According to a recent poll performed by the regulators, very few community institutions haven’t started implementation or have selected the methodology they’ll use to implement the new CECL standard. Instead, most are in the process of gaining an understanding of the various methods to estimate the financial impact of CECL by talking to third parties and determining the availability and adequacy of their institution’s data for the different methods. The good news? Simplicity and practicality are just around the corner—despite political distraction.

According to a recent poll performed by the regulators, very few community institutions haven’t started implementation or have selected the methodology they’ll use to implement the new CECL standard. Instead, most are in the process of gaining an understanding of the various methods to estimate the financial impact of CECL by talking to third parties and determining the availability and adequacy of their institution’s data for the different methods. The good news? Simplicity and practicality are just around the corner—despite political distraction.

Complexity versus simplicity

To date, the most common mistake community institutions have made has been selecting a methodology prior to understanding all their options and, perhaps more importantly, not fully understanding the data inputs required for that methodology. The result? A fork in the road that leads to a choice between investing resources to ensure adequate historical data is being used or employing a more simplistic methodology where the loan-level data required is minimal.

Some institutions may be thinking that complexity equals superiority. After all, these models are getting the most discussion by the industry today. However, that’s only because the complex institutions—which require the most complex models—are the closest to CECL adoption. The road ahead for community institutions is one where the simpler methods will gain more attention and provide practical application with or without an external software.

In fact, based on a December 2018 presentation, the Financial Accounting Standards Board (FASB) will be providing more guidance on the simpler methodologies in an attempt to provide relief to community institutions and deter these myths of required complexity.

CECL pushback and political noise

There’s been some pushback by the industry regarding CECL. Various stakeholders have contacted the FASB, Treasury, and various elected officials in Washington, DC regarding its complexity and potential unintended consequences, and recently a Congressional hearing took place where several stakeholders voiced these views. While the FASB did not attend this hearing, they posted a tweet linking to the 2016 CECL study regarding its costs and benefits.

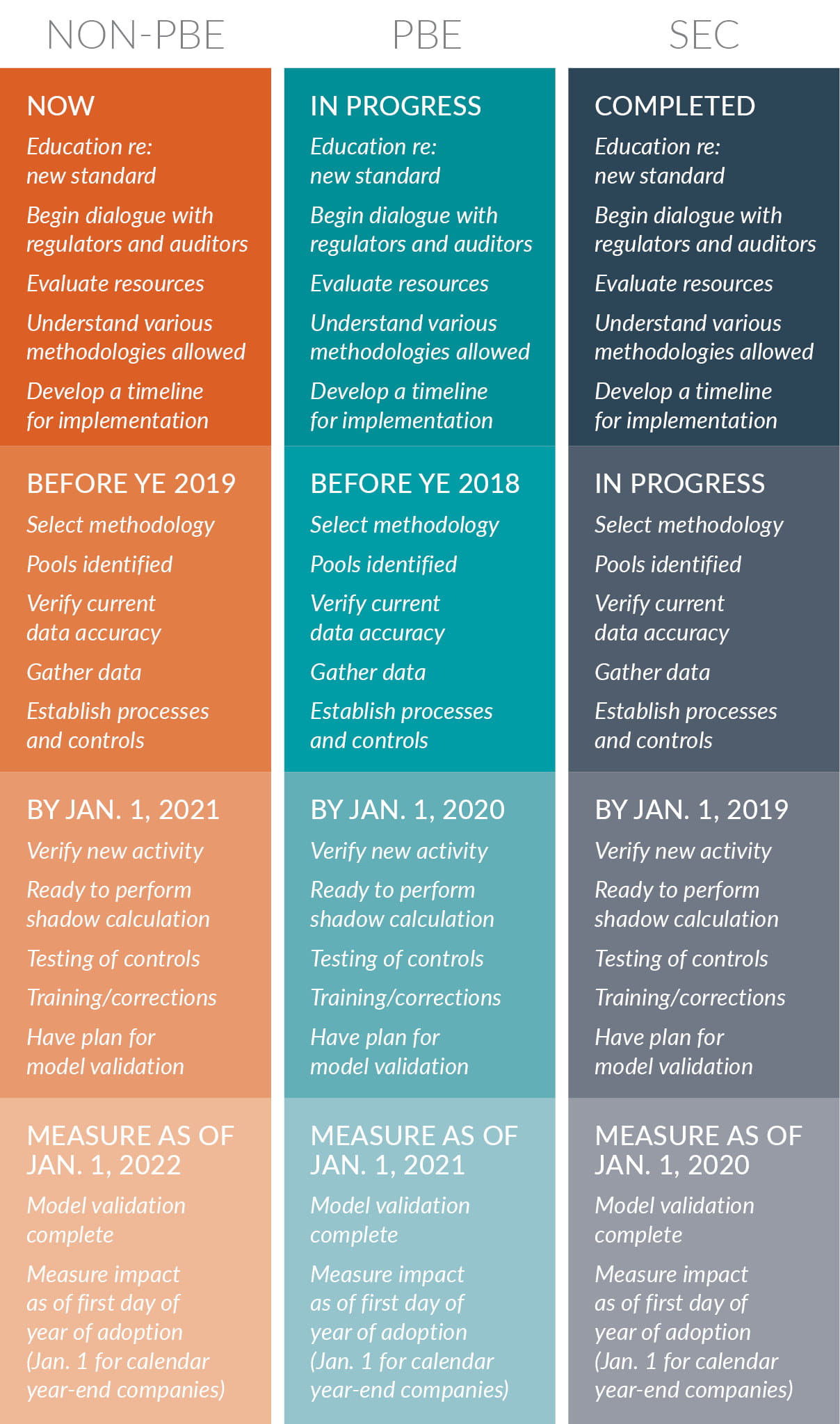

The bottom line with this political noise is that the FASB is an organization 100 percent independent from any political party and is highly unlikely to be deterred from the CECL model. As such, we encourage each institution to move forward with CECL in a manner that will allow for appropriate planning. We’ve provided the following as a guide for implementation:

We can help

We have a number of tools to get you on the right path, including a thorough presentation to ensure your institution has in-depth knowledge of your options and is aware of potential “traps” and practical Microsoft Excel templates to calculate a CECL compliant allowance for credit losses. In addition, if a software is determined to be the right path for your institution, our experts are serving as subject matter experts for both vendor selection and implementation.

At the end of the day, CECL can be as hard and complex as you would like it to be. We encourage each institution to measure twice and cut once.