In this podcast, we'll explain how three automotive trends — autonomous vehicles, Mobility as a Service (MaaS), and electrification — will interact and enable one another to prompt a massive reorganization of the value chain. We’ll provide an executive-level overview of our white paper, Future of mobility: Reinventing the auto industry, and key considerations for auto suppliers as they prepare for reinvention.

Continue reading below for the complete podcast transcription.

Automotive reinvented: A discussion on the future of mobility

Dave Andrea: Welcome to Automotive Reinvented: A discussion on the future of mobility. I’m Dave Andrea, principal within Plante Moran’s strategy and automotive mobility consulting practice group, and I’m joined today by Daron Gifford. Daron has over 40 years in the automotive industry, the last six of which where he is a partner here at Plante Moran and leads our automotive practice, focusing in on technology innovation, operations, and strategic management. Our objective today is to provide you an executive-level overview of the insights you’ll find in our white paper, Future of mobility: Reinventing the auto industry, a paper that we wrote with our colleague Mark Barrott. We will touch on a few highlights from the white paper in this interview, particularly as they relate to the automotive supplier community. Now, the entire white paper can be downloaded at plantemoran.com/futureofmobility. Thank you, Daron, for joining us today. Now, you provided the initiation to launch Plante Moran’s mobility-modeling effort and crafting the white paper itself, so take us back a bit. What were you seeing in the marketplace, hearing from the industry and the suppliers — to give us some grounding of why you wanted to take on this effort?

The direction of personal and commercial transportation

Daron Gifford: Thanks, Dave. Well, we’ve been hearing these questions about technology from our clients for a number of years, and so, our analytics team undertook the effort to really dive deep into some extensive research on the direction of personal transportation and commercial transportation and the impacts of these technologies on how do we transport people and goods from point to point. We undertook this over the last several years, and we’ve used this research to really provide a glimpse into what we think is the future. Not just looking out five years or 10 years, but taking it all the way out to 2050. And, we took it out to 2050 because that’s a couple of generations’ time frame, and we think it will probably take that long to really radically change transportation as a whole. And, it changes the absolute size of the transportation sector, what the sector does, what automotive does, and how these services are provided for transportation. But, we believe all this is a natural evolution really of all the technology capability we have today, and the impacts of what it’ll be like in our society in the future.Dave Andrea: And, that’s an important point. Covering both the commercial vehicle side as well as the passenger vehicle side; where we’ve heard a lot about autonomy and the related technologies and how that will upend transportation and how it is consumed; the business model supporting the delivery of transportation; what components make up the automobile, and even how the automobile is assembled. So, with all that going on, where should a supplier start in understanding what the marketplace will look like 30 or 40 years down the road?

Daron Gifford: Well, our research indicates it really starts with autonomy, or self-driving vehicles. All these technologies, frankly, are available today. The progress toward self-driving vehicles is proceeding very rapidly, much faster than most people really believe, even though there are some hiccups in the road as well. But, the key driver behind all this progress is safety, and it’s the safety as far as reducing the number of accidents, number of people killed prematurely. It’s all the mistakes we make as a driver, and we see it day in and day out. Texting being one of those key mistakes that we see out there.

This vehicle autonomy then enables the adaptation of mobility, or sharing the vehicle. The idea of sharing a vehicle is driven from an economic standpoint as far as utilizing the vehicle more fully. Rather than the one hour per day that it’s utilized today, it can be up to 10 hours. Maybe even 15 hours a day. A huge increase as far as the economics around the usefulness of that vehicle itself. The growth has been limited on sharing frankly to the lack of access to transportation. It’s not easy to get to a point to sharing of vehicles. The rental car company and sites are going to have to get there somehow. So, access to the vehicle is something that we believe really eases the transition for individuals because we want to be able to go out and walk outside the door of our office or the door of our home and be able to go in a vehicle and go somewhere as quickly as possible. Ownership is an expensive approach. Using a taxi or Uber is also an expensive approach. We believe self-driving vehicles really offer an economical, accessible — it’s really an available solution in the future. And, utilization and economics we think are going to be a key driver for that.

Mobility services accelerating electrification

Dave Andrea: So, it’s autonomy then that drives the mobility services. Is it the uptake in mobility services that’s the accelerant underneath the electrification of the vehicle?

Daron Gifford: That’s right, Dave. Electrification growth or electric vehicles, if you think about it that way, are really enabled significantly by both self-driving or autonomous and mobility or sharing capabilities. One of the primary restrictions to wider adoption of electric vehicles today is the driving range of the battery and the ability to recharge the battery quickly, as well as the cost of that whole system as well. More charging infrastructure will help, but you still will have to wait. Even with supercharging stations, you have to wait a little bit to get there, and those are very expensive to put in. Self-driving vehicles give you the capability to drop someone off and go, and they can go recharge on their own. And, if it’s a shared vehicle, then it can be utilized to pick up somebody else after it’s been recharged.

Our forecast model for autonomous, for sharing, for electric vehicles is really built on over 30 different variables. To really predict nonlinear growth in the ecosystem or the business model of the future for the automotive industry encompasses things like the market impacts, the market changes, the government regulations, the technology improvements, the customer perceptions, — even as far as how consumers will perceive not only self-driving but also electric-type vehicles, or sharing their vehicle.

