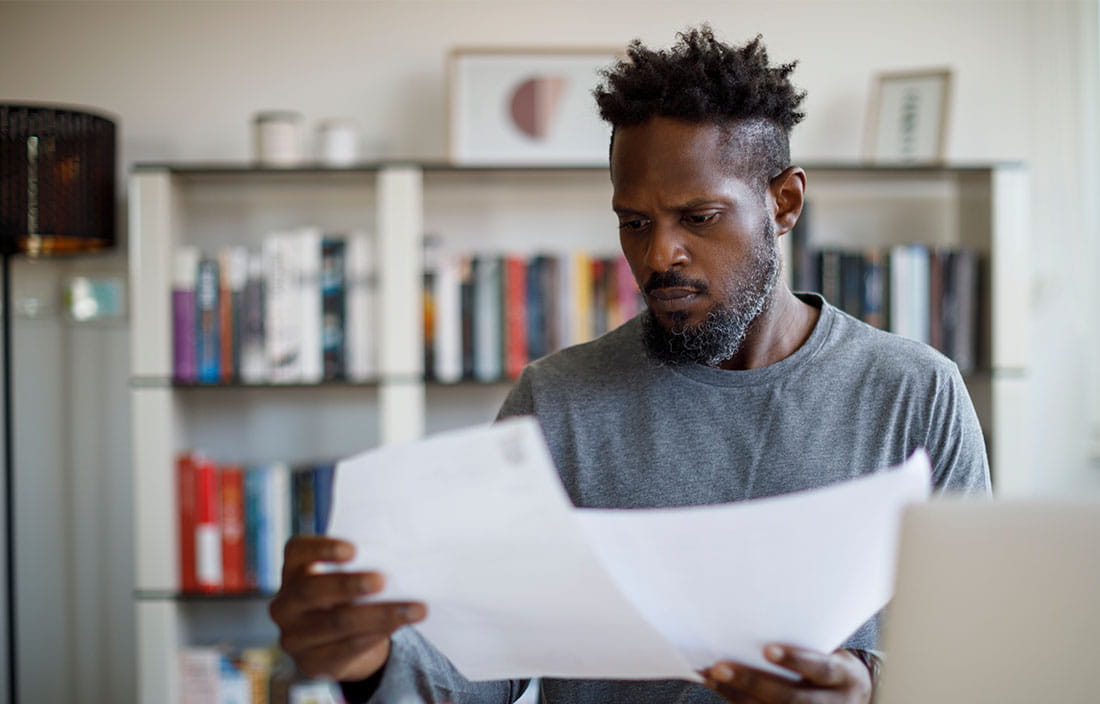

I offer research and development tax credit assistance, depreciation consulting, cost segregation analysis, and family wealth planning services to clients that range from large multinational corporations to senior care and living institutions to family-owned businesses. In other words, I help innovative companies and their owners find ways to save money, achieve success, and give back to the community.

Around the office, colleagues know me for my patience and diligence. When they have a question, they know I’ll work with them until they’re sure they understand the answer. Explaining complex material comes naturally to me; I’ve given a number of webinars and other presentations to clients and professional organizations on research and development tax credits, cost segregation, and fixed asset planning. I’m a member of the AICPA, and I have a B.A. in business administration with an emphasis in accounting from Concordia University (Irvine).

In my free time, I can usually be found at one of my children’s sporting events, be it soccer, cross-country, or archery. I’m also a car guy at heart; I’ve always enjoyed working on and restoring cars.