Why should I invest in anything beyond U.S. large-cap stocks?

U.S. large-cap stocks, as measured by the S&P 500, has been one of the top performing asset classes for much of the last decade. It’s a theme that’s continued to play out this year, although market breadth has been exceptionally narrow, as discussed in our accompanying piece. Because of this dynamic, diversified equity portfolios have broadly lagged the S&P 500 this year. So why should investors remain diversified rather than investing solely in an S&P 500 index fund?

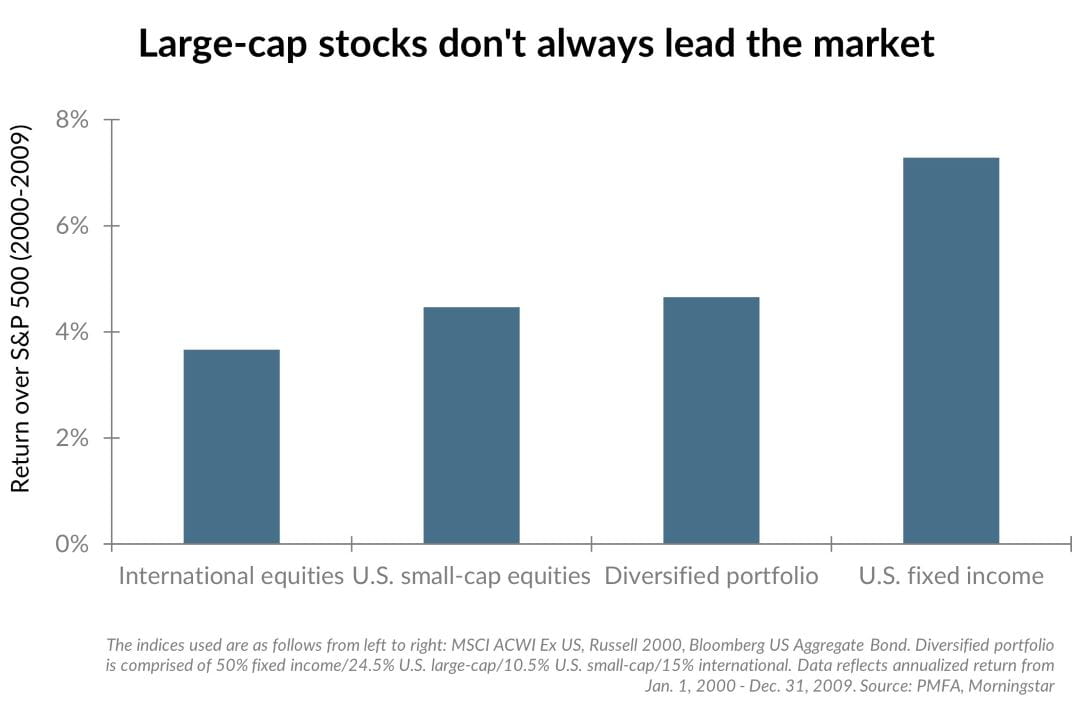

The chart above illustrates that point, looking back to the decade that followed the last period of S&P 500 dominance. In the decade beginning in January of 2000, domestic large-cap stocks underperformed almost all other major asset classes, including international equities and small-cap stocks and even core taxable fixed income. Over that 10-year period, a diversified portfolio of 50% bonds and 50% diversified global equities outpaced the U.S. large-cap market by an average of nearly 5% per year, a sharp contrast from the period in the late 1990s when the technology-led S&P 500 dominated.

Why does this matter? While large-cap stocks have led the pack in recent years, investors shouldn’t abandon a broadly diversified approach to building a portfolio. No single asset class, sector, style, or stock will remain dominant indefinitely. Maintaining diversified exposure across a variety of asset classes not only helps to reduce portfolio volatility, but it allows investors to benefit from exposure to the best performing asset classes, even as specific leaders rotate in and out of favor over the course of time.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.