Collaborative supplier relationships bring OEMs two significant commercial payoffs: competitive supplier pricing and nonprice benefits that suppliers selectively choose to offer individual customers. How do OEMs and suppliers view their degree of collaboration and state of their working relationships today in the face of significant disruption in the auto industry?

The Plante Moran 2022 Working Relations Index (WRI)® is a comprehensive survey methodology that yields a quantitative measure of working relations between suppliers and OEMs. Survey results deliver actionable data companies can use to reduce costs and time spent on commercial relationships and to improve competitiveness.

Why supplier relations matter

This past year, tension rose between OEMs and suppliers as the auto industry grappled with unprecedented challenges — ongoing supply chain shortages and production volatility, transition pains to electric vehicles, logistics constraints, and the increasing raw material costs impacting automakers and suppliers alike. The tension will only worsen if the issues aren’t resolved. That said, the 2022 WRI® Study shows that, despite the myriad challenges, supplier relations don’t have to suffer.

With market uncertainty increasing, manufacturers depend on strong supplier relations to provide operational flexibility, manufacturing launch support, risk mitigation, and product differentiation. These nonprice attributes enhance the value of the goods and services suppliers offer. Manufacturers with the best supplier relations can gain a competitive advantage through:

- Reducing the time to close issues such as material cost recovery.

- Optimizing production schedules given supply chain disruptions.

- Sharing price and other risks when entering new markets such as electric vehicles.

- Developing purchasing and supplier knowledge through information sharing.

- Aligning customer and supplier functions to deliver price, quality, and delivery.

Bottom line, supplier relationships directly impact competitiveness. Read on to see how as we share a few key findings from the 2022 Plante Moran WRI® Study.

2022 Plante Moran WRI® results

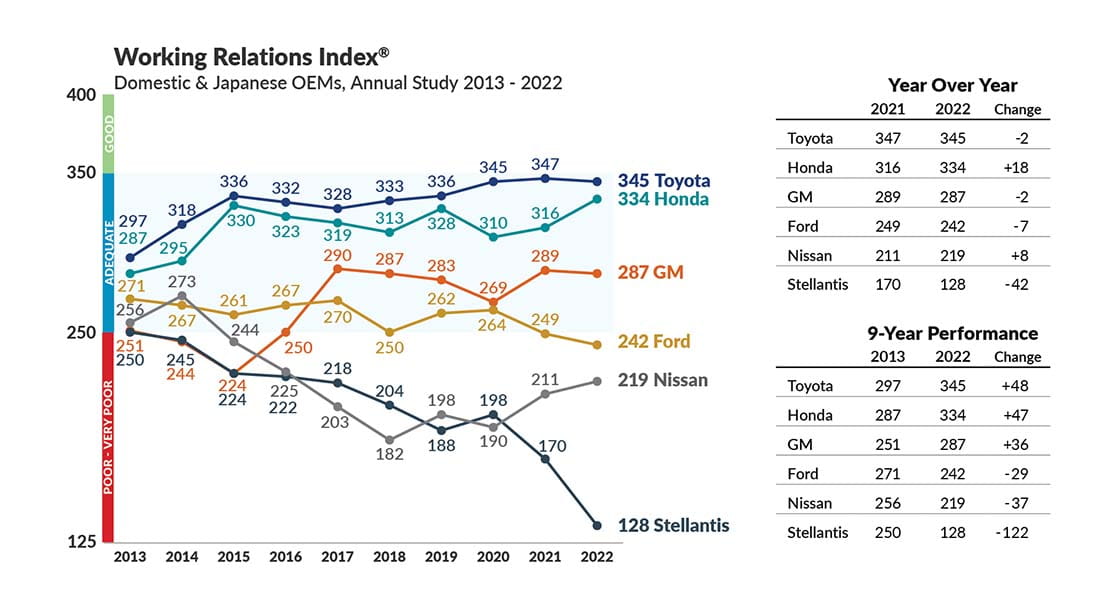

This year’s WRI® Study is based on responses from a representative sample of 673 automotive executives. Compared to 2021, two of the six major U.S. OEMs substantially improved their WRI® scores. Two OEMs held steady, while two others fell — one significantly.

The chart below illustrates year-to-year changes of these six OEMs over the past 10 years and the relative positions of each.

