Detroit, May 22, 2023 – Results of the 23rd annual North American Automotive OEM-Supplier Working Relations Index® (WRI®) Study that evaluates the relations between U.S. automakers and their suppliers were released today by Plante Moran.

The study shows rising tension over increased risk related to short-term cost recovery issues, production scheduling, and supply chain disruptions as the industry transitions to electric vehicles (EVs). These are compounded by long-term strategic issues suppliers have related to adequate insight into automakers’ EV strategy and timing so they can effectively plan for the transition in terms of adequate capital, acquisitions, and staffing investment.

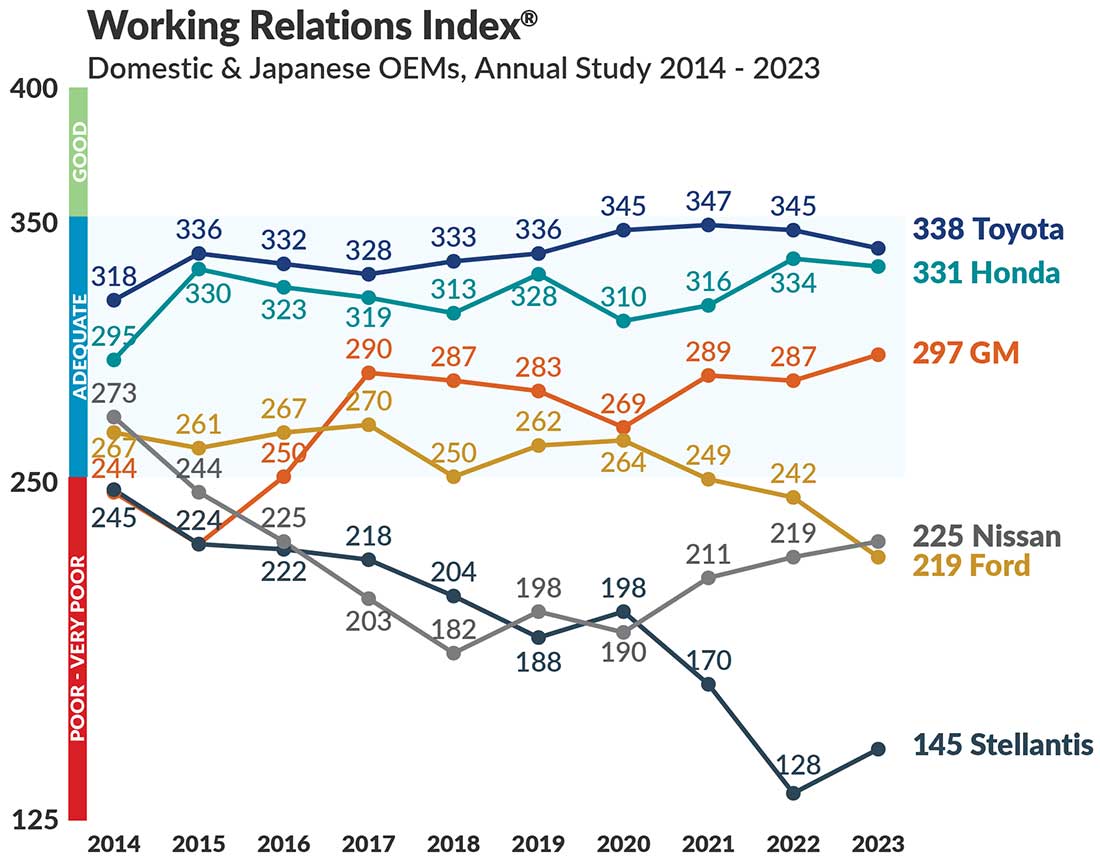

Figure 1.

GM, Nissan and Stellantis improved their WRI® scores while Toyota and Honda dropped slightly, and Ford fell significantly. Stellantis showed the greatest improvement with a gain of 17 points, followed by GM’s 10-point gain and Nissan’s six-point uptick. Nissan took over fourth place from Ford which dropped 23 points — the largest drop by an OEM this year. Toyota lost seven points and Honda declined by three points (see Figure 1).

With the overall industry undergoing major changes in the shift to EVs, suppliers identified several common issues critical to OEM success:

There can’t be a disconnect between OEM senior management’s words and front-line buyers’ actions.

