Industry 4.0 has gotten a lot of attention, and while some larger organizations are well on their way, many mainstream manufacturers are just beginning to accelerate transformation despite concerns over cost and complexity. The reality is that investing in Industry 4.0 technologies is simpler and more affordable than ever before. The benefits of investing in Industry 4.0 include improved productivity and efficiency, better flexibility and agility, and increased profitability.

Industry 4.0 addresses bottom-line shortfalls

First, let’s demystify the term. At a high level, Industry 4.0 is the intelligent connectivity between people, automation, digitization, and data analytics that drives transformative change in the manufacturing process. It represents an environment where computers are connected and communicate with one another to operate processes and make decisions with minimal human involvement. Technology advances allow for a powerful management transition, giving leaders the ability to guide the organization by looking forward rather than back, streamlining operations, and reducing manual tasks.

Making Industry 4.0 actionable can be overwhelming. To achieve transformation, focus on the opportunities it brings. Look for ways to realize benefits in 90-day increments. With this approach to a practical, achievable plan of action, your organization will be able to make faster decisions, optimize production, improve customer experience, modernize IT infrastructure, and more.

Making Industry 4.0 actionable can be overwhelming. To achieve transformation, focus on the opportunities it brings, like improvements to existing operating models and better management of volatility.

The power of Industry 4.0

As manufacturers face increased business challenges, CIOs and COOs are feeling the pressure to accelerate Industry 4.0 technology adoption. This shift in mindset represents a real opportunity. Consider that:

- Customers, suppliers, and staff understand the importance of accepting significant changes compared to pre-pandemic days.

- All companies are making changes to answer current business challenges. Organizations who move up their transformation timelines have the opportunity to leap-frog their competitors.

- Efficiencies lost due to supply chain and labor disruptions will need to be recouped. Increasing operational efficiencies and adopting new technologies can be one of the most effective ways to do this.

- Digital technologies such as automation are creating new jobs and revenue streams.

- Industry 4.0 reduces silos, improves connectivity, and boosts resilience and agility.

Use Industry 4.0 to improve resilience

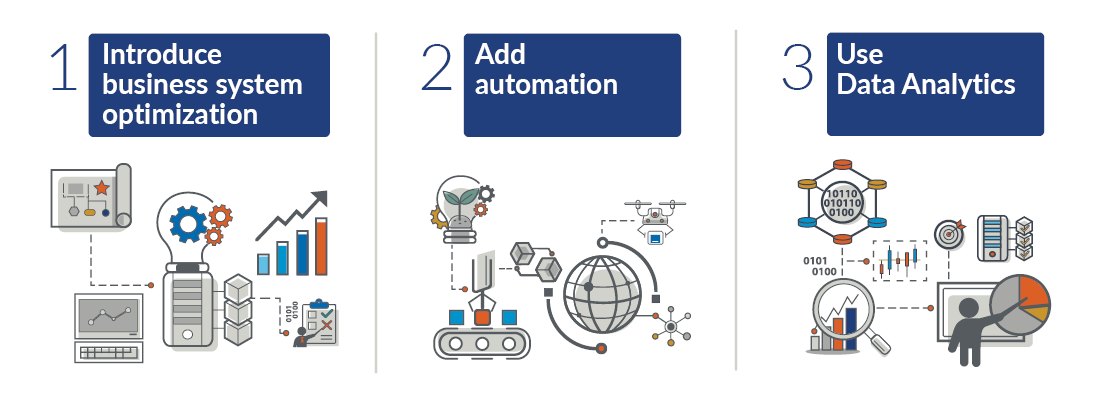

Facing increasing customer and competitor demands, companies must reevaluate how they do business. It’s critical to root out these inefficiencies soon, or you’ll risk being left behind. Industry 4.0 technologies can be a valuable tool to make changes to your operating model. First, evaluate where people congregate or perform work together — such as clocking in, attending shift meetings, or at work assembly stations. These are all potential areas for trimming expenses and boosting efficiency. Then, focus on three key actions to restart your core operations:

1. Introduce business system optimization

Consider business system optimization to help reduce inefficient, paper-based processes. Such processes tend to rely on a physical handoff in order for information to be keyed into systems. Automating how you capture, share, and analyze information increases efficiency and productivity. Evaluate optimization opportunities beyond the plant floor as well, such as accounting, HR processes, and corporate communications.

