In the dynamic world of mergers and acquisitions (M&A), private equity firms are constantly seeking strategies to optimize their investments and maximize returns. One such strategy is the use of an F reorganization, which unlocks state pass-through entity tax elections and may reduce the need to make a gross-up payment to a seller. This article discusses key aspects of the F reorganization and reasons why a PE firm would utilize it to facilitate an acquisition.

What is an F reorganization?

Section 368 outlines several types of tax-free reorganizations that can be undertaken by corporations. An F reorganization, under IRC Section 368(a)(1)(F), involves a mere change in identity, form, or place of organization. At its core, this means that an F reorganization does not alter the ownership of the corporation or its business operations. However, the simplicity of the reorganization is a key component for further action.

An F reorganization is especially beneficial when the target selling corporation is an S corporation and has a business or tax reason to hold assets and operations through a disregarded entity (DRE). Typically, a single-member LLC (SMLLC) is a buyer-favorable entity since it defaults to disregarded treatment for federal income taxes when owned by a single member (e.g., the owner is treated as holding all assets and liabilities directly). An F reorganization is a buyer-preferred transaction structure because the target is generally going to avoid the following items, including but not limited to:

- Obtaining legal consent from third parties, related to vendor/client contracts.

- Obtaining consent from the landlord, related to the lease agreements.

- Incurring transfer taxes and/or retitling assets (exceptions apply).

- Hurdle of transferring administrative items like payroll and employee benefits — Section 401(k), healthcare benefits, etc.

- Regulatory hurdles, which are regularly seen in healthcare transactions but can occur in other industries as well.

Structuring mergers & acquisitions with F reorganizations

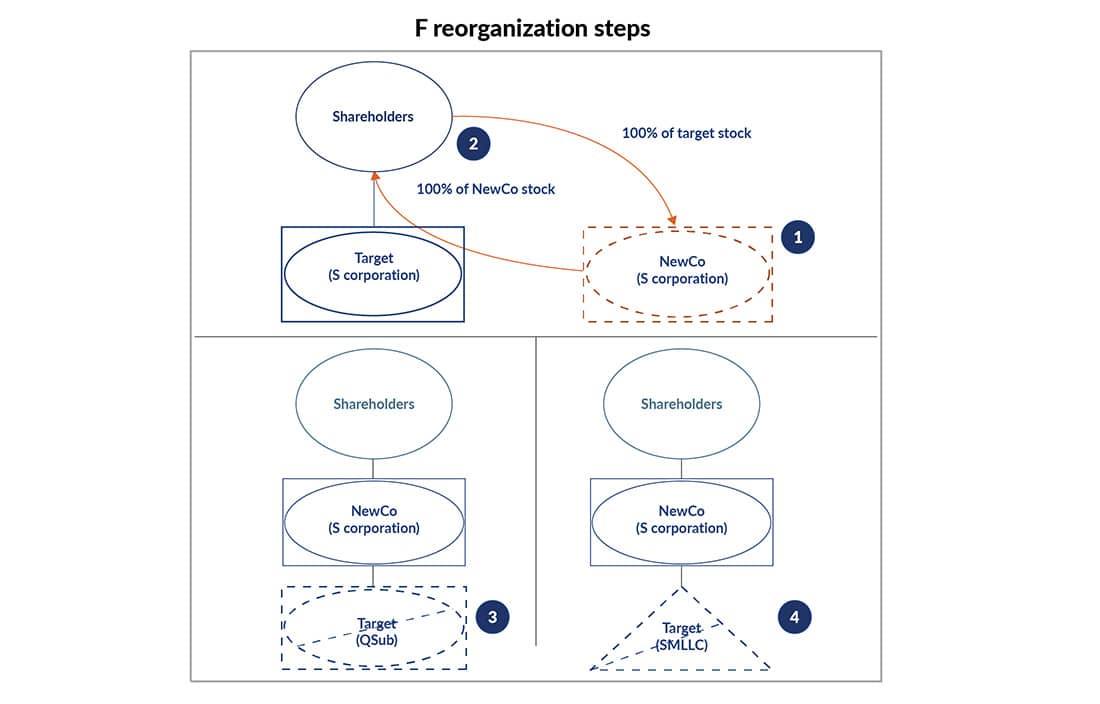

A common example of using an F reorganization would involve a transaction where the target business is operated by an S corporation. Assuming that the buyer desires a tax basis step-up in the assets of the corporation, then the parties might consider a Section 338(h)(10) election, Section 336(e) election, or a drop-down structure. However, the rigidity of those options often creates transaction challenges. Instead, the F reorganization provides more flexibility, and is typically accomplished by the following steps:

- The target corporation shareholders form, or cause the formation of, Newco, a new corporation that will have the same ownership as the target. Newco files a protective election for Newco to be treated as an S corporation. (State S elections may also be required.)

