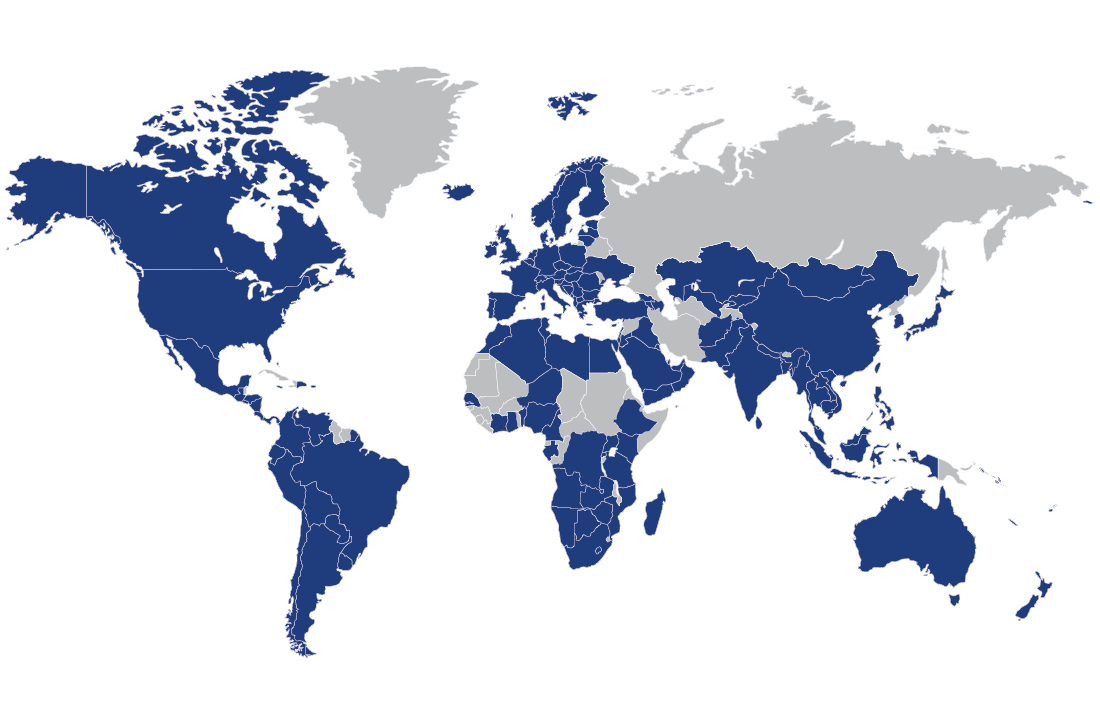

Countries where we have experience serving clients.

Ready to navigate complex and evolving global markets? We’re ready to be your guide.

Our experts adapt swiftly to the latest international business challenges, helping our clients break down barriers and span boundaries to achieve their international growth and strategy goals. With our knowledge, resources, and relationships, you’ll always have access to effective, practical solutions — built for when and where you need them.

- Are you looking to drive growth by exploring new markets and revenue streams? We know how to get you there — with strong infrastructure, streamlined operations, and a comprehensive tax and audit compliance strategy to minimize risk and maximize profits.

- Does your international growth strategy include cross-border transactions? Our experts will guide you through M&A due diligence and help you integrate seamlessly with your new partners and new geography.

- Is your international infrastructure supporting your growth plans? We’ll help you stabilize your supply chain, diversify your supplier base, and increase operational performance.

We’re not here to prove we can conquer the business world. We’re here to help you conquer your business world.