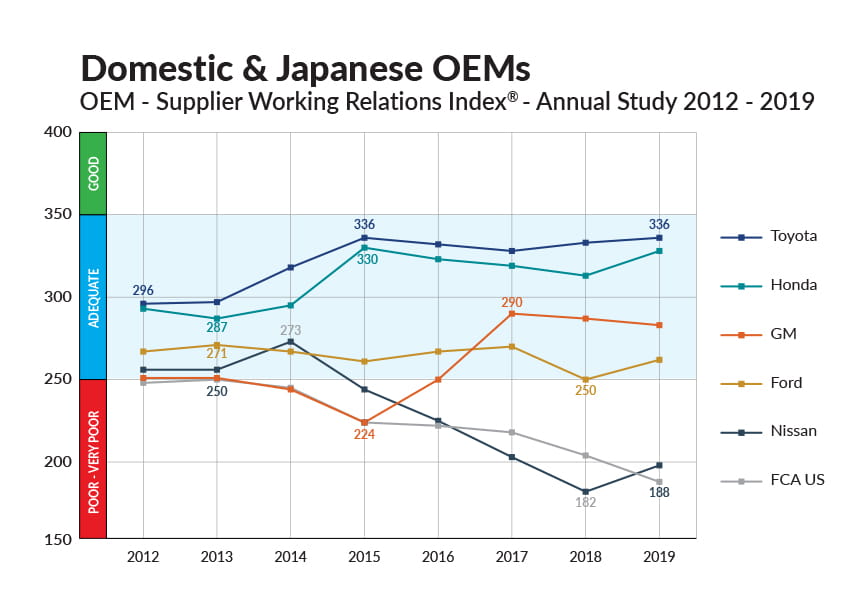

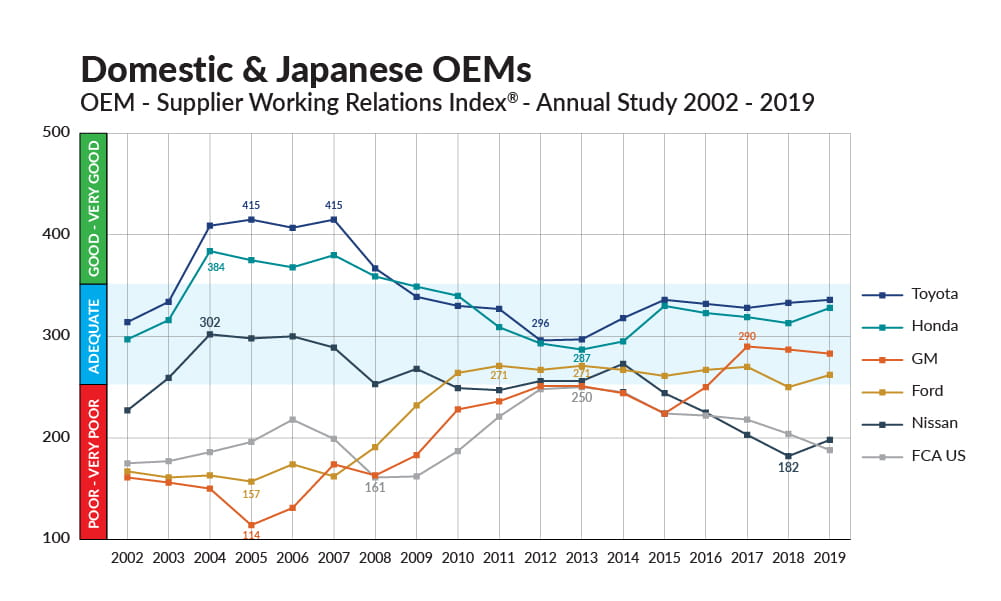

Detroit, June 17, 2019 – Results of the 19th annual North American Automotive OEM - Supplier Working Relations Index® (WRI®) Study released today show that the major U.S. and Japanese automakers are making limited progress in their supplier relations. However, this progress is only incremental compared to the major industry transition underway. The study was conducted by Plante Moran, Southfield, Mich.