The white paper that was written is focused primarily on the U.S., but we’ve also developed this model for other parts of the world, especially Europe, China, and Japan, which we think are the regions that will probably adopt these things the earliest. They’re the more mature countries out there versus some of the other countries in the world. In our forecast and the model, electric vehicle growth is still fairly limited to the next seven years, up to 2025. The real change occurs in the U.S. in the early 30s, when the cost of electric and the cost of gasoline internal combustion engines come closer to parody in our view. And then, the consumers then... It becomes a choice then of which one do they buy, which one is more economical for them. It’s a market-based model in this case, so less on the government pressures in the U.S. If you go to other parts of the world, such as Europe and China especially, much more government pressure. The adoption of electric vehicles happens much faster. Probably closer in the late 20s, so much bigger change in that point in time.

Taking the first step as a supplier

Dave Andrea: Going back to my original question then, Daron, how should a supplier take that first step to address all these megatrends that are coming at them? Because they’re going to obsolete a number of traditional components, even systems, but it opens up a wide range of new opportunities for the supply base. Can you walk us through what you see happening to the assembly plants of the future, and even the builds of materials that the OEMs have traditionally outsourced to the supply base?

Daron Gifford: Well, the manufacturing of the vehicle will be dramatically altered by the adoption of these technologies. For example, an electric vehicle. It requires thousands of fewer parts. It’s a much less complex technology to power the vehicle movement. Well, think about the traditional engine, the transmission, the fuel systems, the exhaust systems; they all go away in an electric vehicle. They’re not needed in that type of environment. And, those are thousands of parts by themselves. In an electric vehicle, what takes their places are battery cells, a battery pack, an invertor for converting the current, traction motor, and the charging modules. All these are new parts and components in the vehicle itself, and huge new supplier opportunities but also threats if you’re a supplier of some of the old, traditional parts.

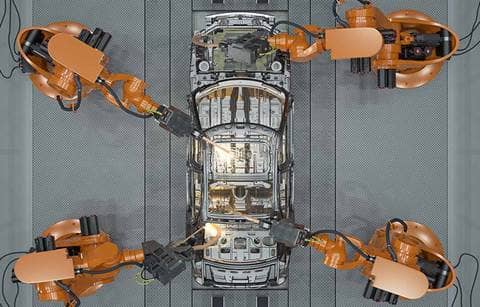

Autonomous and shared vehicles, along the same lines, are going to have different requirements as well. Especially focused on the interior in those cases because those vehicles are intended to be used quite a bit more frequently. They may be multiuse and multipassenger types of environments, so the interior experience or the third living space will become critically important to the suppliers to think about on the interiors of those vehicles in the future. The manufacturing processes associated with all these components, as you might imagine, are different in many cases and will require even more efficiencies and automation and quality because the life of those vehicles is going to be a lot rougher when it’s going 100,000 miles a year versus 12,000 miles a year.

So, one of the key aspects of our model is also looking at how these components and what rate they go into the vehicles themselves. And, we work with our supplier clients to really think about what’s this transition, what’ it looks like, what are the points in time that are critical to them, and what are their key core competencies that they’re going to need to survive and grow in this automotive business model of the future. The need for differentiation for these vehicles will probably decline in many cases because it’s going to become much higher-volume platforms. And, so this whole other idea that we introduced is the idea of the skateboard chassis architecture. It’s been talked about, it’s well-known. We’re seeing it being adopted by many OEMs right now because they need to have a vehicle architecture that can last longer, that can then drive much higher volumes and, frankly, much more utilitarian-type use of the vehicle as well as then cost of the vehicle itself. Well, those will all be key issues that suppliers need to address in the future.

The automotive business model of the future

Dave Andrea: So, in the end, what you’re implying then is a complete radical transformation of the business model that we have known over the 30-plus years here. What part of that transformation do you see impacting the suppliers the most? Is it upstream in that product design and engineering area, or is it more fundamental, that the suppliers should look at what the final customer’s value proposition is itself?

Daron Gifford: Well, that’s a great question. The automotive business model of the future, we believe, is going to be dramatically different. It’ll be driven significantly by the idea of transportation and Mobility as a Service. This whole idea focuses in then on what’s the value proposition at the consumer point in time versus just selling the vehicle, which is what it’s set up to be today. The capital required to compete in this kind of new marketplace is attracting new competitors. You have Google, you have Apple, you have Amazon — Uber. All new players looking to get into that marketplace. Along with the traditional OEMs like General Motors or Ford, Volkswagen, and the others.

We believe the capital requirement to compete all across the board is going to be really significant and that OEMs — they’re going to need to choose where they’re going to place their bets in the future, and we believe they’re probably going to bet more upstream into the consumer side of the business. This offers a huge opportunity from the standpoint of the suppliers to take over more of the manufacturing, more of the engineering, more of the design, and really build and take in some of that core competencies that the OEMs have today. And, it dramatically changes the business model for the suppliers in the future as well.

So, we look at this new business model. It says more capital for manufacturing that some of the suppliers can capture and provide, more engineering capabilities, more design, new ideas. They’re always asking for new ideas, but they’re going to need them in the future. So, more product development will shift toward the supply base. It’s going to drive more technology capabilities at the supplier level. There’ll be more cybersecurity issues, of course, in that case. And, the whole idea of a supply chain from a supplier’s standpoint, we believe that you really need to think about what are your core competencies in the future, and then, where are you going to invest as a supplier to really grow into this marketplace into the future. It’s a great challenge from a supplier standpoint; it’s a great potential threat if you’re not careful.

Dave Andrea: Thank you, Daron, for helping us better understand the megatrends and the implications that the suppliers will face in the mobility industry of the future. We’ve captured our forecast models and the framework that we’ve discussed today in a 19-page thought piece. To download The Future of Mobility white paper, please visit plantemoran.com/futureofmobility. We also invite you to contact either of us directly to discuss how these trends will impact your business. And thank you, our audience, for listening today.