Industry pressures and economic cycles have broken many automotive companies over the years, but the industry has always proven resilient to consumer demand shifts, changing regulations, and capital market pressures. However, the global auto industry’s current transition to electric vehicle propulsion from petroleum-fueled internal combustion engines (ICE) puts the potential disruption on an entirely different scale, impacting a significant portion of the motor vehicle value chain. Vehicle manufacturer product cycle plans, vertical integration strategies, and executive and manufacturing employment bases are impacted. Supply chains that have been built over decades on a global scale face severe disruption.

How significant is the change? In our 2024 EV readiness supplier survey, we surveyed the opinion of 205 executives from Tier 1 automotive suppliers with deep insight into OEM operations, trending market conditions, and supply chain resiliency strategies. We asked about their assessment of EV demand, disruption to current production and revenue generation, preparedness of business plans, and confidence in OEMs’ production volume forecasts. Here are our four top takeaways.

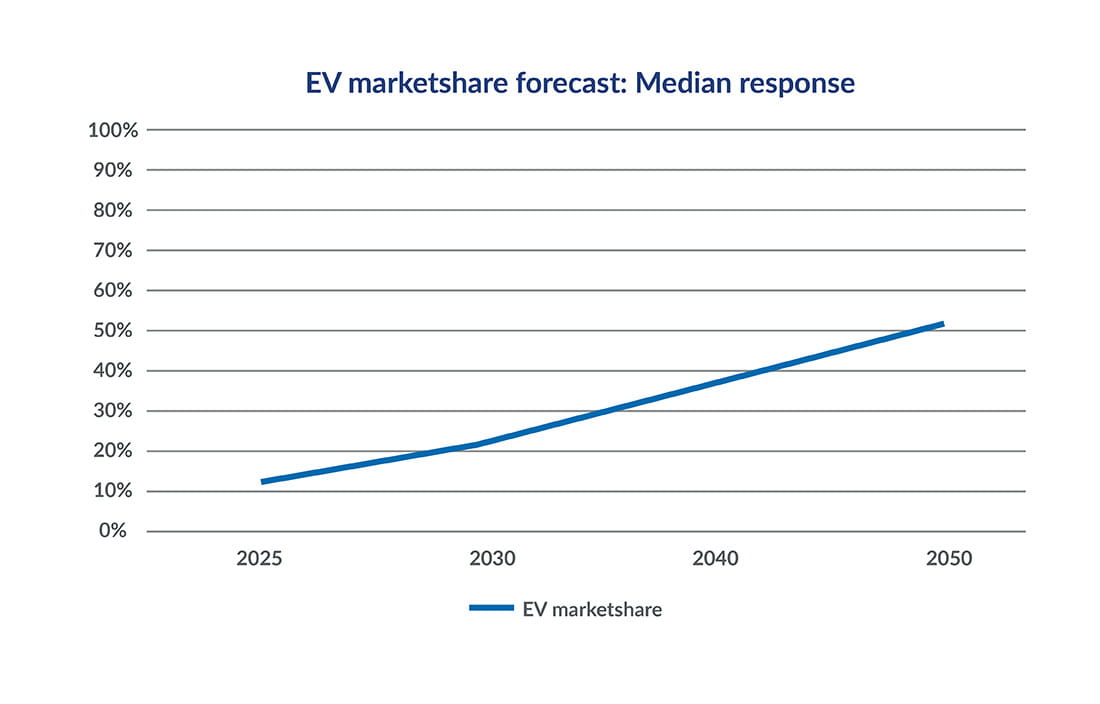

1. EV market share growth rates are anticipated to remain steady despite near-term uncertainty

Suppliers see market share growth for EVs to be steady throughout the forecast horizons, a sign of optimism in the face of near-term reductions in EV demand reported in current news headlines. The midpoints of the market share forecast ranges grow from 12% in 2025 to 22% in 2030, with market share predicted to grow to 37% in 2040. Suppliers anticipate the long-term EV market share to reach 52% out to 2050. It should be noted that the forecasted variability around the median response increases significantly over time, with suppliers estimating the 2050 market share could range from the lowest quartile of 30 to 34% to the highest quartile at 75 to 79%. With this level of long-term uncertainty, the strategic question must be asked: Where will the value chain be overcapacitated, and where will it be supply-constrained?

