The Titanic was “unsinkable.” And yet, it sunk. While it was the iceberg that ultimately took the ship down, a series of bad decisions led up to that final moment. Despite several warnings of ice, the Titanic moved at too-high speeds into waters known to be treacherous, in the dark. When it became apparent the ship was heading right for an iceberg, it was too late to avoid it. Hastily made rivets popped off when the ship hit the iceberg, and as the Titanic began to sink, further mismanagement led to several lifeboats shipping out before they were filled with passengers.

So, what’s the business lesson here? Leadership ignored warning signs, moved too fast without a strategy or clear view of what was in their path, and when disaster hit, they were unprepared to handle it. Your iceberg could be an economic downturn, a disruptive new technology, unyielding competitors coming for your market share, or a miscalculation due to uncertain future demand for your business. But there’s hope. After all, every business faces challenges at one time or another — it’s how you respond to them that seals your fate.

Threats to your business

Are you aware of the icebergs that may lay ahead in your path? Are you asking the right questions, making the hard decisions, and taking dramatic action to steer your organization away from disaster? We don’t always know what’s coming next, but we do know more disruptions are inevitable. These threats can weaken your business, leave you exposed, and bring you down if you’re unprepared:

- Competitive pressure. Your competition may be right behind you, increasing pricing pressures and squeezing your margins so thin that one wrong move could push you into the red. They could also be adapting faster than you, making the strategic transformations necessary to survive the next global disaster. Your competition is coming for more than just your market share; they could be poaching your top talent, too.

- Service model changes & technological advances. New developments in your industry, including changes in technology can make your product or service obsolete. They can also make it easier to produce your product or service, so if you’re not evolving your technology, others in the market could start providing offerings faster, better, and for less money, leaving you in the dust.

- The next economic downturn. Nobody knows for sure when the next economic downturn will arrive or the severity when it does, but trust that challenging times will be coming eventually. Whether it’s another crisis like we saw in 2008 or a minor disruption, it could impede your growth or completely tank your organization. Do you have the financial and operating flexibility required when growth stalls? Can you make strategy changes quickly enough to handle the fallout when your suppliers’ and customers’ financial health is similarly impacted?

Prepare for challenges to your business

What are you doing to evaluate your strategic position and prepare for the next disruption? Let’s start with some business school basics: When’s the last time you conducted a SWOT analysis? What are your strengths, weaknesses, opportunities, and threats? Awareness is key — if you’re not aware of where the icebergs are (and the fact that much of their volume is invisible from the surface) you won’t recognize that an update to your business model is necessary until it’s too late.

Even if you do conduct a SWOT analysis, you might still get hit with a threat you didn’t predict. If that happens, you’ll need a strategy in place to make sure the problem isn’t compounded by mismanagement. Stress testing your financial plans can help you maintain positive financial health and remain resilient.