Toyota, Honda, Ford and Nissan all showed a slight uptick in their WRI®. GM dropped slightly; and FCA fell to last place, continuing its downward trend since 2013. However, none of the six automakers’ gains or losses were statistically significant on a year-over-year basis.

“Given the competitive pressures automakers are under and the exponential pressures they face in the future, the OEMs need to be laser-focused on improving their supplier relations in order to best leverage their supply base,” said Dave Andrea, Principal in Plante Moran’s Strategy and Automotive/Mobility Consulting Practice.

“OEM purchasing has to become as much a strategic priority as engineering and product development are, and unless this happens the OEMs won’t be able to deliver the electrified and autonomous vehicles and new mobility services they envision for the future. Without a concerted effort focused on improving supplier relations and suppliers’ long-term sustainability, OEM and supplier resources are likely to be over-extended. Add to these demands the potential for economic downturns, trade pressures and other competitive pressures, and the challenge of running a profitable automotive business will be extremely difficult without the full support of an OEM’s suppliers.”

The study is watched carefully by automakers because their supplier relations rating on the Working Relations Index® (WRI®) is highly correlated to the benefits that the OEM receives from its suppliers, including more investment in innovation and technology, lower pricing, and better supplier support, all of which contribute to the OEMs’ operating profit and competitive strength.

Two decades of industry WRI® and profit per vehicle data back this up and show that working relations are a strong indicator of profitability for the OEM and supplier alike. That is because strong working relations reduce the cost of doing business, improve efficiency and productivity, and reduce time to market.

Through the Working Relations Index® Study, suppliers are asked to score automakers on 23 variables that fall into five broad areas: OEM-Supplier Relationship (Trust), OEM Communication, OEM Help, OEM Hindrance, and Supplier Profit Opportunity.