Electronically capture process information

Identify internal processes that are manual, time-intensive, and require multiple systems. For instance, eliminate paper travelers by using bar codes to capture work order information and status. Bar codes provide better visibility to manufacturing progress and allow for easier tracking of inventory locations.

Innovate interactions with customers and suppliers

Let’s take accounts payable, for instance. If your A/P process relies on manual staff intervention and paper invoices to process payments, consider optimizing your process with robotic process automation, or RPA. RPA streamlines the invoice process from end-to-end with accuracy and speed while significantly driving down cost. It sounds complicated, but new technology has made RPA simple and achievable. Beyond that, consider working with your suppliers to improve labeling to decrease receiving time, congestion at the receiving dock, and improve inventory visibility.

2. Add automation

Add automation to reduce manually intensive processes. Start by evaluating your core businesses. Don’t spend time improving or changing noncore or fringe parts of your operating model.

Manual work steps

Identify manual manufacturing processes and determine which steps can be automated. Specifically, look at repetitive tasks in assembly areas. Collaborative robots (known as cobots) are becoming a cost-effective solution for many assembly tasks. Cobots can work side-by-side with your staff and allow your team to focus more on decision-making and problem-solving activities. For those remaining manual steps, use automated work directions to guide workers on how to complete tasks efficiently and effectively.

Material flow

Map out material flows and determine how you can automate material handling tasks. Automated vehicles can receive production line signals to transfer materials from the machine to the warehouse. At the same time, inventory transfer transactions are completed in your ERP system so that material visibility remains current. Alternatively, consider introducing RFID chips to reduce the need for scanning and physically tracking materials.

Labor-intensive processes

With skilled labor shortages on the rise, attracting and retaining experienced staff is a constant battle. But with every challenge comes a new opportunity. Explore the possibility of automating labor-intensive processes and replace staff-to-staff interactions with machines, thereby reducing labor dependencies on your plant floor. Analyze inspection areas, since they often involve a group of people. The use of 3D cameras and laser inspection tools enable inline quality checks at incredible speed and accuracy.

Collaborative robots (known as cobots) are becoming a cost-effective solution for many assembly tasks.

3. Bring insights into your data analytics

Bring insights into your data analytics to make faster, fact-based decisions on optimal production parameters. Determine where to start with the end in mind, and identify your biggest problem or opportunity areas. For instance, are you challenged with having the right product in inventory at the right time? Are your facility leases expiring, or is it time to decide whether to stay or move? Have you decided to consolidate production but don’t know where to start? Each of these questions can be answered with the help of a data-driven, decision-making process. Examples of how data analytics-based projects improve customer service and reduce operating and carrying costs include:

Inventory optimization

Rather than determining inventory levels based on a gut feeling, use sales history and forecasts, lead times, production capacity, and profit margins to discern optimal levels. Resetting your optimal inventory levels is especially important given the new operating models that companies have had to adopt. For instance, a just-in-time model may no longer be right for your revamped supply chain.

Manufacturing footprint optimization

Which products you produce and at which locations are often a result of history and chance, and these decisions are seldom analyzed. Developing a model that considers sales history, production and facility costs, raw material sources, transportation costs, and profit margins to optimize your manufacturing footprint allows for fact-based — rather than emotional — decisions.

Production transfer

Moving production from one facility to another can be a risky proposition. You need to ensure you don’t affect customer orders and that you ramp up production quickly. Data-driven decisions about which products and equipment to transfer, when and how to transfer, and how much inventory to accumulate leads to seamless transitions.

And finally, as you add technology to streamline operations, reduce manually intensive tasks, and make intelligent management decisions, don’t forget to protect your operations through robust cybersecurity measures.

Get started with your Industry 4.0 strategy

A smart way to start building out your strategy is with a systematic, focused Industry 4.0 evaluation. This should entail a well-defined approach with discrete activities and outcomes. Any Industry 4.0 evaluation should result in a clear roadmap to achieve meaningful, sustainable results. Start with identifying the core processes of your operating model. Then, assign internal management and external resources with the right skills, determination, and organizational respect to drive the change initiative.

Finally, and most importantly, start the work. Even a few strategic changes can result in higher profits and a safer, smarter plant.