With the Federal Reserve now widely expected to announce rate cut of at least 0.25% in just a few weeks and financial markets pricing in 1% or more in cuts by the end of the year, what does this reversal in policy mean for investors and the markets?

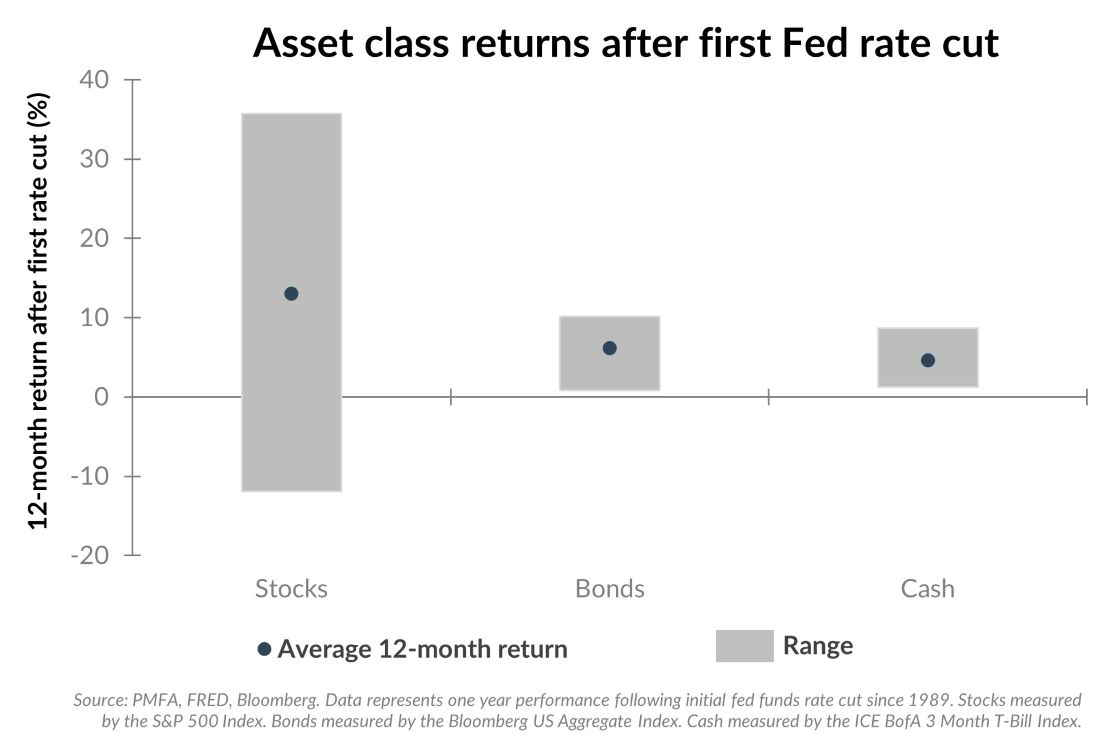

The chart above illustrates the average return and the ranges around those averages for stocks, bonds, and cash since the mid-1980s in the year following the first Fed rate cut in an easing cycle. As shown, stocks have typically performed quite well in these periods, posting an average return of more than 13%. Bonds have also performed favorably, benefiting from a tailwind of falling long-term yields. Relative to stocks and bonds, cash has generally lagged, as falling policy rates quickly chewed away at cash yields.

It’s important to remember, however, that the specific circumstances surrounding each cycle played a significant role in defining the market environment in those periods. In particular, stocks experienced a wide range of outcomes. When rate cuts were accompanied by a recession, stocks generally exhibited greater downside volatility and posted negative returns. Absent a recession, however, stocks tended to perform quite well as borrowing costs declined, providing more juice for the economic expansion.

In the current cycle, the market’s path will also undoubtedly be heavily influenced by this distinction. Most recent data remain positive, nurturing a renewed sense of optimism in a soft-landing scenario. Whether that optimism proves to be justified remains to be seen. One thing is certain though: as the Fed slashes rates, cash yields will also be reduced. Investors sitting on excess cash should consider whether that liquidity is still needed, or if extending a portion into other asset classes (most notably bonds) would be more appropriate in the context of their investment policy.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.