For much of the period following the Global Financial Crisis and before the COVID-19 pandemic, the Fed held the federal funds rate in a range of 0–0.25% — effectively as close to zero as possible. The 10-year Treasury yield, a widely used barometer of the fixed income market, averaged less than 2.5% during this period.

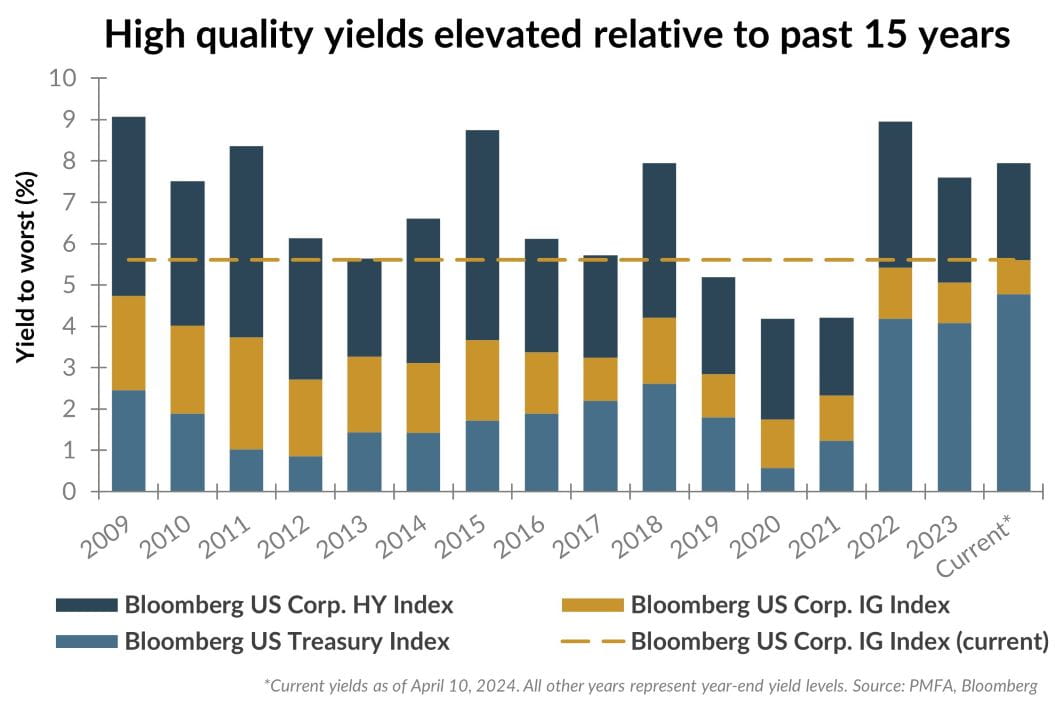

Things have changed in a considerable way, creating a more favorable rate regime than investors have seen in many years. The Fed’s rate hiking cycle has translated to higher yields across the bond market. Today, the 10-year Treasury yield is near 4.5%, while investment grade corporate bonds yield roughly 5.5%. The chart above clearly illustrates this material change in the fixed income environment, showing that investors today can earn a yield in high-quality (IG) fixed income that required taking on additional risk in high-yield (HY) fixed income just a few years ago. This is a beneficial development for conservative investors, who can now earn a higher return in fixed income markets, while assuming less risk than they would have needed to over much of the past decade.

Bonds are different from equities in a variety of ways, but arguably most important is that a bond investor is a lender with a contractual claim to cash flows. As a result, investors receive a recurring level of income that accounts for nearly the entire return of a bond portfolio over time (more than 95% historically), highlighted in our longer form piece released in January.

Absolute yield levels play a large role in fixed income’s overall return outlook, but taking it one step further to assess relative yield levels across credit quality is important. Are investors properly compensated for taking on additional credit risk today in reaching for yield? Our associated piece addresses that question.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.