In partnership with the U.S. Department of Energy (DOE), the Department of the Treasury and the Internal Revenue Service (IRS) have announced up to $6 billion in a second round of Section 48C tax credit allocations for projects that expand clean energy manufacturing, recycling projects, and critical materials refining. The program will provide an investment tax credit of up to 30% of qualified investments for certified projects that meet prevailing wage and apprenticeship requirements. In the first round, the IRS allocated approximately $4 billion of Sec. 48C credits for over 100 projects across 35 states, with approximately $1.5 billion allocated to projects in designated energy communities.

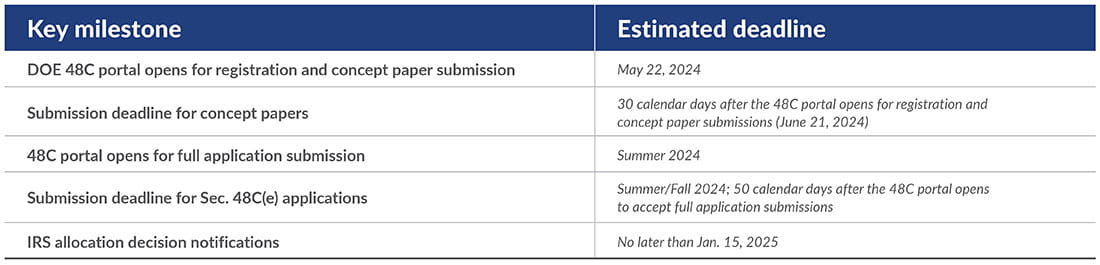

The application portal for submission of concept papers will on May 22, 2024.

What is the qualifying advanced energy project credit (48C)?

Benefitting manufacturers, the advanced energy project credit under Sec. 48C is an enhanced tax credit for those who place in service new investments into industrial or manufacturing facilities for the production or recycling of components for the green energy supply chain. This credit previously existed but has been expanded to cover new investments and additional funding has been provided. Qualifying for this credit requires an advance application and the receipt of an allocation of such credits through a competitive process administered by the DOE. Those allocated tax credits will then be claimed in the future after the qualifying equipment is placed in service.

Eligible funding areas for 48C

48C focuses on funding eligible projects within three areas, including the following:

1. Clean energy manufacturing and recycling projects: A qualifying advanced energy project in this category involves reequipping, expanding, or establishing an industrial or manufacturing facility that produces the following:

- Property designed to be used to produce energy from the sun, water, wind, geothermal deposits, or other renewable resources.

- Fuel cells, microturbines, or energy storage systems and components.

- Electric grid modernization equipment or components.

- Property designed to capture, remove, use, or sequester carbon oxide emissions.

- Equipment designed to refine, electrolyze, or blend any fuel, chemical, or product that’s renewable, or low-carbon and low-emission.

- Property designed to produce energy conservation technologies, including residential, commercial, and industrial applications.

- Light-, medium-, or heavy-duty electric or fuel cell vehicles, as well as technologies, components, or materials for such vehicles, and associated charging or refueling infrastructure.

- Hybrid vehicles with a gross vehicle weight rating of not less than 14,000 pounds, as well as technologies, components, or materials for such vehicles.

- Other advanced energy property designed to reduce greenhouse gas emissions as may be determined by the Secretary.

2. Industrial decarbonization projects: An advanced energy project qualifies under this category if it involves retrofitting an industrial or manufacturing facility, particularly in energy-intensive sectors such as cement; iron and steel; aluminum; and chemicals. The retrofit must include the installation of equipment specifically designed to reduce greenhouse gas emissions by at least 20%. It’s important to note that this category is exclusively focused on projects that upgrade the existing facilities to lower greenhouse gas emissions through the installation of one or more of these specified technologies:

- Low- or zero-carbon process heat systems.

- Carbon capture, transport, utilization, and storage systems.

- Energy efficiency and reduction in waste from industrial processes.

- Any other industrial technology designed to reduce greenhouse gas emissions, as determined by the Secretary.

3. Critical material projects: A qualifying advanced energy project in this category reequips, expands, or establishes an industrial facility for the processing, refining, or recycling of critical materials. This includes materials designated by the Secretary of Energy or Secretary of the Interior, and include the following:

- Critical materials designated by the Secretary of Energy

- Aluminum, cobalt, copper*, dysprosium, electrical steel* (grain-oriented electrical steel, non-grain-oriented electrical steel, and amorphous steel), fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, terbium, silicon*, and silicon carbide*.