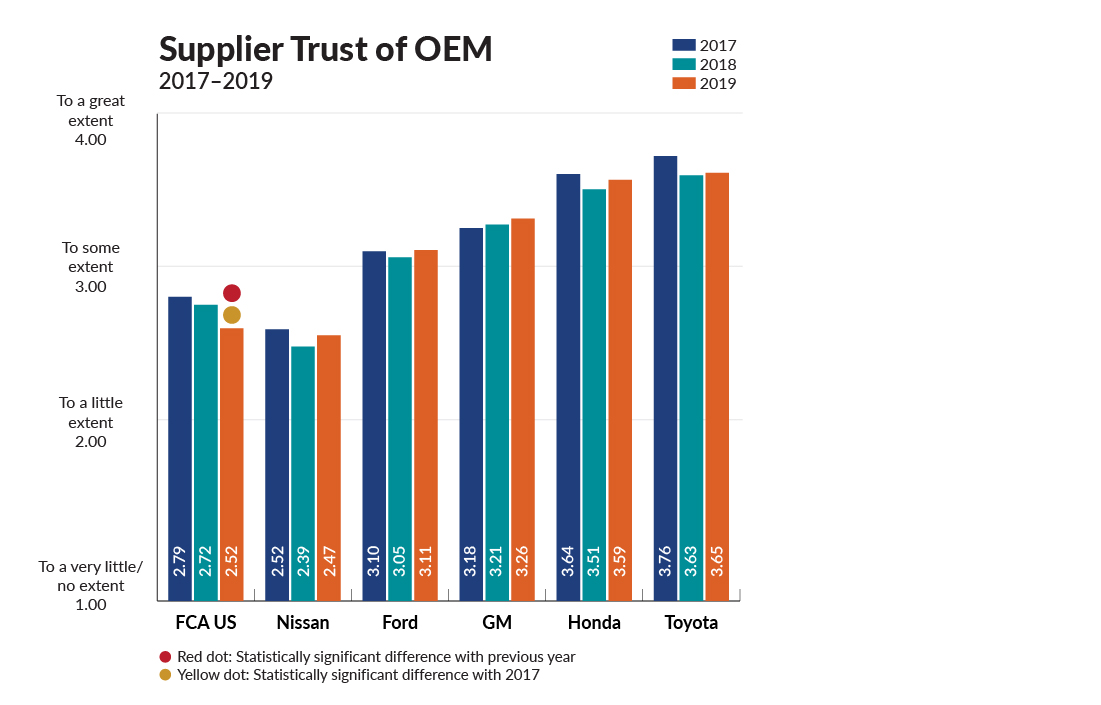

OEM-supplier trust and communication

At the heart of OEM buyer/supplier relations is Trust and Communication, particularly important factors in uncertain times when vehicle programs are in flux, and millions of dollars and thousands of jobs are at risk with supplier companies. These two components are directly correlated to benefits OEMs receive from their suppliers.

How do suppliers rank the six automakers and purchasing teams in terms of trust? The Supplier Trust of OEM graph shows Toyota and Honda are first and second, respectively; GM and Ford rank third and fourth, respectively; FCA is fifth but trending down significantly; and Nissan is last.

The degree of corporate trust is built from many granular elements of the study, which measures everything from protection of intellectual property to the level of open and honest communication and fulfilling contractual commitments. These generally track the WRI®.

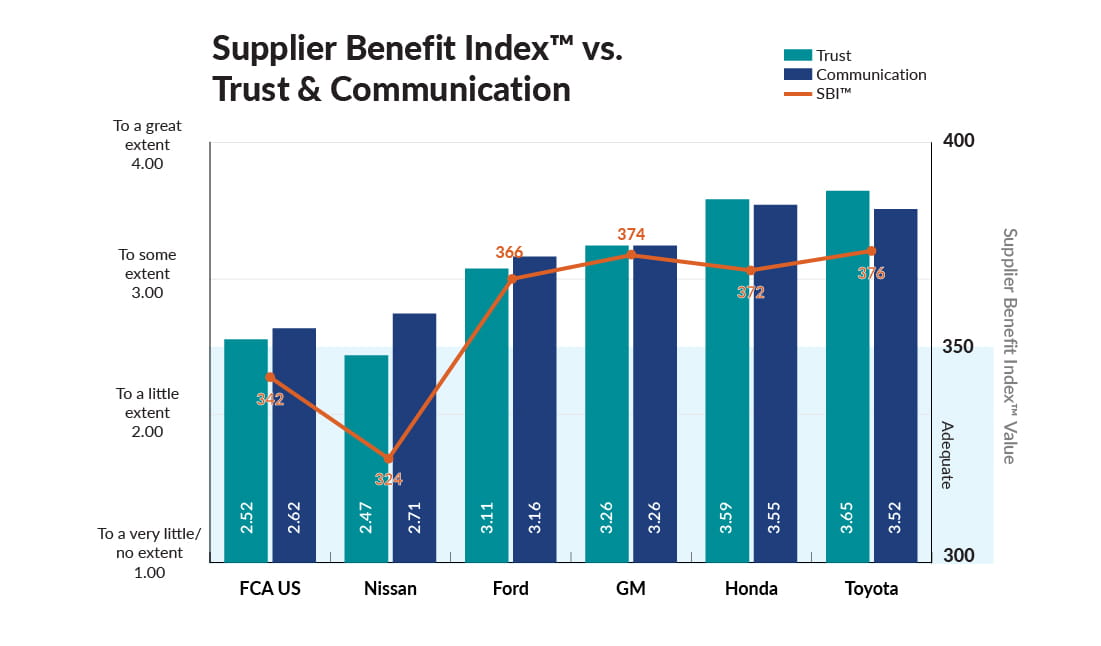

Suppliers support their OEM customers essentially by price reductions on parts, and by providing valuable non-price benefits such as increased investment in new technology, greater sharing of new technology, and earlier and better supplier communication that helps avoid or resolve problems more quickly. This is measured by the black graph line in the Supplier Benefit Index™ (SBI™) vs. Trust & Communication graph.

