With the implementation of GASB 87 (leases) in the rearview mirror, it’s time for most organizations to prepare for two additional statements coming up in the next year. They are:

- GASB 94, Public-Private and Public-Public Partnerships (P3s) and Availability Payment Arrangements (APAs) related to public-private partnership arrangements. This standard establishes definitions of PPPs and APAs and provides uniform guidance on accounting and financial reporting for these types of transactions.

- GASB 96, Subscription-Based Information Technology Arrangements (SBITAs). This standard provides guidance on the accounting and financial reporting for subscription-based information technology arrangements (SBITAs) for government end-users.

Both standards are effective for fiscal years beginning after 6/15/2022, and all reporting periods thereafter.

Depending upon your entity, implementation may require significant work; in fact some organizations are indicating they have more agreements potentially in scope under GASB 96 than they did for the lease standard. But there’s a silver lining in this: Statements 94 and 96 are similar to Statement 87 in many regards, so once you’ve mastered leases, you’ll have a solid foundation for understanding the additional two standards.

How do P3s and SBITAs compare to leases?

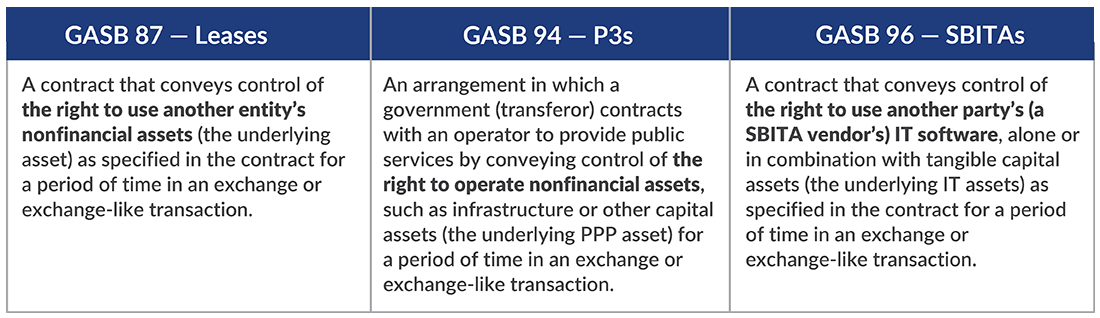

For those already familiar with the lease standard, a good way to understand the similarities and differences to P3s and SBITAs is to compare their definitions side-by-side, as shown in the following GASB 87 lease table.

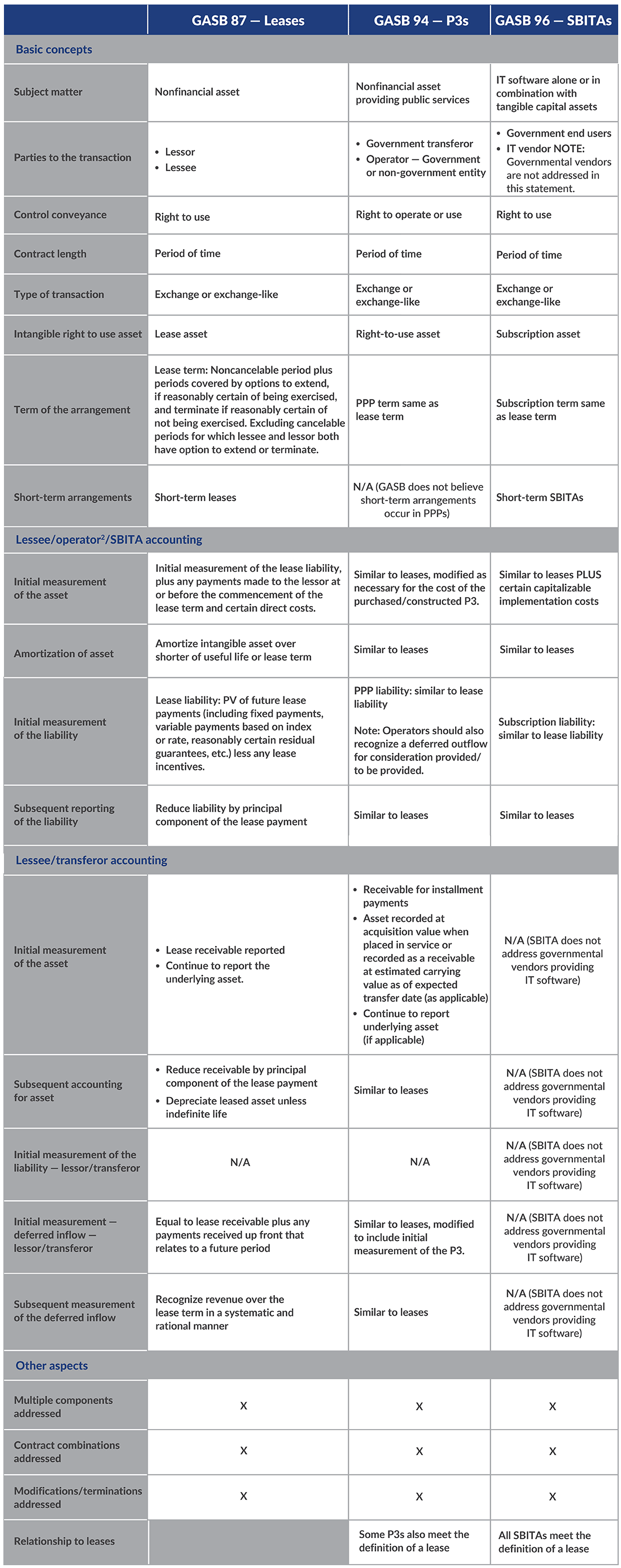

To further highlight similarities and differences between the three standards, the following chart compares and contrasts, at a very high level1, the key aspects of the three pronouncements.

