At times, the stock market can appear to be disconnected from the real economy, performing well despite negative economic news or vice versa. Since late March, large-cap growth companies have experienced a strong rebound even as the economy was contracting sharply. Notably, cyclically sensitive small-cap value stocks also were hard hit during the downturn but have since lagged as equities surged. With data now indicating that the economy is also in recovery, should we expect these same trends to persist? Looking to the manufacturing sector may provide insight.

At times, the stock market can appear to be disconnected from the real economy, performing well despite negative economic news or vice versa. Since late March, large-cap growth companies have experienced a strong rebound even as the economy was contracting sharply. Notably, cyclically sensitive small-cap value stocks also were hard hit during the downturn but have since lagged as equities surged. With data now indicating that the economy is also in recovery, should we expect these same trends to persist? Looking to the manufacturing sector may provide insight.

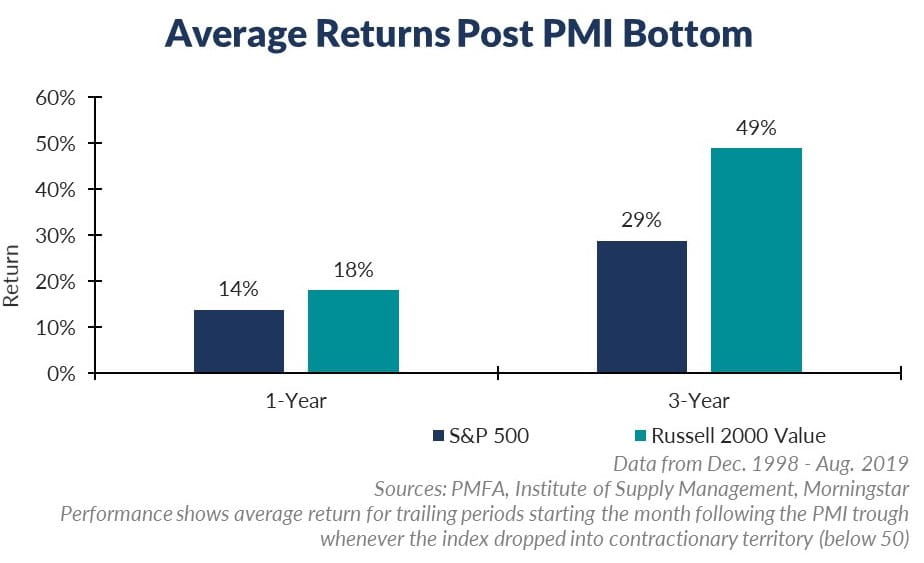

As illustrated in the chart above, when manufacturing activity rebounds from the bottom, small-cap value stocks (measured by the Russell 2000 Value Index) have typically outperformed their large-cap peers over the ensuing three years. Why? First, small companies tend to do less business overseas and are thus more closely tied to the U.S. economy than large multinational firms. Secondly, the small-cap value index has much higher exposure to financials and industrials that are more sensitive to cyclical fluctuations and can benefit disproportionally when the economy accelerates.

The recent surge in COVID-19 cases creates some risk to the near-term outlook for the economic recovery, but a durable rebound in growth should benefit small-cap stocks.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.