Equity markets have extended a sell-off that began last week in a response to unexpectedly soft economic data and a deterioration of investor sentiment. Early Monday, the S&P 500 index neared correction territory, represented by a 10% drop from the most recent peak, before rebounding modestly as the day went on. Despite the recent volatility, the index remains solidly in positive territory year to date, returning over 10%, including dividends through the close today.

On the other hand, core bonds have rallied as interest rates have fallen sharply as investors sought relative safety, with the Bloomberg Aggregate Bond Index up nearly 4% in just over a month. This rally underscores the diversifying power of high-quality fixed income during periods of equity market volatility.

What's changed?

Softer-than-expected economic news prompted concerns around the potential risk of a hard landing. The ISM manufacturing index registered a weaker-than-expected 46.8% in July, marking its fourth consecutive month of deterioration. This was followed Friday by a disappointing jobs report where the unemployment rate edged up to 4.3% — its highest level since late 2021 — and the pace of job creation faltered.

Exacerbating the volatility has been an unwind of the Japan carry trade, in which investors borrowed at ultralow interest rates in Japanese yen to buy other assets. Expectations for more aggressive rate cuts in the United States, coupled with rising interest rates in Japan, have sent the value of the Japanese yen sharply higher and has forced an unwind of what had become a popular momentum trade. Japan’s Nikkei 225 index fell more than 12% overnight and has declined more than 25% from its July peak.

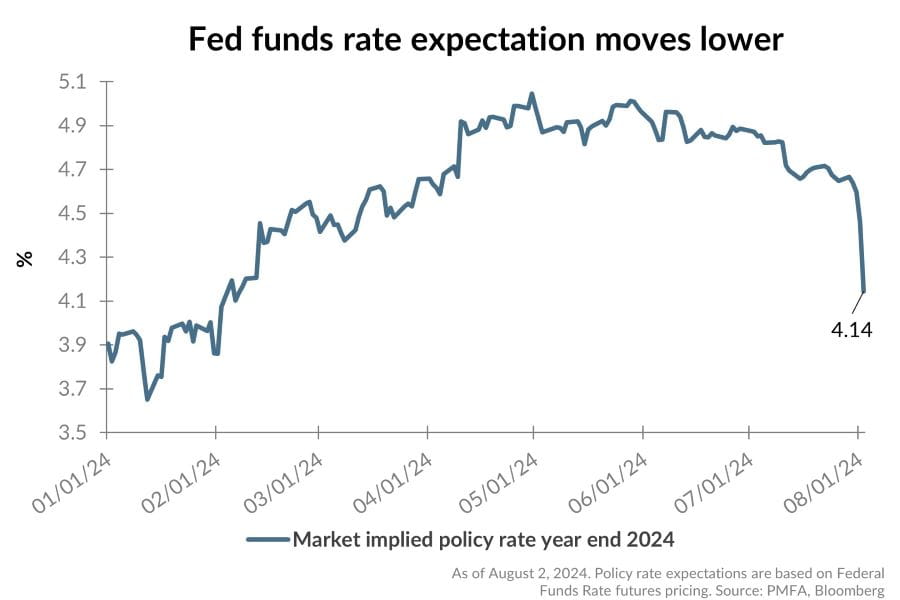

The growing sense that a hard landing for the U.S. economy could be in the cards led to a rapid recalibration of expectations for monetary policy. Fed funds rate expectations have moved dramatically in recent days, as the market increasingly believes the Fed may be behind the curve. Moreover, a growing number of economists and strategists have suggested that the Fed may need to announce a rate cut before the FOMC’s next scheduled meeting in late September. With inflation trending toward the Fed’s 2% target, the risk increasingly appears skewed to a softening labor market. At the end of June, the futures market was pricing in just two quarter-point Fed rate cuts through the end of the year. Now, investors expect a more urgent need for the Fed to cut more aggressively, trimming the fed funds rate by 1.25% to roughly 4% before the end of the year.

While we’ve seen volatility across most global equity indices, it’s important to view recent events within the context of the broader picture. Over the 12 months ended August 2, the S&P is still up 20%. Those areas of the market most impacted by the recent pullback, such as technology, are the same that had risen most sharply over the past year. In fact, the decline in the markets over the past week have only taken the Nasdaq composite index back to its level in early May. Ultimately, periodic market adjustments as we are seeing now are not uncommon.

What’s next?

By many measures, this cycle has been an unusual one. From the massive swings throughout the post-COVID period, to the normalization that has taken considerable time to work its way through the system. As we look forward from here, the pace of economic growth appears likely to slow. Still, coming off a GDP print of 2.8% annualized in Q2, a hard landing isn’t yet a foregone conclusion. Today, the ISM Services Index rebounded to 51.4%, lending support for the current expansion to continue (as the services sector accounts for around 70% to GDP). In addition, several measures of consumer health remain constructive. Debt levels and delinquency rates, while rising, remain low relative to history, indicating that consumer finances may still be able to support further spending growth.

Furthermore, while the employment report disappointed, the economy still added 114k new jobs in July. Though certainly a deceleration from the growth we have seen since the pandemic, job creation in that range isn’t alarming. The three-month average, which smooths out single-month outliers, remains at a very solid 170k. Notably, the uptick in unemployment this year has not yet been accompanied by a significant increase in layoffs. Rather, immigration and other new entrants to the jobs market have notably increased the total supply of available workers, lifting the unemployment rate in spite of continued job gains.

Finally, the election remains on the minds of many investors, and it will undoubtedly continue to occupy much of the media bandwidth in the coming months. However, markets have typically been positive in election years (nearly 90% of the time), as it’s often the economy that influences markets more significantly than the election.

What should investors do?

Until recently, it had been nearly a year and a half without a 2%-plus down day in the S&P 500 – an unusually extended period for volatility to remain relatively low. During this time, markets had climbed the proverbial wall of worry, edging higher on the back of better earnings growth, optimism around the potential benefits of emerging AI technology, and a robust economy. But we know that market corrections aren’t rare. In fact, the S&P 500 has experienced a drawdown of 10% or more roughly every other year on average since 1950. In spite of these selloffs, the market has produced positive returns in about three out of every four calendar years. Further, those who remained invested through the volatility were rewarded with an annualized 11% per year over that period.

While it may be easy to focus on potential risks to the outlook from here, it’s important to maintain appropriate perspective. Heading into 2023, many economists were calling for a near-term recession, but that didn’t come to fruition. Had investors derisked in anticipation of that outcome, it would have represented a significant opportunity loss (and likely tax costs) as equities have been strongly positive since that time. Similarly, in March of 2020, markets fell more than 30% in a matter of weeks but reversed quickly on the back of monetary and fiscal support to end the year on a strongly positive note. Ultimately, market timing is fraught with limitations and can often result in more harm than good to a long-term investment plan.

While investors intuitively know that volatility is an unavoidable byproduct of risk taking, living through it can be difficult, creating anxiety and potential second guessing. During these periods, we encourage investors to not lose sight of your investment time horizon, maintain broad-based diversification, and ensure adequate liquidity to cover near-term spending needs. As always, we’ll continue to monitor developments closely as we evaluate what steps, if any, may be appropriate to consider.

In the interim, please don’t hesitate to reach out to your advisory team with any questions or concerns that you might have.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.