GASB 87 vs. GASB 96 – when to apply

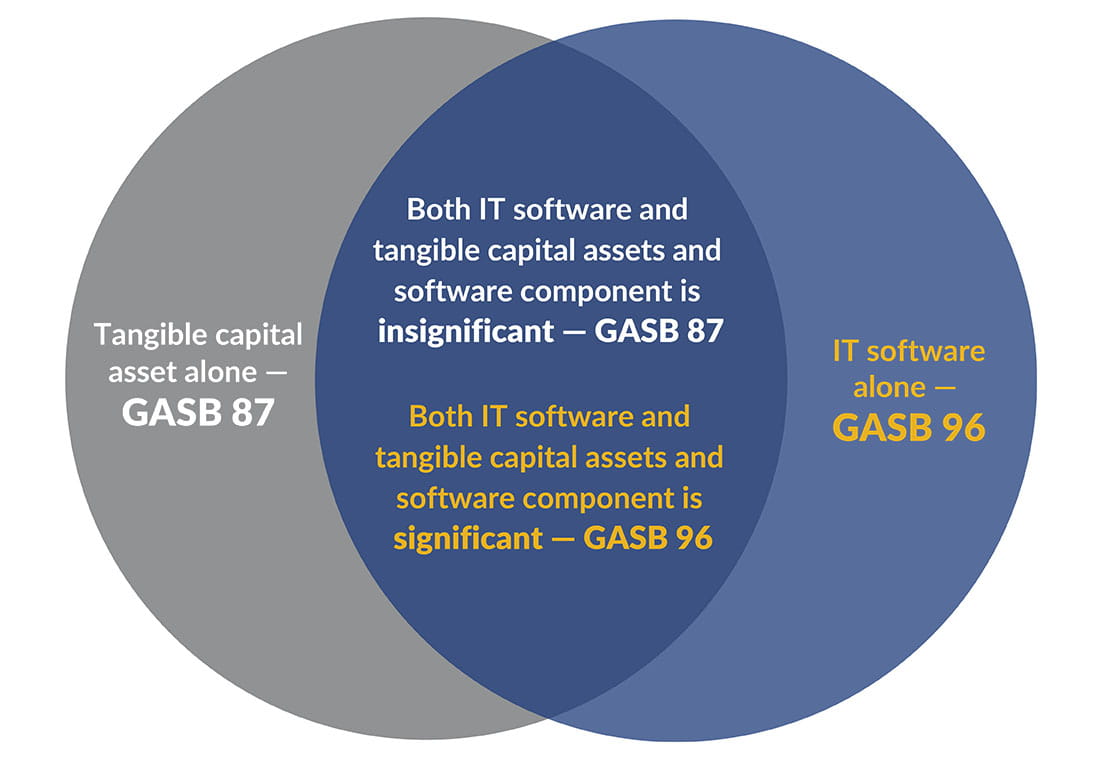

A concept that may have caused confusion during implementation of GASB 87 was distinguishing between what assets fall under the lease standards versus what may fall under the SBITA standard. In general, tangible capital assets fall under Statement 87, whereas IT software by itself falls under Statement 96. But what happens if you have an arrangement that includes IT software and tangible capital assets in combination? If the software component is insignificant, you should apply GASB 87. If the software component is significant, the arrangement falls under the scope of GASB 96.

Where the standards most significantly diverge

Statement 94 defines a number of different types of arrangements, each with their own unique accounting. For example, it brings in the concept of a service concession arrangement (SCA) from GASB 60, which was entirely superseded by this new standard. P3s that also meet the definition of a SCA will have slightly different accounting than a non-SCA arrangement, particularly one in which the underlying P3 is not an existing asset of the transferor. Statement 94 also includes accounting for construction/purchase of a new or improved underlying PPP asset. Finally, the accounting for availability payments arrangements is also introduced in Statement 94. (For more on Statement 94, see our previous article: GASB 94 is approaching: Are P3s on your organization’s radar?)

Within GASB 96, given the nature of SBITAs and the potential for various implementation stages related to subscription-based IT arrangements, GASB pulls in many of the same concepts found in Statement 51 about the appropriate accounting during various different implementation stages. (For more on GASB 96, see our previous article: Understanding GASB 96, Subscription-Based Information Technology Arrangements). The subscription term under GASB 96 could be a bit more difficult to identify given these different implementation stages. This standard clarifies that the subscription term commences when the initial implementation stage is complete. When there are multiple modules, the subscription term begins when the first module or set of interdependent modules is implemented.

This has given you a description of the GASB 94 and 96 standards, and an overview of how they operate alongside GASB 87. As you sit down to consider the implementation of these two new standards, reach out with any questions. We’re here to help.