The Employee Retention Credit (ERC) was created to help businesses that continued to pay their employees despite COVID-19 shutdowns or significant decreases in gross receipts between March 13, 2020, and Dec. 31, 2021. Unfortunately, numerous third-party advisors set up businesses that pushed employers to claim these credits without proper documentation. In response to this cottage industry of claims that were not supported by proper documentation of ERC eligibility, the Internal Revenue Service (IRS) has focused considerable efforts on audits and criminal investigations intended to identify and punish any fraudulent claims for the ERC.

ERC claims for Q3 2021 and Q4 2021 filed after Jan. 31, 2024, will be disallowed under the new law. Since its creation, the accuracy of claims for the credit and the potential for fraud in this area have made it a high priority for the IRS. As a result, the One, Big, Beautiful Bill (OBBB) made some significant changes to the ERC, affecting the businesses that previously claimed them and requiring careful consideration in transactional due diligence efforts for years to come.

OBBB extends statute of limitations and expands penalties

Perhaps the most consequential OBBB changes to the ERC for professionals in the transactions arena are the extension of the statute of limitations (SOL) for these claims and the expansion of penalties to cover additional taxes and continue to hold certain responsible parties personally liable.

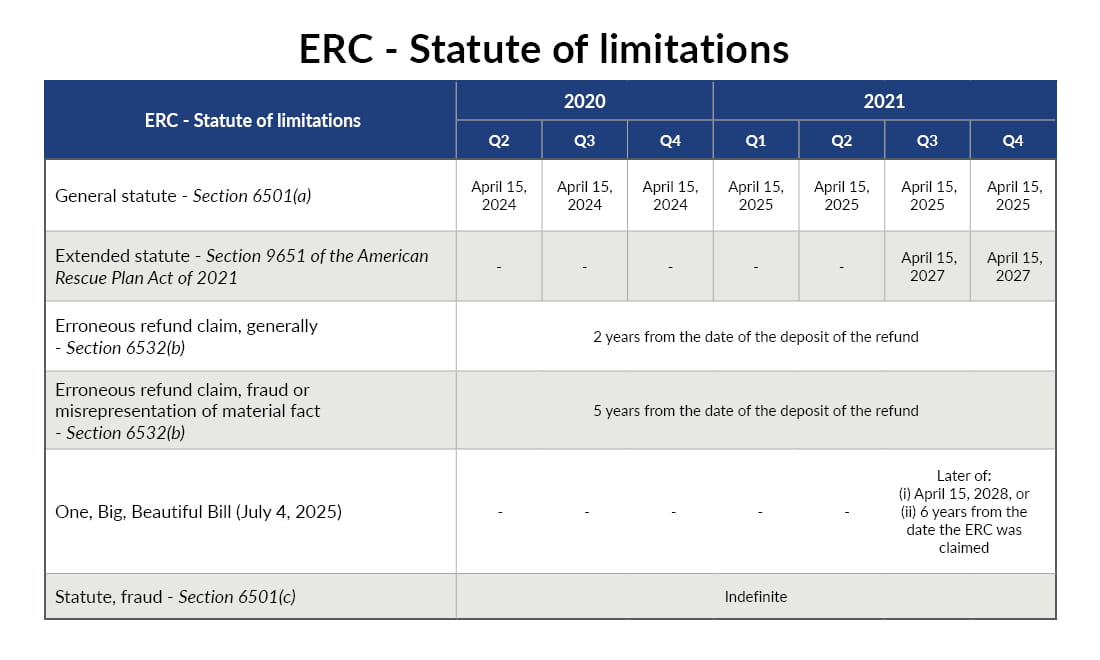

This table provides a helpful overview of where the OBBB extended the SOL in regard to Q3 and Q4 of 2021.

Before the new law, claims for those quarters would not be subject to audit (short of fraud) after two years ending April 15, 2027. The OBBB extends that period to six years from the date of any amended return claiming the credit. As long as the SOL remains open for enforcement of the law, it’ll also remain open for possible extension. (As with other provisions of the tax code, if the IRS determines that the claim was fraudulent, then no statute of limitations applies.) From a due diligence standpoint, this means that proper documentation of ERC eligibility will need to be shown for ERC claims for years to come (as far out as the early 2030s), or the acquirer needs to factor into the deal price the potential exposure that would result from the loss of the credit claim. And the more time that passes since the original claim, the more difficult it’ll become to track down the documentation needed to support the claim if it wasn’t properly assembled and saved in the first place.

The OBBB further clarified that the 20% penalty for erroneous refunds covers payroll tax returns as well as income tax returns. Prior to the passage of the OBBB, the IRS was able to impose several types of penalties on improper payroll tax refund claims, but this provision provides the IRS with an additional tool for imposing penalties on payroll tax returns going forward.

Best practices for ERC due diligence in the wake of OBBB

In some ways, the most important best practice for claiming the ERC and for verifying ERC claims during the due diligence phase hasn’t changed — it’s always thorough, accurate, and organized eligibility documentation. The extension of the SOL means that those records should be kept on hand longer and that acquiring companies performing due diligence should remember to review them for years to come, into the early 2030s at least. This includes a particular focus on: (1) Reviewing any documentation or related memos that support eligibility and diligence (2) Reviewing all timing of transactions, including dates returns were filed, dates funds were received, etc. The ability to document these dates can be critical in establishing an accurate starting point for the SOL and when it's set to expire.

The potential exposures from the ERC should be factored into discussions around both equity and asset deals. It’s possible that the acquirer might be better protected based on their choice of these options. However, no matter the transaction structure, there will be a business interruption upon the audit of prior ERC claims.

The ERC was a significant source of assistance to businesses struggling to survive in the early days of COVID-19 lockdowns, but some used it to claim benefits from the government for which they didn’t qualify. This new round of expanded enforcement deadlines should not discourage taxpayers who made legitimate claims for the credit or the businesses that might be looking to acquire them. The new rules should serve as a reminder to properly document all claims for tax credits and deductions and to maintain those supporting files for future reference.