In 2013, the Office of Management and Budget (OMB) rolled out its most significant federal grant administration reforms titled, Uniform Administrative Requirements, Cost Principles and Audit Requirements for Federal Audit, also known as the “Uniform Guidance.” Built into the Uniform Guidance is a requirement for OMB to reexamine the regulations every five years. That time has come.

The OMB published a draft of the proposed changes early in 2020 and invited comments from users as part of the implementation process. After more than 2,500 comments were considered, the final guidance was published on Aug. 13, 2020. The good news is that the resulting changes aren’t nearly as sweeping as when Uniform Guidance was first implemented in 2014.

The recent revisions to the Uniform Guidance met three primary objectives:

- To support implementation of the President’s Management Agenda Results-Oriented Accountability for Grants CAP Goal and other administration priorities.

- To meet statutory requirements and to align 2 CFR with other authoritative source requirements.

- To clarify existing requirements.

What do I need to know?

Overall, a few things. Here are three highlights:

- Effective date. Nov. 12, 2020 for awards issued after this date, except for two amendments, which went into effect immediately. Those two amendments are Section 200.216, prohibitions on certain telecommunication and video surveillance services and equipment, and Section 200.340, termination.

- FAQs. The revised guidance incorporates many FAQs previously published by the Council of Financial Assistance Reform (COFAR).

- Definitions. Definitions have now been combined into a single provision at Section 200.1. In Subpart A of the guidance, definitions previously were numbered separately. The guidance also includes new and revised definitions. Important changes to be aware of center on award concepts and procurement, including budget period, improper payment, renewal, period of performance, obligations, micropurchase, and simplified acquisition threshold.

What about changes in specific areas of interest?

- De minimis rate. The revised guidance clarifies that any nonfederal entity that doesn’t have a current negotiated (including provisional) indirect cost rate can use the 10% de minimis rate. Be aware that certain nonfederal entities are excluded, as listed in Appendix VII.D.1.b. (Section 200.414(f)).

- Procurement standards. Several changes were made to these standards, including:

- Regrouping of procurement methods into three categories — informal, formal, and noncompetitive (Section 200.320).

- New provisions that permit recipients to increase their micropurchase threshold up to $50,000 and over $50,000 if certain requirements are met (Section 200.320(a)(iv) and (v), respectively). If you plan to increase your micropurchase threshold in excess of the federal threshold established in the Federal Acquisitions Regulations (FAR), the current threshold is $10,000, know that documentation and a self-certification is required. Micropurchase thresholds in excess of $50,000 require approval by the cognizant agency for indirect costs.

- The addition of domestic preferences for the procurement requirements, encouraging the use of goods, products, and materials produced in the United States. (Section 200.322).

- Grant closeout. The amount of time for prime recipients to submit closeout reports and liquidate financial obligations was increased from 90 to 120 days (Section 200.344).

- Never contract with the enemy. In addition to the changes made to 2 CFR Part 200, OMB also added 2 CFR Part 183, which contains a new requirement to never contract with the enemy. Never Contract with the Enemy applies only to grants and cooperative agreements that exceed $50,000, are performed outside the United States, including U.S. territories, to a person or entity that is actively opposing United States or coalition forces involved in a contingency operation in which members of the Armed Forces are actively engaged in hostilities. This also will be reflected in Section 200.215.

What should my organization do now?

The first step is to read, thoroughly, the revised Uniform Guidance regulations and ensure the appropriate individuals in your organization are aware of the changes. To assist, we’ve compiled some additional implementation questions to help you outline a plan for carrying out any changes necessary to comply:

- Who is responsible for understanding the changes and evaluating the specific impact to your organization? The guidance includes several pages of introductory explanation that can be very helpful to understand OMB’s considerations and ultimate conclusions related to some of the revisions.

- Will your organization adopt any “entity-wide” changes that will be applied to ALL grants after the effective date (rather than just grants that are awarded after Nov. 12, 2020)?

- Is your organization now able to take advantage of using the de minimis indirect cost rate? Remember, this option is only available if you don’t have a current negotiated (including provisional) indirect cost rate.

- Do any of your organization’s written policies or procedures, including procurement policies, need to be updated? Refer to the provisions’ crosswalk below.

- Do your organization’s standard contract terms need to be updated to incorporate revisions in requirements relevant to agreements with subrecipients and contractors? Appendix II to Part 200 - Contract Provisions for Non-Federal Entity Contracts under Federal Awards is a good resource to review.

- Does our organization have a process in place to ensure the submission of closeout reports and liquidation of financial obligations are met? If your organization receives awards as both a prime recipient and subrecipient, the timing will differ.

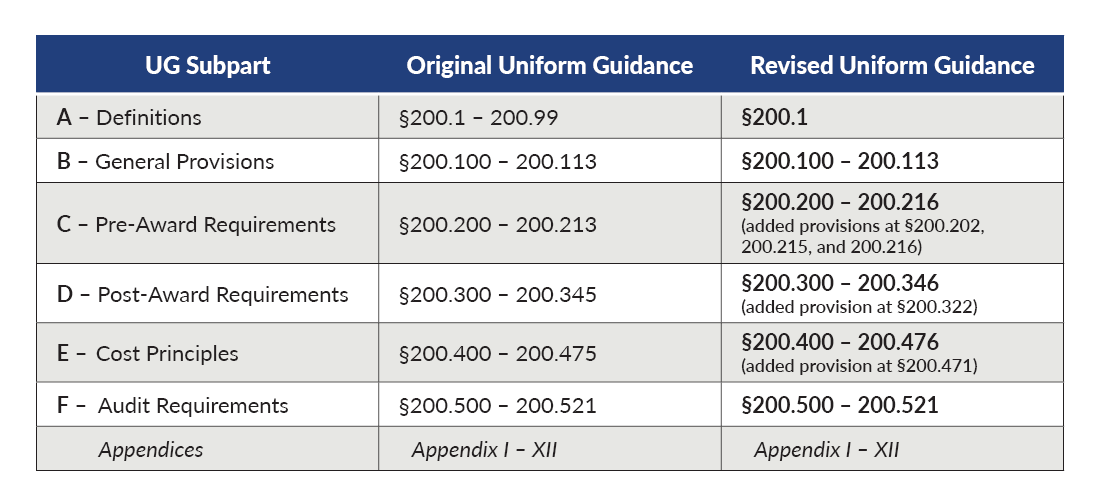

As you consider these questions, and how to update your policies, the following crosswalk can help you identify changes to the CFR numbering:

Closing thoughts

We hope this summary helps you ensure you’re on track to implement the Uniform Guidance revisions. This article is intended to focus your attention on high-level concepts only and to spark further, more in-depth discussions as your organization evaluates the impact of this regulatory change on your existing grant management process. Our deep bench of compliance specialists has closely analyzed the revised guidance, and we’re here to help as you navigate implementation.

As always, if you have any questions, feel free to give us a call.