The first look at Q2 GDP revealed the devastating effect that the COVID-19 crisis had on the U.S. economy. The contraction was so severe that it easily surpassed the worst quarterly decline in modern U.S. history.

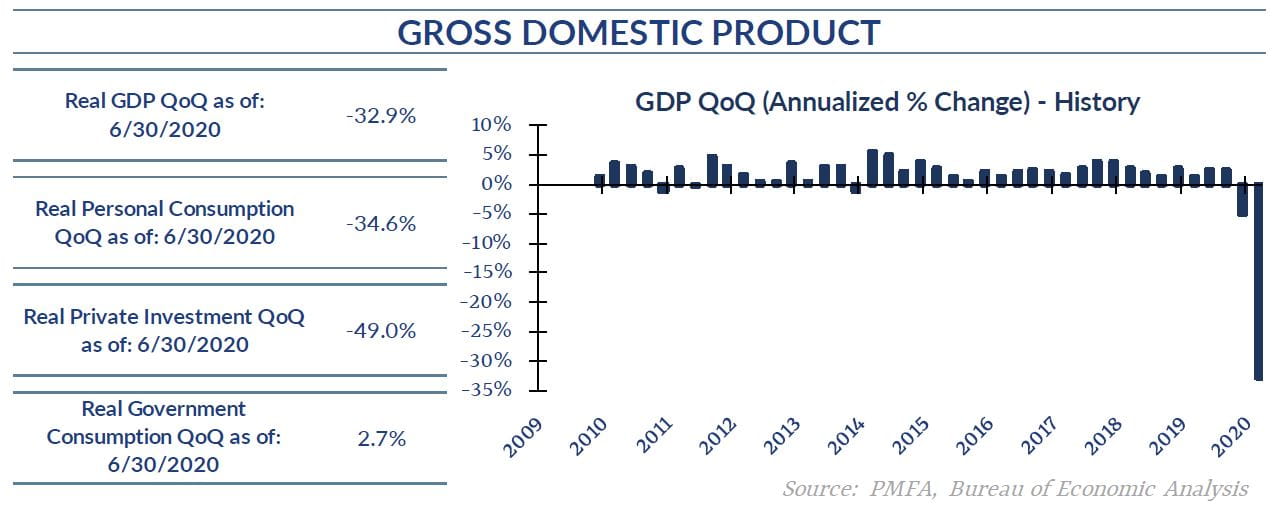

Today’s report estimate of second quarter GDP declined by an annualized rate of 32.9%, effectively eliminating one of every three dollars that would have otherwise been spent in the preceding quarter. The median estimate was for a decline of 34.5%, but with a range of estimates that was exceptionally wide, signaling the incredible difficulty in accurately estimating the impact of such a massive disruption to the economy.

The report revealed that very few areas of the economy were spared from the broad shutdowns that occurred. Of particular note, consumer spending contracted by 34.6%, particularly noteworthy given that the consumer sector represents over 60% of all spending. Outlays for services dropped by 43.5%, which isn’t surprising given social distancing and shelter-in-place mandates that prevented providers from effectively delivering a range of personal services. Consumers were able to shift the purchases of many goods to online retailers or other delivery means that limited direct contact, an alternative that wasn’t completely possible for many services.

Private investment took the largest hit, falling by nearly half with both the business and residential homebuilding segments declining sharply. With so many businesses shut down, inventories were also drawn down sharply, solely accounting for an outright four percentage points of the total decline.

Coming into today, the bad news on the economy was clear, and today’s report contained few surprises. The good news is that the sharp deterioration in economic activity during April has already quickly reversed course. Activity picked up sharply in May and June as stay-at-home orders were eased across much of the country. Fiscal programs aimed at providing supplemental income replacement for impacted workers helped to sustain demand, while various loan programs provided support for impacted businesses and governmental entities.

That sharp reversal should mean a potentially robust pickup in activity and an outsized growth rate in Q3, but overall activity is expected to remain well below pre-pandemic levels for some time to come. The scars will be with us for a while; it’s not as easy to bring the economy back online quickly as it was to shut it down. Data over the past two months had suggested that the economy was on course for a better-than-expected recovery, but more recent reports on consumer spending and the labor market have called that into question.

The economic path remains murky, but the primary risk is clear and noneconomic; the spread of COVID-19 and the significant health risk that it presents remains substantial. That unknown will keep the recovery on a somewhat fragile footing over the coming months.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.