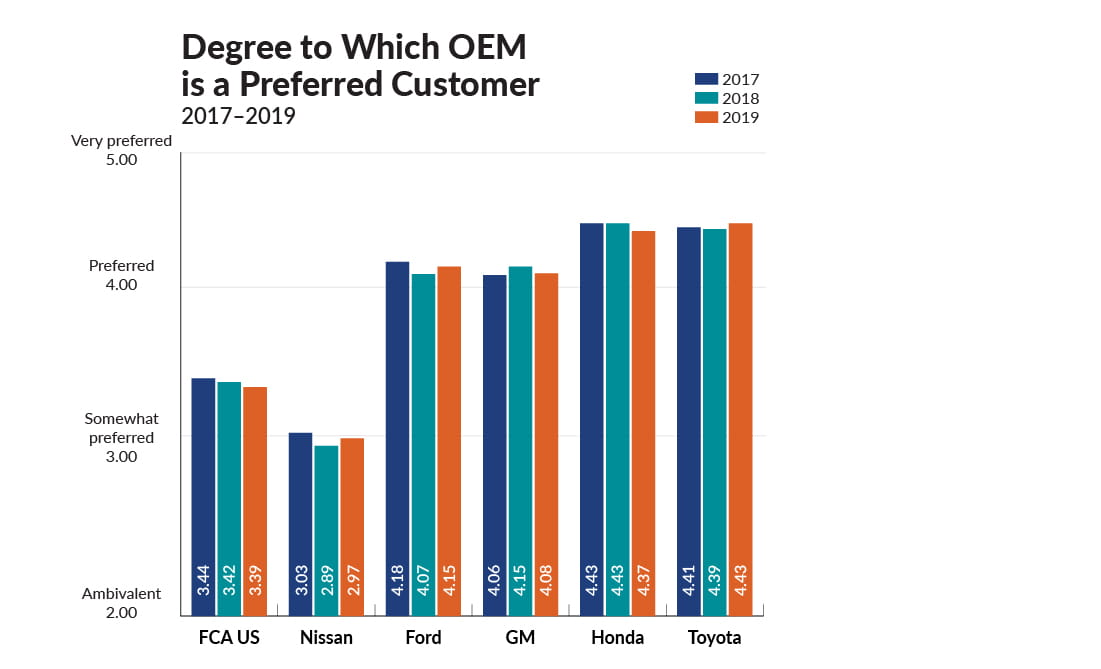

The SBI™ also closely tracks the results shown in the Degree to Which OEM is a Preferred Customer graph with Toyota and Honda ranking first and second, respectively; Ford and GM, third and fourth, respectively; FCA fifth, and Nissan significantly lower in last place.

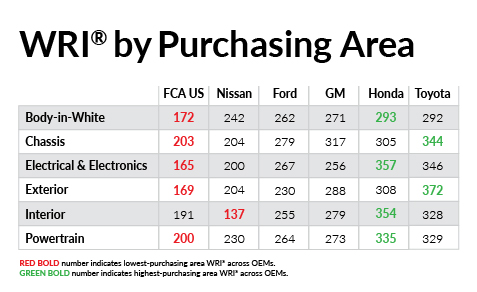

Purchasing area WRI®

The rankings in the overall WRI® extend down to the automakers’ respective purchasing areas. As shown in the Purchasing Area table below, Honda ranks best in four of the six purchasing areas with Toyota taking the other two top places, while FCA ranks lowest in five of the six purchasing areas and Nissan the lowest in one. GM and Ford are well above average in all six with GM ranking higher than Honda in one.

Engineering performance & supplier relations

“It’s not just purchasing that influences an automaker’s WRI® ranking; product development and engineering do, too,” said Andrea.

“For instance, the study asks to what extent late or excessive OEM engineering changes impact on-time development or quality and cost targets, whether the supplier is given flexibility in meeting cost and quality objectives, and whether the supplier is involved early enough in the OEM product development process and kept involved throughout the process.

