imperative that the owners keep this documentation on hand. Additionally, any building owner claiming the deduction for government property would also need to keep an “allocation letter” on file from the government entity that verifies the party’s involvement with the project, the cost of the property installed, the year it was placed in service, and the amount of the Section 179D deduction.

- Guidance: The statutory text of Section 179D is somewhat detailed in comparison to other similar provisions. Although Section 179D has been around since the early 2000s, some questions still exist as to how the deduction will be claimed in the years to come. While some of these questions are expected to be addressed in forthcoming guidance from the IRS, building owners and their advisors should evaluate all technical requirements with care heading into the 2023 tax filing season.

To learn more about how you might qualify for the Section 179D energy-efficient commercial buildings deduction, please contact your tax advisor.

Have additional questions on how IRA tax credits, incentives, and monetization options could impact your organization? Explore more from our tax leaders as they track the latest developments.