Across equity markets, valuations paint a divergent picture. Within the U.S. market, large-cap stocks look comparatively expensive on a price/earnings basis, while small-cap value stocks look increasingly cheap compared to their long-term historical averages. In the near term, valuations can remain quite stretched and could become even more so before normalizing. Over longer periods though, the historical evidence is clear: price matters. Over longer periods, investing in a stock, a sector, or a market when they're out of favor rather than those where prices are stretched generally leads to superior returns.

Across equity markets, valuations paint a divergent picture. Within the U.S. market, large-cap stocks look comparatively expensive on a price/earnings basis, while small-cap value stocks look increasingly cheap compared to their long-term historical averages. In the near term, valuations can remain quite stretched and could become even more so before normalizing. Over longer periods though, the historical evidence is clear: price matters. Over longer periods, investing in a stock, a sector, or a market when they're out of favor rather than those where prices are stretched generally leads to superior returns.

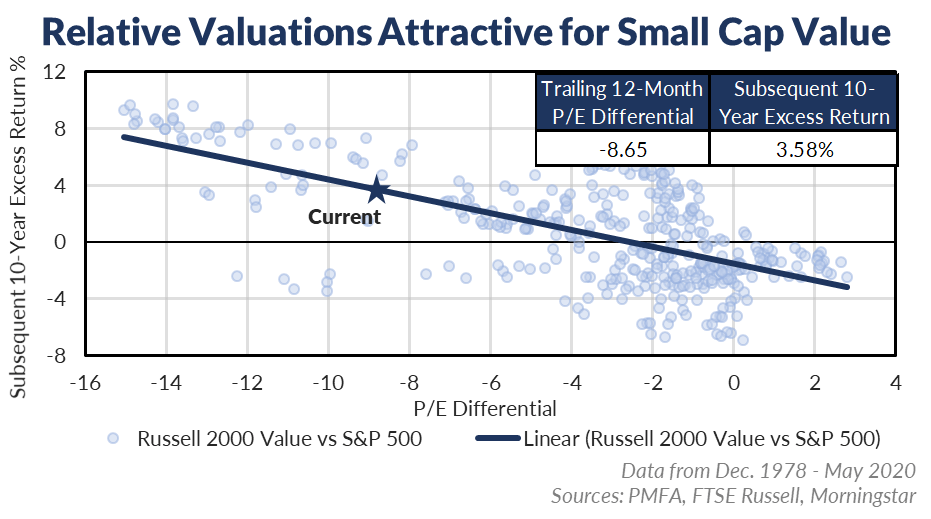

Large-cap stocks have outperformed smaller companies for several years; that dynamic has continued through the selloff and subsequent rebound this year. The result is a valuation discrepancy that has become quite pronounced, with small-cap value stocks in particular looking increasingly attractively priced compared to blue-chip growth stocks. Since 1978, when relative valuations have reached these levels, the Russell 2000 Value Index (small-cap value stocks) has outperformed the S&P 500 by an average of about 3.5% annually over the subsequent decade.

A word of caution: Valuations alone aren't good timing indicators, and prices could become even more stretched. For long-term investors though, the opportunity is clear.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.