In a “good news is bad news” environment, a stronger-than-expected jobs report tells us a couple things: that the Fed’s efforts to cool the economy to tame inflation haven’t yet had the desired effect, and that the probability of the central bank continuing to hike into next year remains quite high.

In a “good news is bad news” environment, a stronger-than-expected jobs report tells us a couple things: that the Fed’s efforts to cool the economy to tame inflation haven’t yet had the desired effect, and that the probability of the central bank continuing to hike into next year remains quite high.

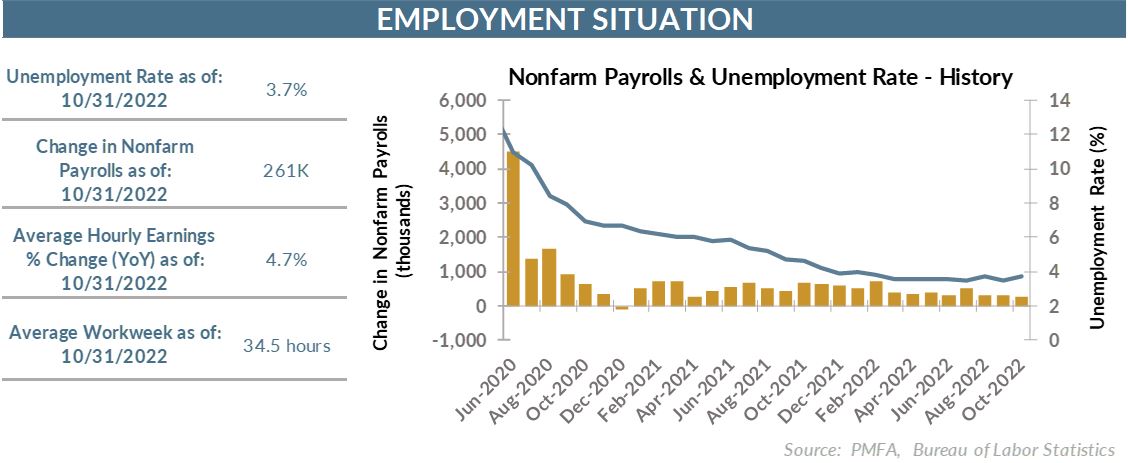

Nonfarm payrolls rose by 261,000 in October, easily exceeding the average forecast of 200,000 new jobs for the month. Revisions to the preceding two months tacked another 29,000 onto that increase, making the report an even bigger upside surprise.

Despite that surprise, there was some inconsistency between the household and employer components to the report. Households reported a decline of over 300,000 in the number of employed individuals and an offsetting increase in the ranks of the unemployed. The unemployment rate ticked back up to 3.7%.

Job creation has slowed considerably since midyear but from an unsustainable pace that far exceeded the long-term trend. Even with the slowdown, the recent pace of job creation is still well above the monthly average of about 190,000 during the five years leading up to the recession.

Beyond the level of job gains, the composition of the increase is also somewhat surprising, particularly for the manufacturing sector. There’s been a growing bifurcation in consumer spending and the broad economy, as goods spending has slowed sharply, but demand for services has solidified after lagging in the early stages of the recovery. Against that backdrop, one might expect a similar dynamic in the labor market as well. Instead, manufacturing employment rose by 32,000 in October and has shown little evidence of any loss in momentum, despite weaker demand.

Surging home prices and the highest mortgage interest rates in over two decades has weighed heavily on housing, throwing ice water on what had been a sizzling hot market. Even with post-Hurricane Ian reconstruction needs in Florida expected to provide a near-term boost, construction payrolls were effectively flat for the month.

For the Fed, inflation remains the primary concern and focal point, but the strength and resiliency of the labor market reinforces their bias that more work will be needed to cool off the economy and bring inflation back under control. The uptick in the unemployment rate to 3.7% may suggest some marginal easing in conditions but is still reflective of a tight labor market. Wage gains also reflect that reality. Average hourly earnings increased by 4.7% over the past year, which is the slowest pace in a year but remains well above the high end of the range dating back more than a decade.

The question for the Fed is how to calibrate their tightening pace in the coming months while attempting to assess how much bite from prior rate hikes has yet to be felt. The so-called “long and variable lag” leaves plenty of room for an overshoot. For now, the Fed appears committed to additional rate increases into 2023, erring to the side of too much monetary medicine than reducing the doses without more tangible evidence of progress. The ability to stick the proverbial landing with so many variables will provide a significant test for policymakers who don’t want to be viewed either today or through the lens of history of being too soft on inflation. A recession isn’t the desired outcome, but it’s more palatable than allowing inflation to become further entrenched.

The bottom line? Economic momentum has slowed over the past year but not nearly enough to suggest that the Fed’s war on inflation is at a tipping point. Labor conditions remain too tight, and underlying inflation pressures remain too strong. Until there’s greater evidence of progress, the Fed will continue to aggressively pump the brakes on the economy, even at the risk of bringing it to a stop.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

- Barron's

- MarketWatch

- WSJ's Real Time Economics Newsletter

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.