- OEMs need to ensure purchasing staffs have the experience and training to understand new EV technologies, and internal relationships to engage with engineering and manufacturing as the OEMs conduct staff reductions and reorganizations.

- OEM’s product plans and technology requirements need to be articulated and communicated to suppliers for suppliers to know where they and their products fit into long-term strategies.

- OEM decision-making locations need to be located near and reinforce where supplier sourcing and manufacturing occurs.

- The WRI measures the total commercial relationship, which is a function of perceived trust, timely communication, mutual profit opportunity, assistance, and a reduction in friction in dealings with automakers.

“The industry continues to face unprecedented challenges in the shift to EVs that unless effectively addressed will only get worse,” said Dave Andrea, principal in Plante Moran's strategy and automotive and mobility consulting practice, which conducts the annual study. “During COVID-19, a ‘war room’ approach was adopted to quickly resolve critical issues. That approach is what auto manufacturers need to maintain during the transition to EV technologies. The industry needs that level of collaboration, even without the pressure of a crisis.”

Top four industry takeaways

- OEMs have improved their supplier relations by incorporating the WRI findings in their personnel performance metrics, corporate strategic planning processes, and communication strategies, allowing them to better leverage their suppliers.

- Strong supplier working relations are more than external relations with suppliers. An improving WRI reflects improved OEM cross-functional internal relations and indicates how well purchasing, engineering, and manufacturing are working together — a critical need to achieve faster product development.

- New market conditions, such as supply chain disruptions and new technologies that change product plans and manufacturing strategies, require short- and long-term forecasts and production schedules to be more accurate and to be communicated more timely with suppliers.

- Cost recovery mechanisms shouldn’t be judged in isolation. Inflation-driven cost increases and adjustments need to be addressed in a timely manner that’s consistent, tested, and institutionalized and supported by OEM and supplier cost reduction efforts.

OEMs that effectively address these issues are generally stronger customers of choice for suppliers and rate the OEMs better on perceived trust, supplier business return on investment, and rewarding suppliers for high performance.

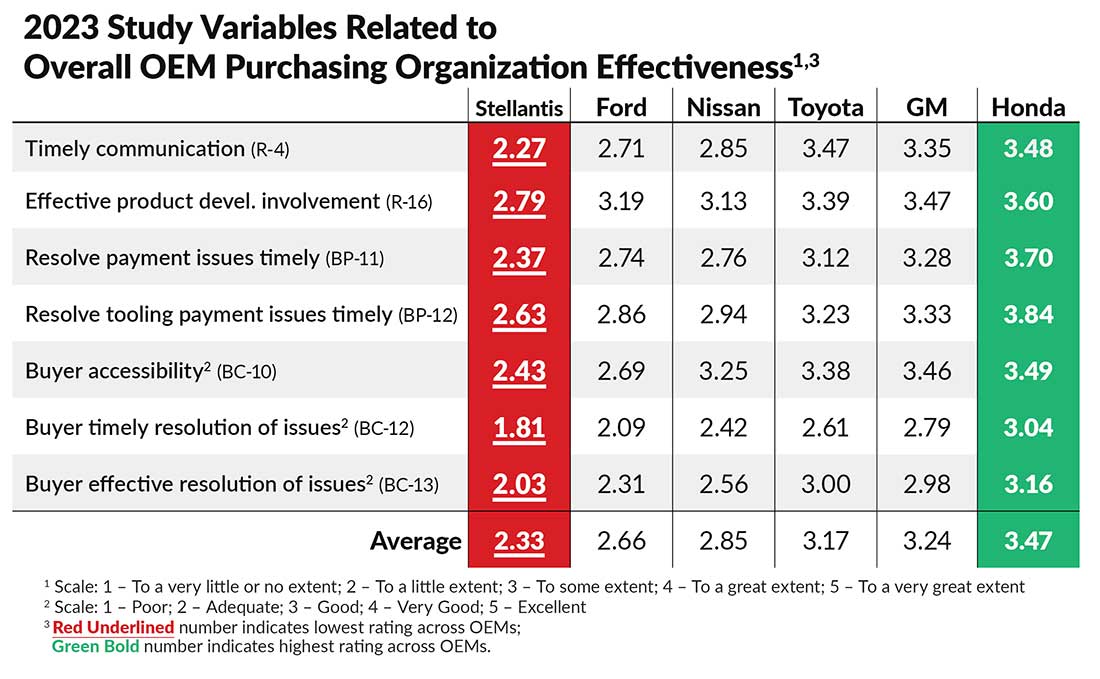

Figure 2.

