The AICPA’s upcoming State and Local Government Client Affiliate independence changes, which come into effect for years beginning after Dec. 15, 2021, will require auditors to be independent of both their client and their client’s affiliates. For PERS organizations, affiliates will now likely include certain investments held in their portfolios.

If you missed our initial article outlining the broader impact of the changes, we encourage you to read it. Although you might be thinking that independence is only an auditor issue, it’s very much a shared responsibility between auditors and their clients. Those within PERS organizations that are responsible for the oversight of the external audit function — whether they be audit committees, internal audit departments, or boards of trustees — play a critical role in ensuring the independent audit firm they hire is truly independent. Given the pending changes, assessing independence will require your organization and your auditor to work closely together.

What aspect of this revised interpretation will impact my PERS organization most?

PERS organizations will need to determine if any investment they hold meets the definition of an “affiliate,” and for those investments that do, auditor independence will be required related to the investment.

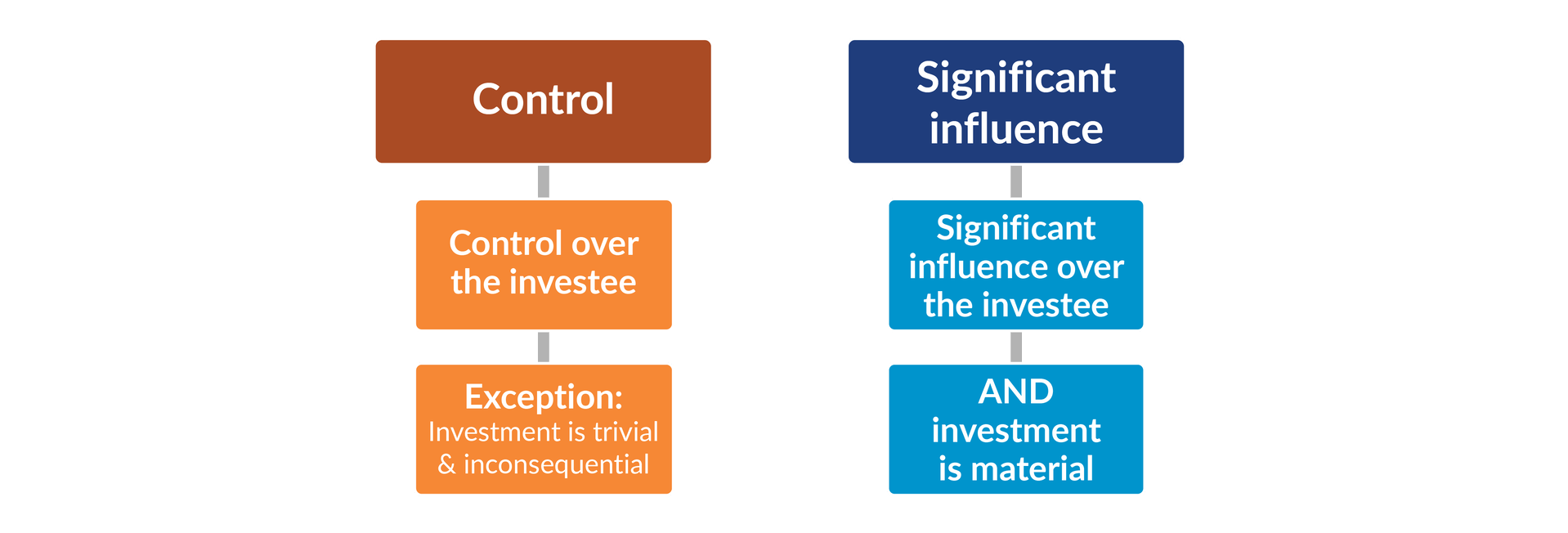

The first step in this process is identifying your organization’s relationships with the investments it holds and evaluating how that relationship might affect independence. Under the revised standards, an investment will be considered an affiliate if it meets either of the following criteria:

- The PERS has control over the investee, unless the investment is trivial and clearly inconsequential.

- The PERS has significant influence over the investee and the investment is material.

How do I know if the PERS has control over one of its investments?

When considering control over the investee, the AICPA refers to existing Financial Accounting Standards Board (FASB) guidance (ASC 810), which generally defines “control” as having more than 50% of the outstanding voting shares/voting interests of the investment. If an investment your organization holds meets this definition, and the holding is not “trivial and clearly inconsequential,” your audit firm will need to be independent of that investment. Note there’s no specific definition of “trivial and clearly inconsequential” in the guidance; however, we understand it to be a much lower threshold than “not material.” Why? “Trivial” usually means something so small that there’s a remote likelihood of it making a difference, and “clearly inconsequential” is typically used for referencing items that are of a small order of magnitude.

How do I know if the PERS has significant influence over one of its investments?

Here again, the AICPA refers to existing FASB guidance (ASC 323-10-15) to define “significant influence,” primarily basing it on the extent of ownership — typically 20% or more of the voting stock of an investee — although other factors could come into play, including participation in policy-making processes and/or representation on the board of directors. An investment of less than 20% of the voting stock would typically mean your organization doesn’t have the ability to exercise significant influence. But even if your organization does have significant influence, the investment is only considered an affiliate if the investment is material to the financial statements as a whole; both parts of the two-part test must be met.

What should I do now?

Collaborate with your auditors to identify entities that qualify as your affiliates. Consider the qualitative and quantitative factors of the investment in making the affiliate determination and document the conclusions reached. The revised interpretation is effective for years beginning after Dec. 15, 2021, so it’s important to ensure the evaluation of auditor independence is completed in a timely manner. It’s also important to note that if your organization is going out to bid for audit services, prospective bidders won’t be able to faithfully attest to their independence without proper identification of the affiliates under this standard in the pre-proposal materials.

For more information on how the revised independence interpretation affects your organization, feel free to reach out — we’re here to help.