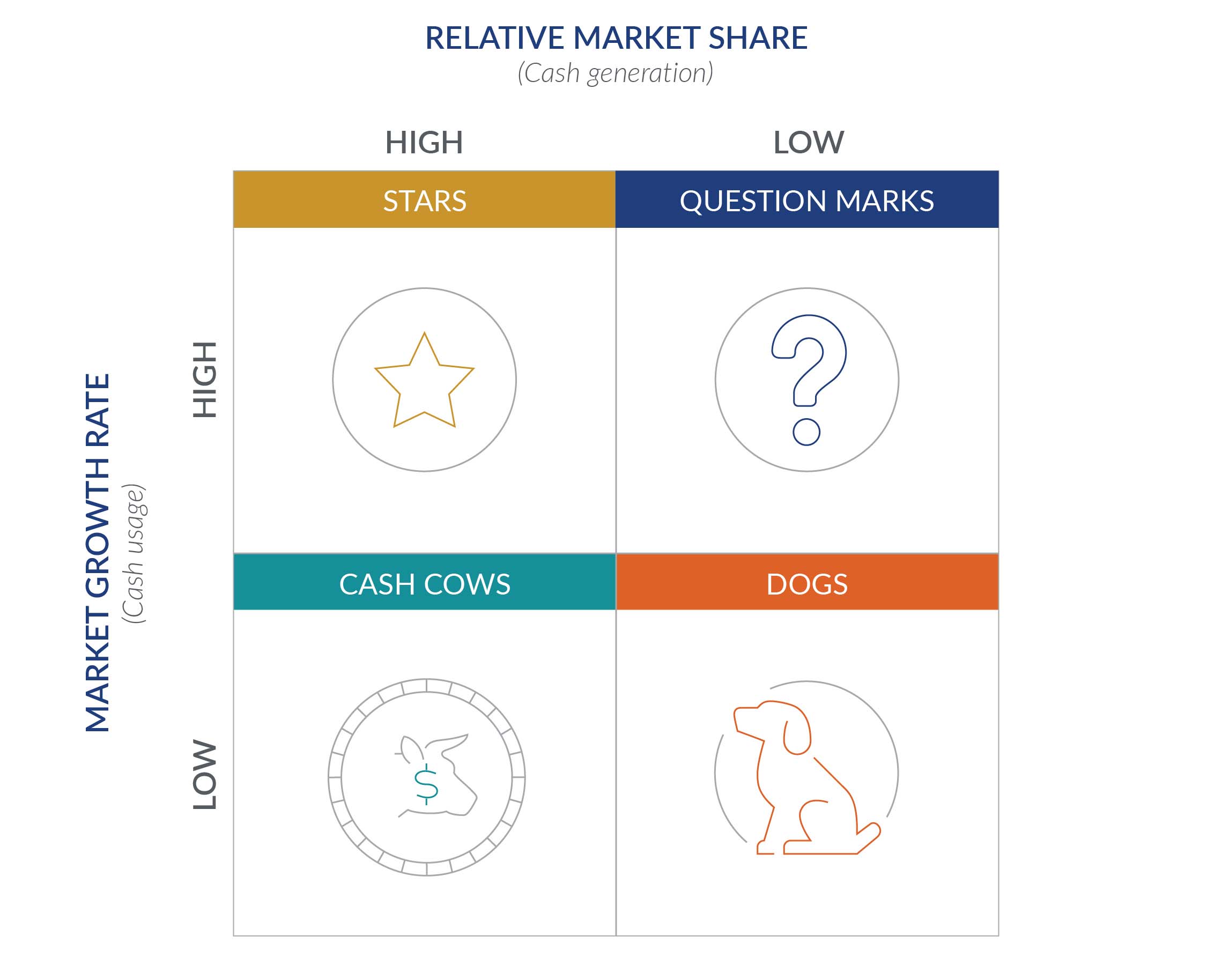

You should also consider categorizing your offerings into a two-dimensional matrix of expected growth rate and market share. What are your “stars” — those high-growth, high market share products? How long can you harvest your “cash cows?” What can you do about your low market share dogs and question marks to make them more attractive? If the competition comes for your stars and cash cows, or they throw off less cash because of declines in demand, can you adjust quickly enough to avoid going under? If your business is too reliant on one product or service and you fail to plan for contingencies, you won’t have a cushion to fall back on.

If you feel like you’re in too deep, financial and turnaround consultants can help you restructure and bring you back from the edge. However, weathering the storm may be treacherous, and an alternative strategy of cashing in your chips and selling your business can turn out to be the option that provides the greatest return to the stakeholders.

It’s not all bad

Change and disruption are always uncomfortable and can be downright frightening. But opportunities do exist — for our businesses, our customers, and the industry at large.On an industry level, competition and an opportune amount of disruption drive innovation. It forces you to find more effective ways to create quality products and services. It gives you a crash course in adaptability and flexibility, which means a stronger business for you and better outcomes for consumers.

Bottom line: Exposing barriers and true pain points allows you to better understand where you make money and where you don’t so you can restore or maintain a strong competitive position. If you manage to work through the issues, you’ll have a point of reference for the next time you have to sail through the darkness — you’ll know what works, what doesn’t work, and how you can remain flexible and adaptable in an ever-changing environment.