The Financial Accounting Standards Board (FASB) recently issued Accounting Standards Update 2015-07, Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (ASU 2015-07). ASU 2015-07 changes the required disclosures for investments where fair value is measured using net asset value per share (“NAV”) as a practical expedient, such as private equity, hedge funds, and limited partnerships.

Investments valued at NAV as the practical expedient will no longer be categorized in the fair value hierarchy. This means reporting entities will no longer have to determine if investments valued at NAV as a practical expedient are based on observable inputs (Level 2) or unobservable inputs (Level 3) or consider how redemption restrictions might impact the leveling of the investments. Additionally, investments valued at NAV, and thus not leveled, that were traditionally reported as Level 3 investments will not be included in the roll forward of Level 3 investments upon adoption of the standard.

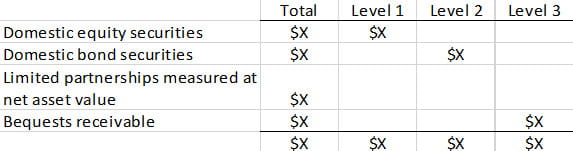

The accounting standards require that the fair value footnote reconcile with the balance sheet; therefore, investments valued at NAV as the practical expedient must be disclosed in the footnote in a manner that allows the reader to reconcile to investments presented on the balance sheet. This can be accomplished by presenting the NAV investments in the hierarchy table without assigning them to a particular level within the hierarchy (for example, including them in the total column only):

The ASU has also modified the disclosure requirements such that certain disclosures about the nature and risks of investments are no longer required for investments that are eligible to be measured using NAV as the practical expedient, but for which the practical expedient was not elected. These disclosures are still required when the practical expedient is used.

ASU 2015-07 is effective for fiscal years beginning after December 15, 2015, for public business entities (including not-for-profit entities with publicly traded debt) and for fiscal years beginning after December 15, 2016, for all other entities. Early adoption is permitted. The standard is to be adopted on a retrospective basis.

Based on the changes noted, it could be beneficial to your organization to early adopt this standard to reduce the information disclosed for investments valued at NAV as the practical expedient. Please contact your Plante Moran team to discuss this option.