Honda excels in purchasing effectiveness, followed by GM

“Purchasing effectiveness” is another important overall measure. It rates OEMs on seven important variables, as indicated in Figure 2. Honda maintained first place this year in “purchasing effectiveness,” which involves timely communication, resolving issues, and buyer accessibility among other characteristics shown in the table.

In overall OEM purchasing organization effectiveness, Honda lead in all seven categories with a composite average score of 3.47. GM purchasing was second and led in five categories with 3.24 and surpassed Toyota that scored 3.17. Nissan was fourth with 2.85; Ford fifth with 2.66; and Stellantis last in all seven categories at 2.33.

“The automakers will have to continue building on these fundamentals to survive near-term parts shortages, rising costs, and high risk to truly deepen supplier relations to support their transition to electric vehicles,” said Andrea.

WRI Cornerstones: OEM-supplier trust and communication

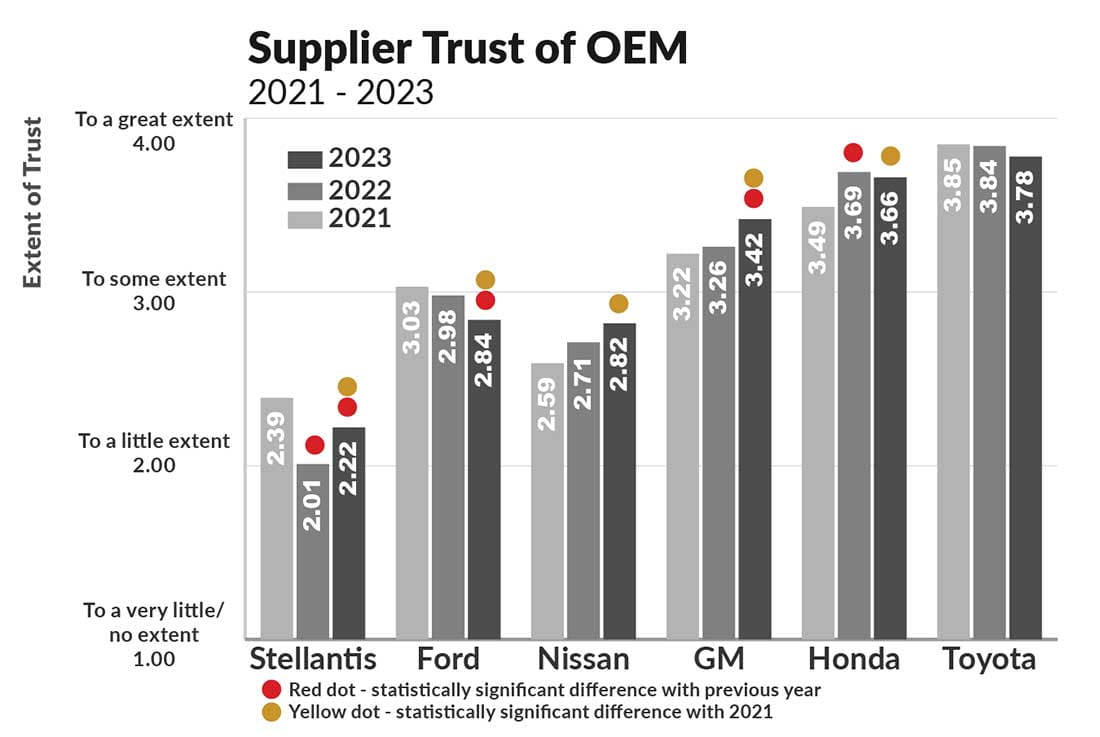

Figure 3.