Figure 1

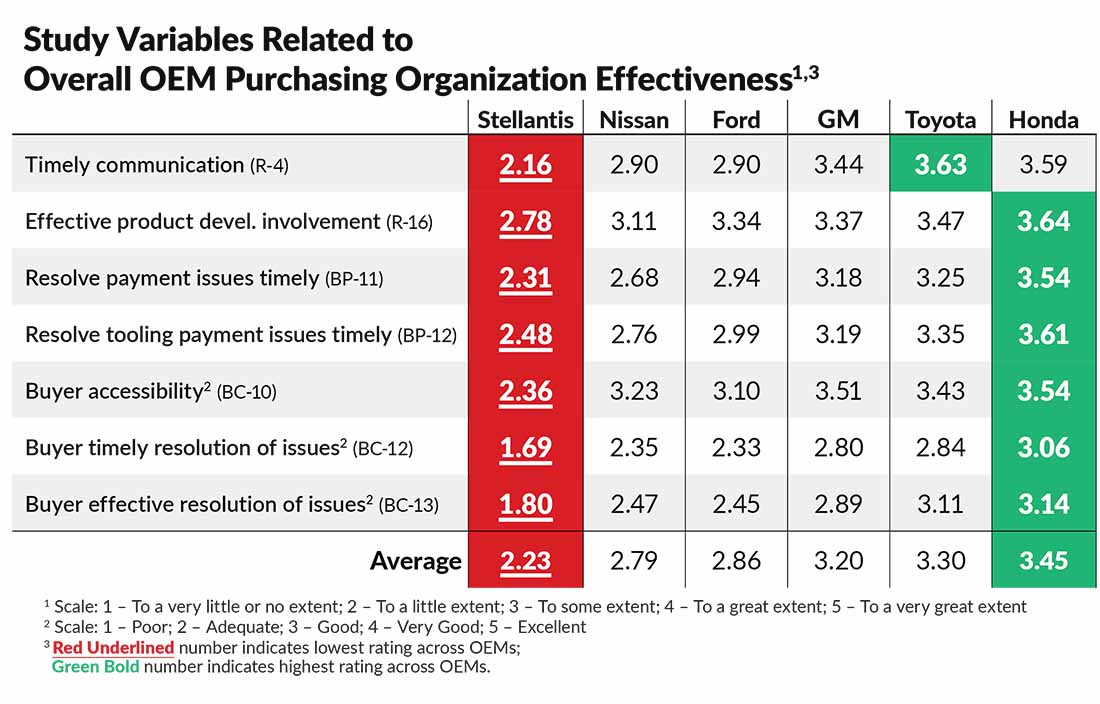

Figure 2

Diving deeper into the results, we see that Honda built its 2022 WRI gains on “purchasing effectiveness.” This measure encompasses variables from the WRI questionnaire related to how purchasing organizations handle disruptive supply chain issues on top of the company’s day-to-day commercial matters. Attributes contributing to purchasing effectiveness include perception of effective communication, efficient and fair resolution of issues, and other buyer and business practices, as shown in figure 2.

In overall OEM Purchasing Organization Effectiveness, Honda led in six of the seven categories, with a composite average score of 3.45. Toyota remained in second, tying last year’s score of 3.30. GM dropped slightly but remained in third place with a 3.20. Ford remained in fourth at 2.86. Nissan was up slightly at 2.79, and Stellantis dropped significantly to 2.23.

A particular friction point with all OEMs was the increasing time for dispute resolution. Much of this friction was driven by material shortages and cost inflation. These, in turn, led to rising input costs and a decline in profitability as production schedule volatility drove volumes down. Supplier requests for cost recovery and other accommodations piled up with OEM purchasing groups. Smaller suppliers were hit particularly hard as they don’t have the ability to absorb these costs nor the resources to spread across multiple open issues.

Promptly resolving these and other disputes allows buyers and sellers to move on to new product introductions and more “productive” activities. Dispute resolution — whether considered a “win” or a “loss” — also increases cash flow predictability, since the resolution recovery or cost can be accurately booked. Improving resolution times should be treated no different from improving production cycle time toward the objective of asset utilization.

For OEMs, a focus on the effectiveness of the purchasing organization is essential; it drives organizational alignment vertically up and down the organization and horizontally across engineering, manufacturing, quality, supply chain logistics, and finance. It reinforces that supplier relations should not be the sole responsibility of purchasing. Like quality, supplier relations is everyone’s responsibility. For example, effective product development engagement involves engineering relationships, but it also requires alignment with quality-related material specifications for designing around materials that may be in short supply. The timely resolution of issues by buyers is undoubtedly a function of the buyer’s commercial knowledge and accessibility, which also requires a financial component if the case involves a material cost recovery or a warranty chargeback negotiation.

Applying WRI® Study results to improve customer-supplier working relations

Improving OEM-supplier working relationships will be critical as the industry shifts from internal combustion engine (ICE) vehicles to battery-electric vehicles (BEV). First, strong supplier relationships can minimize costs as OEMs end their ICE programs. Clearly communicating technology roadmaps with suppliers will help them navigate an orderly transition to other products, industries, or even ultimately exit operations.

Second, OEMs will be dealing with many of the same suppliers on future BEV products considering they have on previous ICE products. And OEMs won’t be able to convince suppliers to take on additional volume and cost risk of BEV programs if they’re increasing uncertainty while exiting ICE programs. OEMs’ cost and risk-sharing practices are critical for supporting this transition.

Third, the auto industry will be working with new software and electronics suppliers that have entirely different expectations around trust and its components: realistic expectations, accountability, and information transparency. Purchasing organizations need to develop and improve the capabilities and capacities to work with this new supply base.

Productive customer-supplier relationships depend on various factors, including the effectiveness of OEM purchasing organizations. As the industry continues to face significant challenges, including the transition to BEVs, supplier relationships will be paramount — to meet production, quality, and delivery objectives; manage risk; and maintain competitiveness.

About our WRI® Study

These are only a slice of the insights in the 2022 Plante Moran WRI® Study. The survey methodology and the commitment of the 673 responding executives provide a clear depiction of the state of OEM-supplier commercial relationships. Our WRI® methodology draws on qualitative observations, analyzes large data sets, and prioritizes actions for customers and suppliers to take in order to reduce the cost of doing business.

To learn more about the annual Plante Moran WRI® Study, how to apply findings in your organization, or to participate, contact Dave Andrea.