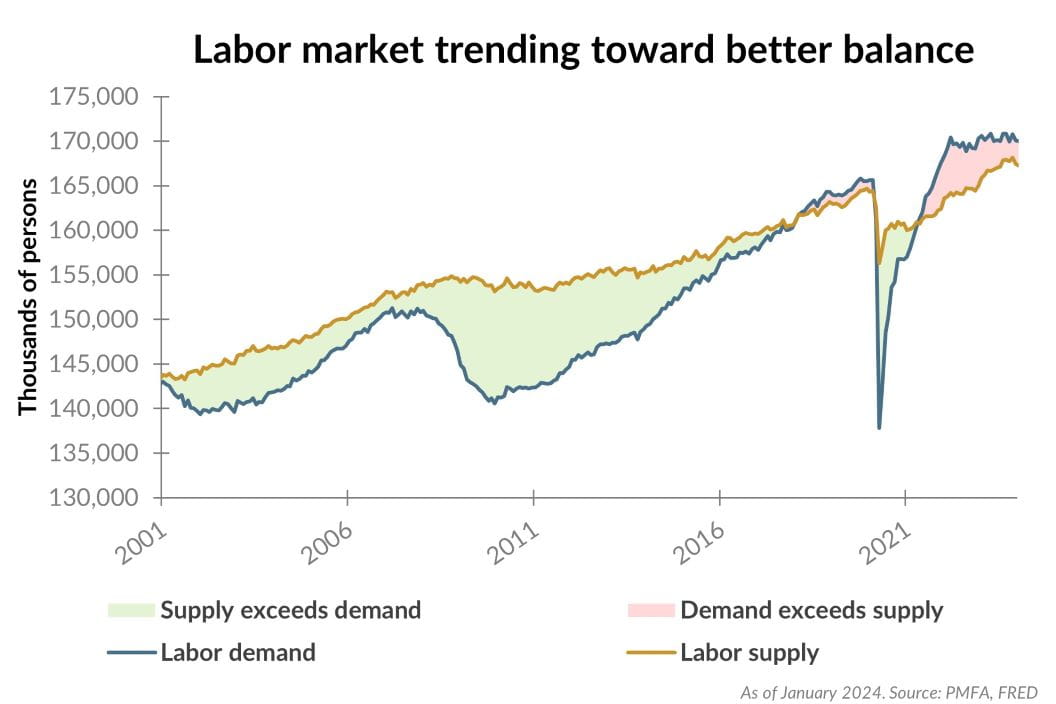

It wasn’t all that long ago that the term “V-shaped recovery” served as a vivid descriptor of the economy’s reopening following pandemic-era shutdowns. The chart above illustrates this well, specifically as it relates to labor demand and supply. A sharp cratering in demand for labor occurred amid wide uncertainty around in-person commerce, which subsequently rocketed back higher as the U.S. economy reopened.

Job openings reached an all-time high of 12 million in March 2022, contributing to the largest excess demand for labor in at least 25 years. The labor market has served as the centerpiece to an economy that’s continued to defy consensus expectations for a slowdown. Put another way, the persistence of more job openings than available workers validates the strength of the economy and business conviction in that strength.

The trend matters though; job openings have receded for nearly two years. And although they’re still above the peak in the prior expansion, a better balance between labor supply and demand is evident. Additionally, recent signs of stronger productivity gains have emerged. Combined, both developments could help to alleviate the inflationary impact of wage growth over time, as discussed in our associated piece.

What’s the bottom line? The Federal Reserve’s dual mandate of stable prices and full employment are often intertwined. Further normalization in labor market conditions is a welcome development that should help to allay inflation concerns, even if wage growth remains elevated for now.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.