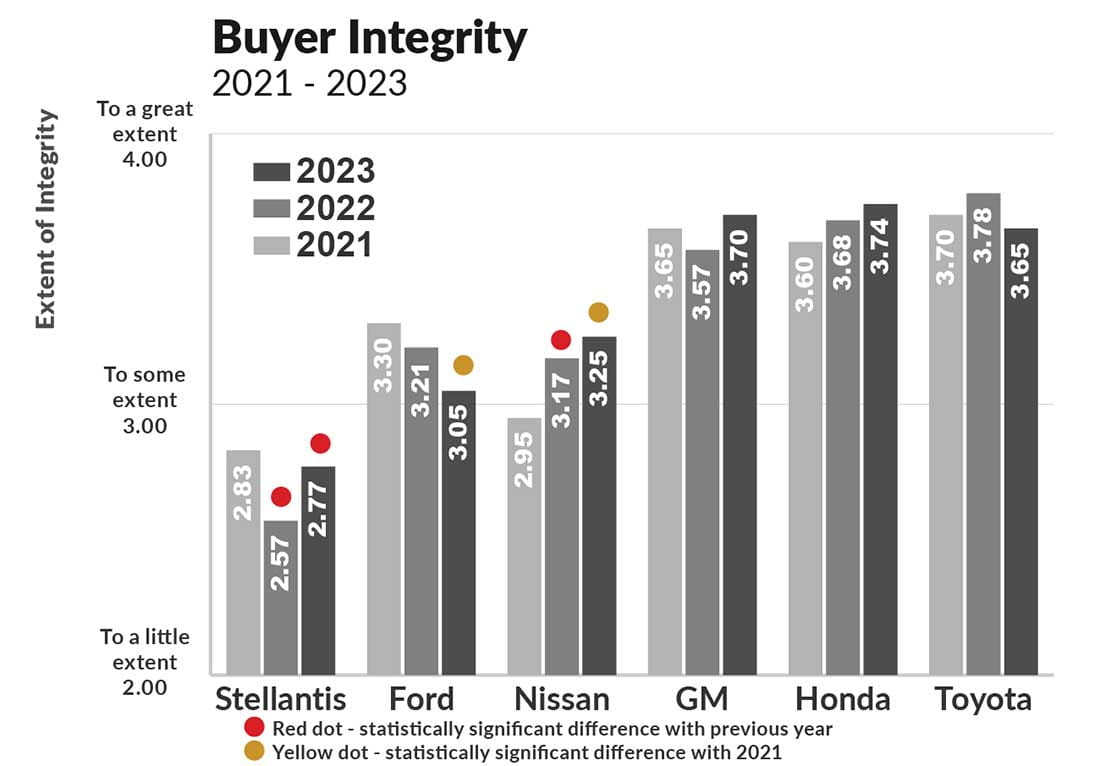

Figure 4.

The study has shown trust and communication to be the cornerstones of good working relations, especially in the high-risk environment automakers and suppliers are now dealing with. Billions of dollars and thousands of jobs are at stake. Figure 3 shows overall trust with GM, Honda, and Toyota having the best trust rankings. However, this year, Stellantis and Nissan made statistically significant gains, as did GM, but Honda and Toyota were down slightly, and Ford, substantially. Note how the trust rankings track the overall WRI rankings.

Related to overall trust is suppliers’ perception of the buyers’ integrity. (Figure 4).

Again, Stellantis showed a statistically significant improvement with a 0.20 gain, and Nissan was up .08, while GM reversed its 2022 decline and Honda continued an upward trend. However, Ford continued a significant three-year drop falling 0.16 points.