- Critical materials designated by the Secretary of Interior

- Aluminum, antimony, arsenic, barite, beryllium, bismuth, cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium, zinc, and zirconium.

*Indicates materials not designated as critical minerals by the Secretary of Interior.

Priority areas for 48C tax credit funding

The DOE has identified certain priority areas based on analytical criteria, including an assessment of current and anticipated supply chain gaps. When evaluating clean energy manufacturing and recycling projects, the DOE will take into consideration whether the project addresses the following energy supply chain and manufacturing priority areas. While applications aren’t required to meet one of the priority areas if they meet eligibility requirements noted above, funding priority may be given to the identified priority areas for Round 2 noted below:

1. Clean hydrogen: Manufacturing of electrolyzers, fuel cells, and associated components, including gas diffusion layers, bipolar plates, power electronics, membrane electrode assemblies and stacks, and catalysts.

2. Electric grid: Manufacturing of distribution and large power transformers and associated subcomponents; materials (including grain-oriented electrical steel, amorphous steel); power electronics; HVDC cables; HV circuit breakers; and other grid components and equipment (including MVDC/HVDC converter station components and switchgears).

3. Electric heat pumps: Manufacturing of air-source or geothermal (ground-source) heat pump components and systems, particularly heat pumps for industrial or networked applications and/or those utilizing low-GWP refrigerants (such as natural refrigerants).

4. Electric vehicles**: Manufacturing of power electronics (including semiconductors, modules, and circuits for EV motor traction drives, on-board EV chargers, DC/DC converters, and EV charging stations); permanent magnets; and specific battery components (separators; electrolyte salts and solvents; cathode and anode active materials and precursors). Manufacturing of capital equipment for battery manufacturing. Manufacturing of subcomponents and components specific to medium- and/or heavy-duty (MDV/HDV) electric vehicles and final assembly of MDV/HDV electric vehicles.

5. Energy-intensive materials that have a substantially lower carbon intensity when compared to an appropriate industry-specific benchmark: Manufacturing or recycling of low carbon cement, concrete, or components such as supplementary cementitious materials; low carbon iron and steel; and low carbon aluminum.

6. Nuclear energy: Manufacturing of specialized components and equipment for nuclear power reactors or their fuels (including fabrication of fuels and manufacturing of equipment for conversion, enrichment, and deconversion) for both existing reactors and new reactor deployments.

7. Solar energy**: Polysilicon; wafer production facilities; ingot and wafer production tools; and solar rolled glass production facilities.

8. Sustainable aviation fuels: Manufacturing of equipment needed for low-carbon aviation fuel production, including feedstock handling equipment and pretreatment reactors.

9. Wind energy**: Component production facilities and specialized steel production, particularly for offshore wind, such as monopile-grade steel and towers; recycling of wind components, particularly blades; offshore wind electrical balance of system component manufacturing, including submarine cables (AC and DC), large power transformers, and HVDC converter stations and converter station components.

** The production of some products under this section may be eligible for tax credits under Sec. 45X and receiving an allocation under Sec. 48C(e) may preclude an applicant from receiving tax credits under that program. Applicants are encouraged to evaluate which program may be most beneficial to their project before submitting a concept paper for consideration under Sec. 48C.

48C application process

48C involves a two-stage technical evaluation process for application submissions:

1. Stage 1 concept paper: The first stage of DOE review requires applicants to submit a five-page concept paper describing the proposed project and highlighting the following:

- Project overview and schedule

- Commercial viability

- Strengthening U.S. supply chains and domestic manufacturing for a net-zero economy

- Greenhouse gas emissions impact

- Workforce and community engagement

2. Stage 2 application: The second evaluation stage will consist of a review of applications submitted after the concept paper stage. Applications should be no longer than 30 pages and will need to detail the following:

- Company overview

- Project summary

- Project management and timeline

- Siting and permitting

- Risk management plan

- Financial information

- Market information

- Levelized cost information

- Management plan

- End product GHG emissions impacts

- GHG emissions from the facility

- Impact on U.S. supply chains and domestic manufacturing

- Supply chain resilience

- Workforce and community engagement plan (separate from the 30-page application)

48C timing and key deadlines

The 48C portal is expected to open by late May. Applicants will require strong coordination to meet the set concept paper and applications deadlines and be considered for federal support. Key dates for applicants are outlined below:

How taxpayers should proceed with the 48C application process

The application process will involve many deadlines and requirements for various materials. Those looking to apply for this credit should carefully consider the timeline and plan accordingly. Working with a trusted advisor during the application process could help ensure you’re able to optimize this opportunity.