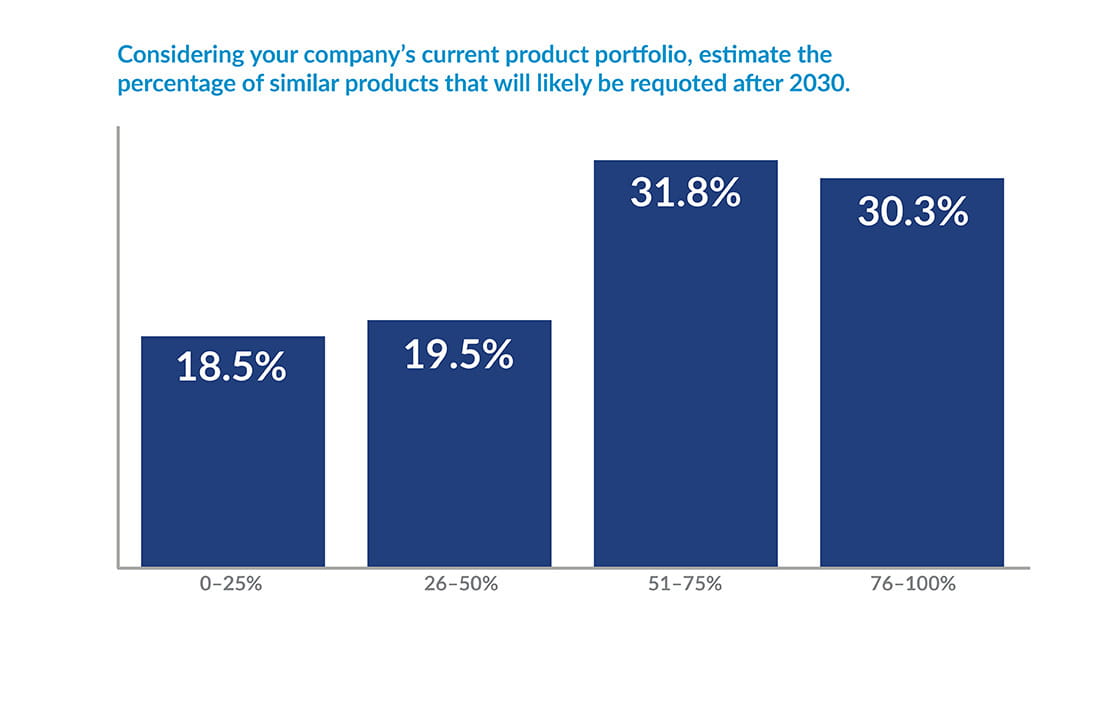

2. Loss of traditional ICE components will create winners and losers

For vehicle systems, such as the powertrain and drivetrain, the EV bill of material is radically different from a traditional ICE vehicle. As EV market share grows, demand for these traditional component sets falls to the extent that nearly 40% of the respondents expect half of their product to be not requoted by 2030. On the other hand, vehicle components, apart from powertrain, are more resilient for the 30% of respondents that see an average of 76% of their current product type existing through the 2030 EV transition.

This variability sets up a potential “have-and-have-not” situation, requiring OEMs and suppliers to communicate product planning and sourcing decisions to reinforce the prosperity of the suppliers they expect to be in their long-term supply base. In turn, suppliers can use this information to make strategic product portfolio decisions to sell obsolete products to consolidators, repurpose products to new EV specifications and use cases, and grow into new areas through acquisitions or organic growth.

3. Transitioning through uncertainty requires creative, flexible business plans

Given the uncertain market, supplier business plans must be flexible to drive success through emerging market scenarios. Suppliers express a wide range of confidence in their current business plans. On the positive side, 20% of the respondents are very confident in their business plan. However, 9% are on the opposite side of the scale, reporting little or very little confidence in their business plans. Most suppliers are in between, indicating potential supply chain disruptions if strategic suppliers aren’t in the most competitive business position. Creating dynamic business plans for suppliers to accommodate diverse business scenarios is essential. Suppliers need to ask themselves about their confidence level in their business plans and if they are dedicating resources to stress-test those plans against various scenarios to succeed.

4. Contracting and pricing strategies need to supersede OEM overoptimistic planning volumes

As the EV market is established, production planning volumes are overoptimistic. This is particularly true as volumes are added up across the entire industry. The respondents provided their assessment of OEM production planning volumes, and, when suppliers develop pricing strategies, find the best are Honda, Toyota, Hyundai, and Tesla, with GM, Nissan, Stellantis, and VW grouped in the middle, followed by Ford. Suppliers must diligently forecast, actively monitor market signals, and recalculate assumptions driving business plans and resulting product and customer portfolios.

Where things stand

As the above results suggest, there’s a considerable gap between projections on EV adoption and how things are likely to play out for suppliers. This uncertainty highlights the importance of risk assessment, product planning in an uncertain environment, and clear communication around planning volumes.

For more information about the 2024 EV readiness survey and the impact of the EV transition on your operations contact our experts using the form below.

Contact our experts

The study was generated from surveys collected from Jan. 9 to Jan. 23, 2024, via an online survey. The sample included all respondents to the 2023 Plante Moran Working Relations Index® annual study. Respondents included 205 executives from 177 unique supplier companies.