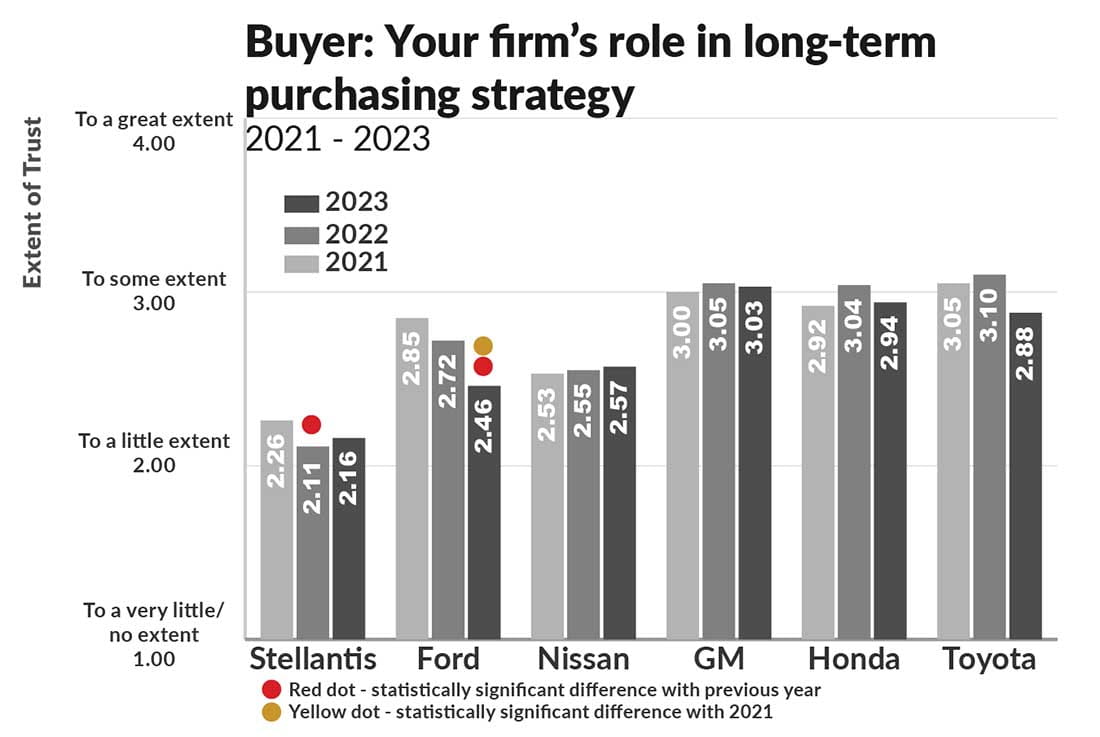

Figure 5.

Timely communication is key, especially now

While the key to mutual success in OEM-supplier relations is trust, trust is based on three factors: having the OEM customer set realistic expectations; delivering on commitments; and sharing information on the OEM’s long-term purchasing strategy on a timely basis (Figure 5). Here, the bottom three OEMs match their order in the WRI, while the top three are reordered: GM first with Honda and Toyota following.

“All six of the OEMs need to improve in this important area,” said Andrea. “In the current high-risk business environment, communication is key, because the supplier CEOs must ask: who would I rather do business with? Who is my customer of choice? And the answer comes down to three questions: Who do I trust? Where will I get the best return on investment? And what is the prospect for future business? So, it’s in the OEM’s best interest to maintain open and honest communication with its suppliers.”

However, communication goes beyond the OEM-supplier relationship, said Andrea. Externally, the OEMs need to focus on more transparency and better communication with their key suppliers. But the OEMs also must improve their internal communication to better align purchasing, engineering, and manufacturing so they’re working to achieve the same corporate goals — greater efficiency, cost reduction, and speed. This will take cost and time out of the entire supply chain while helping both the OEMs and suppliers achieve their cost and financial performance goals.”

About the WRI® Study

Now in its 23rd year, the 2023 North American Automotive OEM-Tier 1 Supplier Working Relations Index® Study was conducted by Plante Moran from mid-February to mid-April. Respondents are executives from Tier-1 suppliers serving Ford, General Motors, Honda, Nissan and Stellantis, and Toyota. The annual study tracks supplier perceptions of working relations with their automaker customers in which they rate them across the eight major purchasing areas broken down into 20 commodity areas. The results of the study are used to calculate the WRI, which can then be used to calculate the economic value of working relations based on a proprietary economic model.

The respondents to the survey were 715 salespersons from 459 Tier-1 suppliers, representing about 50% of the six OEM’s annual purchases. The sales personnel provided data on 2,301 buying situations (e.g., supplying brake systems to Ford, tires to Toyota, and seats to GM). Demographically, the supplier respondents represent 38 of the top 50 NA suppliers and 69 of the top 100 NA suppliers.

The study was founded in 2001 by Dr. John Henke, CEO of Planning Perspectives, Inc., and acquired by Plante Moran in 2019. The automakers utilize the study carefully because the attributes measured by the WRI are highly correlated to the benefits OEMs receive from their suppliers, including competitive pricing, investment in innovation and technology, and better program launch support. These benefits contribute to the OEM’s operating profit and competitive strength.

About Plante Moran

Recognized as a leader in automotive and mobility strategy, Plante Moran is among the nation's largest accounting, tax, consulting, and wealth management firms and provides a full line of business analytics and data management services to private and public sector organizations. Plante Moran is an automotive industry strategy and mobility transformation thought leader covering the entire automotive value chain. The firm has a staff of more than 3,500 professionals throughout the United States, with international offices in Shanghai, China; Monterrey, Mexico; Mumbai, India; and Tokyo, Japan. Plante Moran has been recognized by several organizations, including Fortune magazine, as one of the country’s best workplaces. For more information, visit plantemoran.com.