“These are critical questions that show how important it is that all OEM functions are aligned to take cost and time out of the entire supply chain to deliver not only the OEM’s cost objective but help the suppliers’ cost and financial performance as well.”

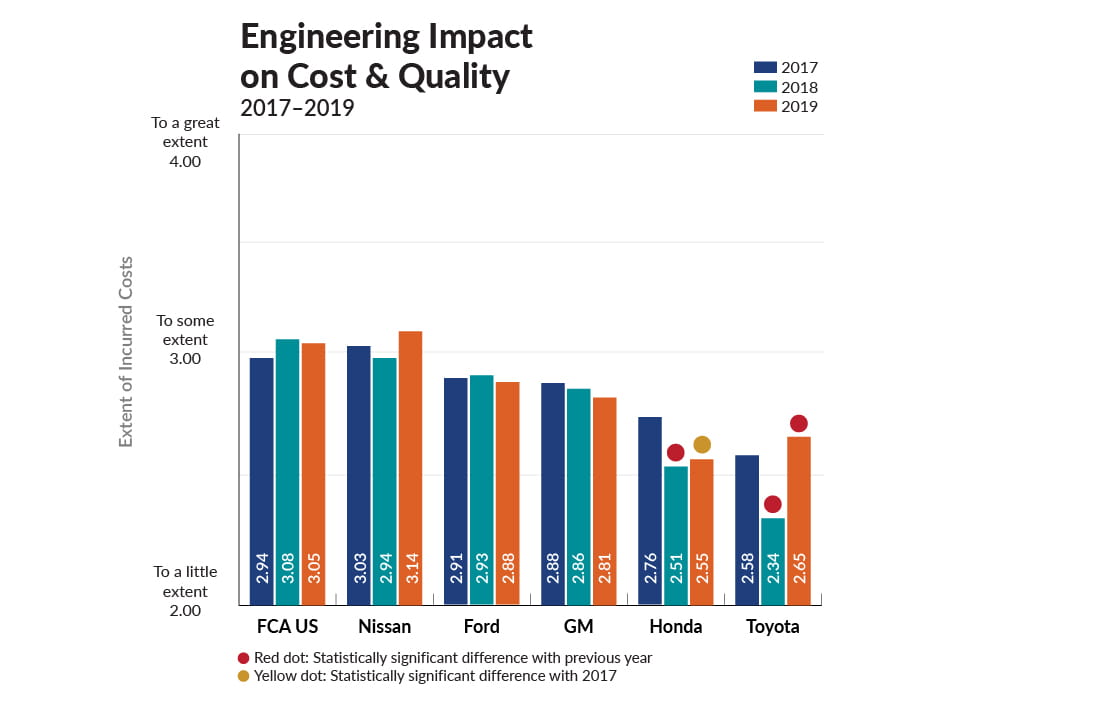

Impact of late engineering changes

The number of late or excessive engineering changes impacts a supplier’s contribution to the OEM in three important ways: cost, quality, and time.

As shown in the Engineering Impact on Cost and Quality graph, Toyota was best at managing engineering changes in 2018, followed by Honda. In 2019, they’ve swapped places with Honda, now in first place. GM and Ford are ranked in the middle, and FCA US and Nissan are last.