- The shareholders contribute 100% of their stock in the target to Newco in exchange for 100% of the stock of Newco.

- Newco files an election for the target to be treated as a qualified Subchapter S Subsidiary (QSub).

- At least one day after both the filing date and effective date of the QSub election made in Step 3, the target (QSub) converts to an LLC under state law or the target (QSub) will need to reincorporate in a state that has a direct conversion statute, such as Delaware, and then convert to an LLC under state law. After, Newco will own 100% of the target as a single owner.

The above steps are intended to allow the entity to retain its current Employer Identification Number (EIN) under the existing IRS rules. Therefore, it’s recommended to follow the same steps mentioned above.

If the target is an LLC, then the following alternative Step 4 is needed.

- If the target is an LLC organized under state law and has chosen to be treated as an S corporation for federal tax purposes, it was automatically deemed to make a check-the-box election to be treated as a taxable corporation for federal tax purposes, followed by an S corporation election.

- At least one day after the filing date and effective date of the QSub election made in Step 3, to revert to its status as a disregarded LLC, the target must make an “un-check the box” election by filing Form 8832 as part of its F reorganization, as outlined above.

- According to Treasury Regulation 301.7701-3(c)(1)(iv), if an entity changes its classification, it can’t make another change for five years after the effective date of the first election. However, an S corporation election by a newly formed eligible entity isn’t considered a change subject to the five-year rule. Therefore, an entity with the same S corporation date and organization date can make an “un-check the box” election within the first five years of its existence. Conversely, a noncorporate entity with different S corporation election and organization dates can’t “un-check the box” within the first five years of its S corporation election.

Seller benefits of F reorganization

The F reorganization structure places the seller in a position where they can have the flexibility to do the following:

- No immediate tax is triggered on the exchange of stock as the F reorganization is treated as a nontaxable event for both the corporation and its shareholders.

- Might be able to avoid obtaining legal consent (depending on the contract language) or incurring transfer taxes via a drop-down.

- Structure the LLC interest sale to avoid the constraints of Sections 338(h)(10) and 336(e), such as S election validity, 80% ownership, full gain taxation, and qualified stock purchase rules.

- Deferral of gain recognition with respect to rollover equity.

- Potentially higher after-tax proceeds.

Note: Seller will need to send a letter to notify the IRS, states/local jurisdictions to change the name from Inc. to LLC because of the F reorganization. Further, the seller may need to submit a letter to transfer the estimated tax payments for income tax, franchise, and nonresident withholding from the target account to the new S corporation account.

Buyer benefits of F reorganization

The F reorganization structure places the buyer in a position where they have the flexibility to do the following:

- Achieve a step-up in the tax basis of the target’s assets equal to the portion paid for seller’s LLC interest — creating future tax deductions.

- Retain the Federal Employer Identification (FEIN) number of the target.

- Remove the risk associated with the validity of the seller’s S Corporation election that could otherwise potentially taint a step-up in the basis of target’s assets under Section 338(h)(10) election or Section 336(e) election.

Note: While the F reorganization structure protects the buyer’s tax basis step-up, the risk of historic C corporation income tax liabilities if the target lacked a valid S election could be inherited by the buyer under state law.

Caution for target entities in existence before 1993

If the trade or business existed before 1993 and the seller is going to own more than 20% of the buyer entity post-close, under Section 197(f), then an intangible asset acquired by a taxpayer can’t be amortized if the taxpayer or a related person held or used the intangible between July 25, 1991, and August 10, 1993. This section of the code is commonly referred to as the anti-churning rules and can prevent the taxpayer from amortizing the step-up on the basis of the assets if the seller receiving rollover equity is related to the taxpayer. The related party and attribution rules should be closely analyzed as they can pose certain traps for the unwary. Because anti-churning rules and Section 1223 involve detailed rules that can significantly impact tax outcomes, they’re best examined in a separate discussion where their complexities can be unpacked and understood in full context.

Why do private equity firms opt for F reorganizations?

F reorganizations offer private equity firms a tax-efficient strategy by enabling tax basis step-ups, tax-deferred rollovers, and flexible deal structures. As the M&A landscape evolves, these reorganizations are becoming an increasingly valuable tool for maximizing investment returns.