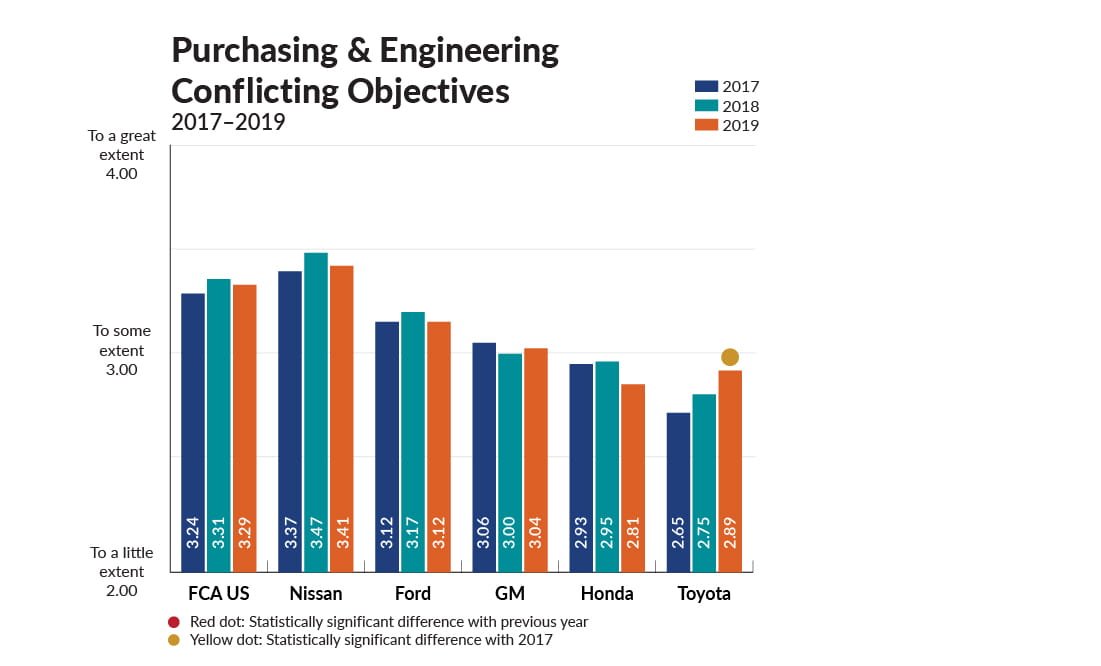

Conflicting objectives

OEMs can also hinder suppliers by creating conflicting objectives between the purchasing and engineering functions. The Purchasing and Engineering Conflicting Objectives graph shows the degree to which automakers hinder suppliers. Again, Honda is ranked best, with Toyota, GM and Ford close behind.

“Focusing on improving supplier relations has never been more important for the automakers,” said Andrea.

“With all the challenges the automakers are facing, the OEMs must be very conscious of their supplier working relations going forward. Suppliers contribute 60-70 percent of the value of the vehicle, so it is clearly in the OEMs’ best interest to set the goal of becoming the most preferred automaker to do business with.”

About the Working Relations Index® Study: The 2019 North American Automotive OEM-Tier 1 Supplier Working Relations Index® Study was developed by Dr. John Henke, of Planning Perspectives, Inc. Now in its 19th year, the 2019 study was led by Plante Moran and was conducted from mid-March to early May. Respondents are salespersons from Tier-1 suppliers serving the Top 3 Detroit and Top 3 Japanese automakers. The annual study tracks supplier perceptions of working relations with their automaker customers in which they rate them across the six major purchasing areas broken down into 14 commodity areas. The results of the study are used to calculate the WRI® which can then be used to calculate the economic value of working relations based on a proprietary economic model. Respondents represented 635 salespersons from 414 Tier-1 suppliers, representing about 60% of the six OEMs’ annual buy. The sales personnel provided data on 2,024 buying situations (e.g., supplying brake systems to FCA US, tires to Toyota, seats to GM). Demographically, the supplier-respondents represent 43 of the Top 50 NA suppliers and 74 of the Top 100 NA suppliers.

About Plante Moran: Recognized as a leader in automotive and mobility strategy, Plante Moran is among the nation's largest accounting, tax and consulting firms and provides a full line of services to organizations across many industry segments. In addition to automotive, Plante Moran has depth of expertise in manufacturing and distribution, private equity, Japanese-owned businesses, financial institutions, service, health care, public sector and real estate and construction. Headquartered in Southfield, Michigan, Plante Moran has a staff of more than 3,000 professionals throughout Colorado, Illinois, Michigan and Ohio with international offices in China, Mexico, India and Japan. Plante Moran has been recognized by several organizations, including FORTUNE magazine, as one of the country's best places to work. For more information, visit plantemoran.com.